Hear more about Alphinity’s world tour:

Our five global portfolio managers met with over 130 companies in 14 cities and 8 countries. This video series highlights their insights and demonstrates how their respective trips have shaped our diversified, high-conviction portfolios of high-quality global earnings leaders.

- Hitting the Road with Alphinity Global

- Part 1: European Industrials & Energy Trip with Chris Willcocks

- Part 2: US Healthcare Trip with Jonas Palmqvist

- Part 3: China & Consumer Luxury trip with Mary Manning

- Part 4: US Technology Trip with Trent Masters

- Part 5: European Financials & Consumer trip with Jeff Thomson

FROM THE GROUND UP AND BEYOND THE NUMBERS – KEY THEMES AND STOCK IDEAS FROM RECENT TRAVELS

Visiting Nvidia’s spaceship headquarters in Santa Clara and Saint-Gobain’s flagship office tower in Paris, driving Epiroc’s electric drill rigs, testing out the latest BYD & Tesla EV models and operating on dummies using Intuitive Surgical’ s $2m minimally invasive surgical machines! These are just some of the highlights of the Alphinity Global team’s recent travels across the globe.

Experiencing company products firsthand, touring production facilities, meeting management teams in person and scouting end-markets, can all provide critical insights which help our portfolio managers better understand both the opportunities and risks facing the companies we are invested in.

Over the last few months, Alphinity’s five global portfolio managers have collectively met with over 130 companies in 14 different cities and 8 different countries. In this note we summarise some of their important insights and how their respective trips have shaped our diversified, high-conviction portfolios of high-quality global earnings leaders.

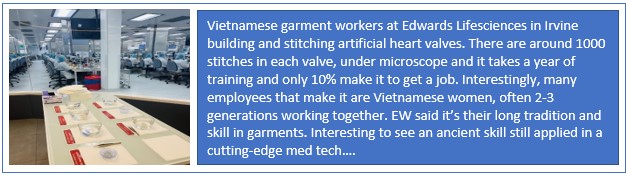

HIGH LEVEL THEMES

US consumer ‘normalisation’ and European resilience: Management teams were generally nervous about the economic growth outlook, with US consumer weakness concerns raised in a variety of different meetings. The US consumer has been resilient so far despite weathering multiple scares, but there are signs that consumption trends are now weakening. Across in the UK and Europe, activity has not been as bad as most feared 6 months ago, but it has been choppy and more about resilience than any tangible acceleration or improvement in growth.

China re-opening has been uneven, and the long-term growth outlook remains uncertain: The sentiment about the outlook for Chinese growth was downbeat at a conference Mary attended in Hong Kong. China is struggling to achieve their 5% growth target without stimulus in the year it has reopened, the property market remains weak, youth unemployment rate is at an all-time high, demographic pressures are more obvious and animal spirits in the tech sector have been reigned in. The debate has moved from a 5-6% GDP growth outlook for China to 3-4%, particularly without any prospect of a “stimulus bazooka” from government stimulus many expected. China’s post lock-down recovery is happening, but it is not the hockey-stick many expected. None of the management teams we met were outright bearish on China, but activity is just not as good as they had hoped for. Any concerns about China were however followed by positive comments on India, despite limited operational exposures to date for most. It is however a clear signal where future capex and growth intentions are heading.

Moving from inflation to disinflation: In contrast to our previous trips, inflation was less of a focus this time round. Relatively few companies mentioned energy costs or wage inflation. Inflation is still running above levels we are used to historically for most companies, with some residual cost pressures still apparent within supply chains, but it is significantly lower than 12 months ago (disinflation). A few of the more cyclical companies we met with even talked about cutting prices for certain specific products as cost inflation headwinds abate and potentially turn to tailwinds in the second half and into 2024.

Pricing power remains critical: On pricing, the focus for most companies is to hold the price increases they have achieved, with some capacity for further pricing for some (albeit at a lower rate than in 2022). Certain pockets are giving back pricing (such as commodity type products), but many management teams said they have built “pricing muscle” and will be reluctant to give it up. Companies generally downplayed hopes of any immediate margin recoveries (inflation to remain elevated, hedging etc.), but companies with pricing power could potentially see gross margin recovery into 2H23 and 2024; however, we would expect most to reinvest these gains back into growing revenues and restoring volume growth.

Supply Chains have largely normalised: Relatively few companies mentioning supply chains concerns, which is allowing companies to execute on large backlogs and inflated order books. For most companies with decent backlogs this should be margin positive and increasingly so (as pricing from the backlog keeps improving), however this is beginning to raise concerns about the demand outlook in 2024 as order books fall.

SECTOR THEMES & STOCK IDEAS

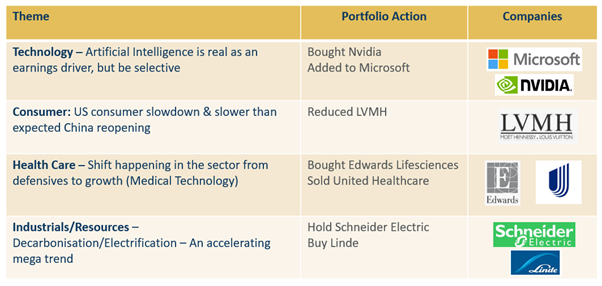

The Artificial Intelligence (AI) opportunity is real: Buy Nvidia & Added to Microsoft

AI, AI and more AI! The excitement around AI was palpable with every technology company Trent met on his US trip talking about it. However, it was clear that companies were at various stages of implementation and monetisation plans. The excitement around Ai was also balanced somewhat by what looks like an incrementally tougher macro environment for businesses and greater scrutiny on IT spend.

In terms of thinking through sector positioning with regard to Ai and the macro environment, conclusions were:

- Semiconductors: the timing for earnings inflection from AI differs materially across segments, with GPU’s seeing almost insatiable demand (Nvidia) while memory names and semicap equipment players remain weak on PC and smartphone demand weakness. In the middle sits electronic design automation names (Cadence) who will see incremental Ai related demand over time. Outside of Ai, auto semis (On Semiconductor) remain strong.

- Software: Lots of talk about AI, but the monetisation path and timing remain uncertain, and companies continue to face elongated deal cycles and greater scrutiny on spend.Microsoft is best placed to capture some early Ai related benefits through new product offerings and cloud consumption uplifts

- Hardware: PC, smartphone and networking appear more difficult, with macro having an impact on end markets that are feeding back through to capex intentions for networks in particular. The potential Ai inflection remains on the horizon, but it will take time to come through.

Stock implications: AI offers a plethora of investment opportunities, but they are not all created equal. Investors will need to be selective and do a lot of bottom-up analysis to understand the impact on each company’s earnings in the short vs long term.

- BUY Nvidia: Nvidia is a leader in Graphic Processing Units (GPU’s) and associated software used for accelerated computing underpinning building and training of LLM’s. Generative AI has created a powerful demand environment for NVDA’s market leading GPU’s and associated software solutions. AI will accelerate the migration from CPU’s to GPU’s over 5-10 years with approximately US$1 trillion of data centre infrastructure spend up for grabs. Nvidia surprised the market with their 1Q23 guidance, showing tangible evidence of their AI opportunity, guiding to a doubling of revenue from $15bn in FY22 to FY23 and increase operating income by 72%.

Nvidia – AI already driving significant earnings upgrades

Source: Alphinity, Bloomberg, July 2023

- Increase Microsoft (MSFT) – Well positioned for broad secular trends in technology and a leader in AI. MSFT’s partnership with Open AI (the creator of ChatGPT) facilitates the infusion of AI through Office 365 applications. The exciting part is that there are already clear and tangible benefits from AI for MSFT. For example, Microsoft has 400-500m paying Commercial Office users, with 250m of these being on higher value offers. Microsoft recently announced intended pricing for Ai infused M365 at $30 per user per month. Pushing this $360pa cost across 250m users and assuming a 30% penetration rate generates an extra $27bn or 13.5% of revenue for MSFT. In addition, MSFT can benefit from a simplified offer to users on lower value SKU’s along with benefiting from further uplift in Azure consumption as more data is pushed to the cloud, with data integrity and accessibility is a key element when using AI. Finally MSFT could also see potential Search uplift from new Bing along with continued security business expansion. Also see Trent’s note on the topic here: The AI revolution is no segway – Alphinity

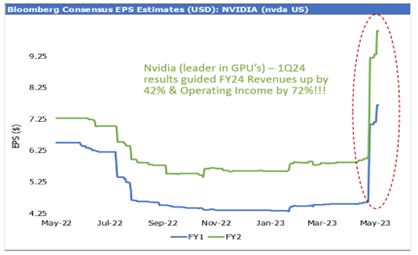

Luxury – Exciting trends but now a crowded trade: Reduced exposure to LVMH

Mary recently travelled to China and Hong Kong where she met with luxury experts, luxury companies and visited over 20 different luxury stores including Dior, Louis Vuitton, Gucci, Balenciaga, Bottega Veneta, Burberry, Prada, Tiffany’s, Cartier, and Rolex.

Her on the ground due diligence revealed a few exciting new trends within the luxury space (see table below): the influence of GenZ, the rise of collaborations, the casualisation of luxury and cross over from athleisure wear, the increasing important of technology and sustainability and increased diversity and internationalisation within the luxury sector. Of the trends outlined above, the growing influence of younger luxury consumers is by far the most important in her view.

Key Trends in Luxury

Stock implications: Reducing luxury exposure with LVMH still our top pick:

Global luxury stocks have been one of the best performing sub-sectors in the last 3 years, benefiting from the post covid reopening and price inelasticity of a more resilient high-end consumer. In our view, the luxury sector remains a very attractive sector from a structural perspective with impressive long-term tailwinds, however in the immediate term, investor positioning in the sector remains crowded and there are risks to luxury consumption decelerating in the US. As such, good stock picking is now paramount to generate alpha in the luxury sector.

- Reduce LVMH: Our top luxury pick remains LVMH given its diverse product offering, superior brand mix, growth outlook and reasonable valuation. Following a stellar performance since August 2021 when we initiated a position, we have reduced our exposure given the near-term risks flagged above.

See Mary’s detailed note here: Crowded Maison: Are global luxury stocks still a buy? – Alphinity

Healthcare: Shift happening in the sector away from defensives (hospitals, insurers) to medical technology (growth)

Jonas met with 18 management teams across the healthcare sector in the US and noted a big divergence between sub sectors, with a clear shift happening away from the generally more defensive side of the sector (pharma, insurers) to the growthier side, such as medical technology stocks. US health insurer, United Health’s CFO sounded more cautious following a large increase in utilisation rates (day surgeries), which in turn could see claims spike and weigh on their earnings.

The US medical technology (“med tech”) sector has had a tough time in the past 18 months with higher cost inflation and softer volumes driven staffing shortages. 1Q23 has marked a turning point for the sector with volumes beats across the industry and normalising input costs. Prior investment in pipeline is also paying off in innovative new areas such as diabetes and structural heart.

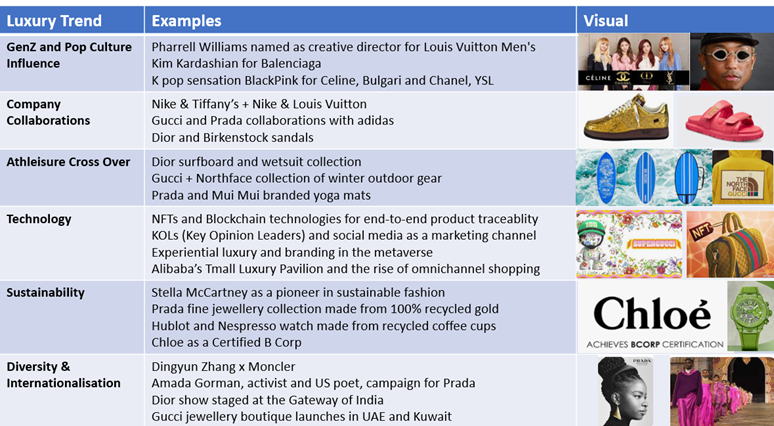

Stock implications: Switching exposure by buying Edwards Lifesciences and selling United Health

- BUY Edwards Lifesciences (EW) Edwards is a global leader in cardiovascular products (artificial heart valves) and treatments, focused on medical innovations for structural hearth disease, repair and replacement, as well as critical care and surgical monitoring around it. The heart disease market is expected to grow at double digits through the 2020’s with the artificial valve market to double from $10bn to $20bn by 2028 in the US alone. Continued rising penetration of EW’s low-invasive heart valve replacement (vs open heart surgery) should drive double digit top line growth through the 2020’s. EW is also leading innovation in this field, putting 17-18% of revenues into R&D & outspending peers. The company generates very high margins (c 75-80% gross margin & 30% EBIT margin), driving very solid returns (23% ROIC) being more labour than materials intensive).

Visiting Edwards facility in Irvine, USA

Decarbonisation / Electrification – An accelerating mega trend: Hold Schneider Electric, BUY Linde

The demand for this megatrend came through strongly in numerous meetings Chris and Jeff attended across a wide range of industrials and consumer companies throughout Europe. Companies (products, solutions and/or services) which enable electrification and/or improve energy efficiencies (i.e. lower carbon emissions & costs) are all seeing significant demand. Even large, long lead-time projects, that have been impacted by higher financing costs are still going ahead. Examples include everything from electrically generated steam systems, to heat pumps, large electricity transformers and grid hardening projects. Whilst demand for these products is real, it remains challenging for many companies to execute at satisfactory margins due to challenges include regulation, competition, and weak industry structures. The most interesting example of this was Siemens Energy, which is still struggling to turn their Gamesa wind business around. BMW also had a greater focus on EV’s relative to the prior year but remain cautious about the outlook for related margins and profitability.

Stock implications: Hold Schneider Electric & Buy Linde

- HOLD Schneider Electric (SU) Schneider Electric is a leading global manufacturer of equipment for energy management and industrial automation solutions. The company aims to drive digital transformation by integrating world-leading process and energy technologies, endpoint to cloud connecting products, software, and services, across the entire lifecycle, enabling integrated company management, for homes, buildings, data centres, infrastructure, and industries. SU continues to gain market share within the industry, leading to consistent organic growth of mid to high single digits. Add effective M&A plus margin expansion from mix (more software) and efficiencies and Schneider can deliver double digit earnings growth over a 3yr horizon. Despite potential short term cyclical headwinds (weak trends in construction activity, China etc), we maintain our exposure to this megatrend and are actively doing more work on a bench of new ideas.

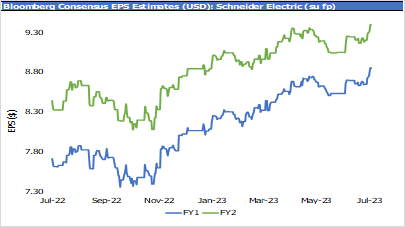

Schneider Electric – enjoying ongoing earnings upgrades

Source: Alphinity, Bloomberg, July 2023

- BUY LINDE (LIN): Global leader in industrial gases with resilient, diversified growth and decarbonisation opportunities

In summary, on the ground research provides significant insights into a company’s investment case that you can’t touch and feel through number crunching. The 5 most recent trips have resulted in several important shifts within our global portfolios, and we continue to do more work on the long bench of exciting ideas it has delivered.

Author: Elfreda Jonker – Client Portfolio Manager & Investment Specialist