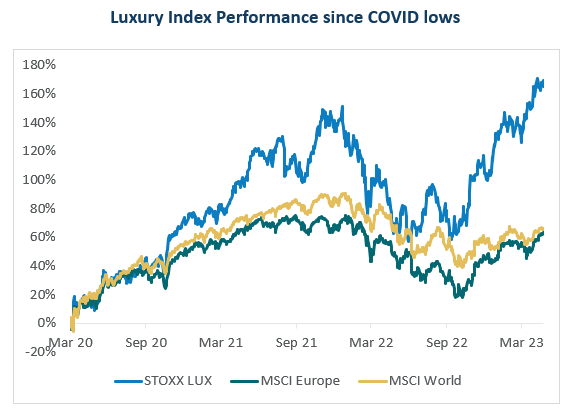

Global luxury stocks have been one of the best performing sub-sectors in the last 3 years. The STOXX Luxury Total Return Index is up 165% from the March 2020 COVID low and has outperformed the MSCI Europe Index and the MSCI World Index by over 80% during that time frame. French luxury stocks LVMH, Kering and Hermes, plus L’Oreal, now have a combined market cap of over $US800 billion and account for over 50% of the market cap of France’s CAC 40 Index.

LVMH was one of the largest positions in the Alphinity Global Fund last year and was one of the largest alpha generators. But the question going forward is: Can the remarkable outperformance of the luxury sector continue or is the luxury trade now a crowded house (maison)?

The following analysis aims to answer this question and consists of 4 parts:

- A brief overview of the structure of the luxury sector and how this translates into superior margins, higher returns and consistent growth at a reasonable price;

- Analysis of current trends in the luxury sector such as GenZ influence, collaborations, casualisation, technology and internationalisation;

- Discussion of near-term risks namely investor positioning and a potential US slow down; and

- Analysis of the long-term opportunities and threats including balancing scarcity and scale and effective succession planning.

The conclusion is that the luxury sector remains a very attractive sector from a structural perspective and has impressive long-term tailwinds. However, in the immediate term, investor positioning in the sector remains crowded and there are risks to luxury consumption decelerating in the US. As such, generating alpha from the luxury sector going forward requires good old fashioned (no pun intended) stock picking, rather than simply making the right call on the sector.

PART 1: What makes the luxury sector such a good investment?

A classic business school analysis of the luxury sector reveals some impressive structural advantages:

- Extremely high barriers to entry;

- Few competitors at the ultra-high end;

- Very few substitutes;

- Bargaining power of customers is minimal. The brands hold the power via pricing, exclusivity, design capability and artisan-centric supply chains;

- Customers are generally insensitive to macroeconomic cycles versus other cohorts in the consumer discretionary sector;

- The industry is consolidated with the largest companies using organic growth and M&A to extend their dominance across subsectors and fortify their economic moats; and

- Family ownership and intergenerational stewardship at luxury giants like LVMH, Hermes and Prada foster a prudent, long-term view of capital allocation and an aligned approach to maximizing shareholder value.

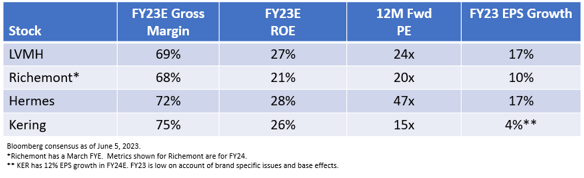

As a result of the points above, the luxury industry has high and stable margins, very high ROEs and consistently provides investors with growth at a reasonable price.

PART 2: Current Trends and Opportunities in the Luxury Sector

To inform my view on the luxury sector, I recently travelled to China and Hong Kong where I met with luxury experts, luxury companies and visited over 20 different luxury stores including Dior, Louis Vuitton, Gucci, Balenciaga, Bottega Veneta, Burberry, Prada, Miu Miu, Fendi, Tiffany’s, Cartier, and Rolex. Yes, it’s tough work covering this sector!

Kicking the Tyres in Style

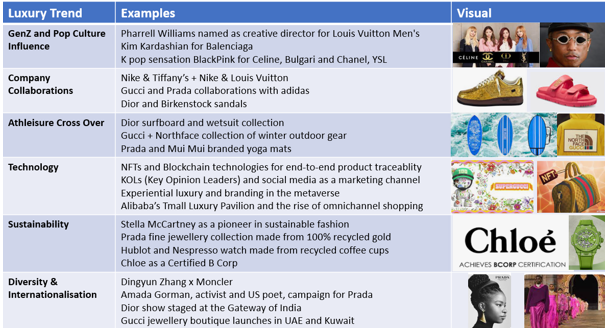

My on the ground due diligence revealed a few main trends: the influence of GenZ, the rise of collaborations, the casualisation of luxury and cross over from athleisure wear, the increasing important of technology and sustainability and increased diversity and internationalisation within the luxury sector. Of the trends outlined above, the growing influence of younger luxury consumers is by far the most important. According to a recent study by Bain & Co, GenZ plus Millennials accounted for the entire growth of the luxury market in 2022 and are predicted to represent 70% of luxury spending by 2025. This same study found that GenZ consumers enter the luxury space earlier than Millennials some as early as 15 years old.

The other thematics to a large extent flow from this “youthification” effect. Younger consumers are more casual and active, are more influenced by popular culture, and have different views on diversity, inclusivity, and sustainability versus older generations. They are also digital natives who are more tech savvy, are active on social media, follow luxury influencers and Key Opinion Leaders (KOLs) and demand omnichannel luxury experiences. These trends are shown below along with select examples.

Key Trends in Luxury

PART 3: Near term outlook for the luxury sector

There are two near term risks for the luxury sector: positioning and the cadence of China reopening versus US deceleration.

Positioning

The luxury sector has been the beneficiary of rolling investment theses. The first uptick in sector performance was based on the reopening of US and European economies post-COVID. Then the thesis shifted to luxury as a relative safe haven in an inflationary environment given the price inelasticity of high-end consumers. Finally, in late 2022 and early 2023, luxury was seen as a beneficiary of China reopening.

These theses have all been correct, but the net effect is that positioning in the luxury sector has become crowded. Some of this excess was shaken out in the last month but positioning remains on the heavy side. Luxury is my no means a contrarian thesis therefore generating alpha from here will be a function of stock picking more so than making the right sector call.

Balancing China reopening with a slowdown in the US

China reopening has provided the latest boost to earnings momentum for the luxury sector. However, the US and Europe are now cycling very hard comps from last year when revenge travel and revenge spending on luxury goods took hold in the Norther Hemisphere summer.

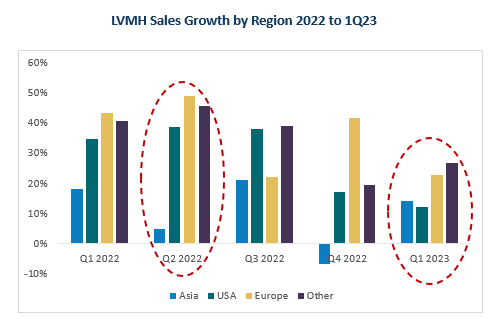

The table below shows LVMH sales growth by region for the last 5 quarters. In 2Q last year, year over year growth in the US and Europe was almost 40% while Asia was barely positive on account of ongoing lock downs in China. Fast forward to 1Q23, and regional growth rates have converged while decelerating overall.

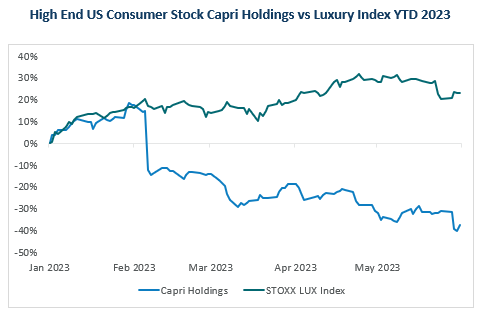

Of course, no one expected 40% sales growth to be maintained forever. Consensus already has negative US sales growth baked into LVMH estimates for the 2Q23. However, the US and Europe are still cycling very hard comps and recent warnings from Burberry and Capri (owner of high end but not-quite luxury US centric branks like Michael Kors, Versace, and Jimmy Choo) have put investors on high alert for signs the US consumer is slowing further.

PART 4: Long term opportunities and threats in luxury sector

Balancing scarcity and scale and effective succession planning are two important long-term considerations for the luxury sector. Incidentally, these factors are both opportunities and threats.

Balancing Scarcity vs Scale

Ubiquity is the killer of luxury. My trip to China and Hong Kong suggested that this is becoming a risk. Every Tier 1 city plus Hong Kong and Macau is home to every luxury brand often with a huge flagship store and multiple other outlets. Add to this online channels, like the Alibaba Tmall Luxury Pavilion, department stores, bespoke retailers and Duty Free and the net result is a veritable bombardment of luxury brands and images. It can be quite overwhelming. China is set to become the largest luxury market in the world but to be successful there, luxury companies must balance scarcity and scale.

Succession IRL

The hit HBO show Succession has many parallels to the luxury industry in real life (or IRL as my kids would say). Hermes is the poster child for how to run a successful family business in the luxury sector with CEO Axel Dumas a sixth-generation member of the Hermès-Dumas family.

Next up are the succession outcomes of LVMH and Prada. In a scenario worthy of its own streaming series, CEO Bernard Arnault has 5 children from 2 marriages, all of whom work at LVMH. A recent reshuffle suggests that daughter Delphine Arnault, board member and CEO of Dior, is the likely front runner with eldest son Antione, close behind. He is the CEO of Christian Dior SE, the holding company that controls LVMH, and has a seat on the board of the parent company.

The other 3 sons are from Arnault’s second marriage: Alexandre is VP at Tiffany, Frederic is CEO of Tag Heuer, Jean works in LVMH watches. Bernard is 74 and LVMH recently raised the CEO age limit from 74 to 80 last year. The market interpreted this as 6 more seasons – I mean years – until the ultimate successor is confirmed.

Spot the Difference: The Fictional Roys vs the Arnaults IRL

Over at Italian competitor Prada a similar succession drama is underway but the plot is slightly different in that the matriarch, Miuccia Prada, is the head designer and the patriarch, Patrizio Bertelli is the Chairman. Their son, Lorenzo Bertelli, has been announced as the ultimate successor but new CEO Andrea Guerra has stepped in to lead the company until Lorenzo is fully prepared. His father Patrizio has become Chairman of the group and the family continues to hold their controlling stake.

While succession plans have been strategised for years, the ultimate handing over of the day to day responsibilities at these companies is not without risk. The next generation of luxury heirs have big shoes to fill and given that the companies their families control are now mega-cap companies in a European context with thousands of employees and hundreds of shareholders. The downside risk of messing up the family business is much more acute than for previous generations.

Conclusion:

In summary, the luxury sector has unique characteristics which result in high and stable margins, consistently high returns, and provides investors with growth at a reasonable price. Not unlike the goods they sell, luxury stocks are scarce.

There are some exciting trends emerging in luxury, but positioning is somewhat crowded and a potential slowdown in US luxury spending is a risk to earnings for some companies. As such, good stock picking is now paramount to generate alpha in the luxury sector.

Our top holding remains LVMH given its diverse product offering, superior brand mix, growth outlook and reasonable valuation. We have a few high-quality luxury conglomerates such as Kering and Hermes on our “Best Research Ideas” list, where we are either waiting for evidence of a specific turnaround or a better valuation entry point. On the other hand, luxury names we are avoiding at this point include Prada, given its non-diversified brand portfolio and Burberry, following their recent results warning and exposure to a US consumer slowdown.

Author: Mary Manning, Portfolio Manager