Our Investment Philosophy

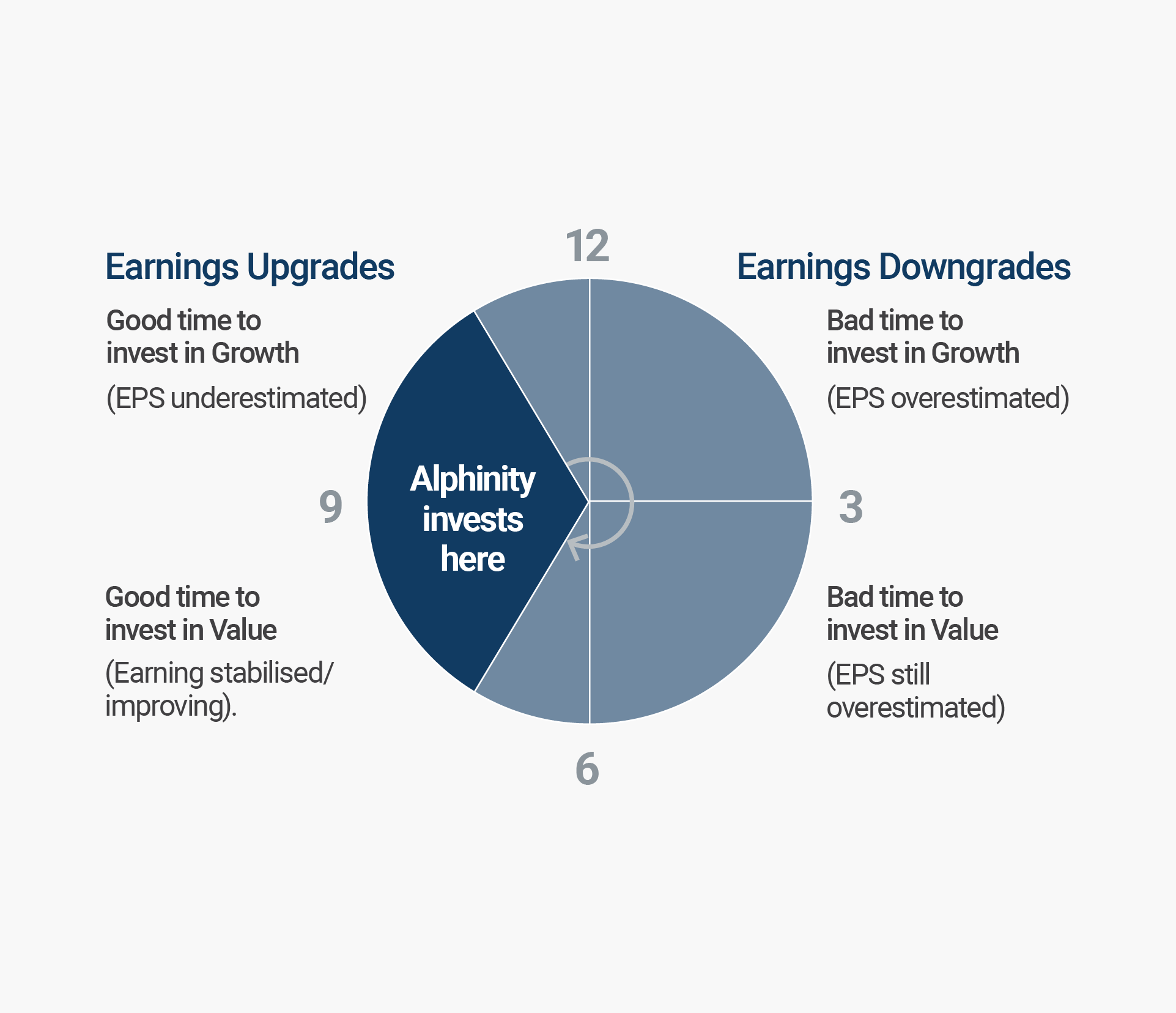

Alphinity seeks to identify and invest in attractively valued, quality companies which are in, or are about to enter, an earnings upgrade cycle. Simply put, we look for stocks that can deliver ‘earnings surprises’ that will drive outperformance.

A company’s earnings ultimately will drive its share price performance over time. The share price will, at any given point, reflect the market’s future earnings expectations. However, the market is typically inefficient at accurately pricing future consequences of new information that will affect company earnings. Clearly identifiable characteristics exist for companies whose earnings ability is likely to be under (or over) estimated by the market, allowing an investor to exploit this inefficiency to create outperformance.

A typical earnings revision path is shown in this diagram. We will enter a position when earnings per share for a company are underestimated by the market. We then sell the position when the share price runs too far ahead of our earnings estimates.

Our approach has rigorous backing in academic research and statistical analysis, as well as in practice over a long period of time. For more detailed background please refer to our research paper “Finding alpha in an earnings upgrade cycle“. In summary:

- a positive earnings announcement by a company is more likely than not to be followed by a period of sustained positive earnings revisions/surprises driving share price out performance (and vice versa for negative announcements);

- earnings revision cycles can be explained by the gradual nature of business cycles as well as human behavioural biases; and

- the investment performance from investing in companies in an earnings upgrade cycle (called Momentum) is enhanced when combined with Quality and Valuation factors.

This ‘relative earnings surprise’ approach is unique in the Australian market. We do not just wait in hope for a turn in company fortunes or expect sustained earnings growth into perpetuity. As such we see our philosophy as a “Core” approach, rather than being strongly style-based. Buying and selling are equally important. The greatest risk with using an earnings revision-based investment approach is the risk of missing the end of the upgrade cycle. By combining earnings revision factors with quality and valuation factors, growth and value traps can typically be avoided.

Alphinity is a Responsible Investor. Environmental, Social and Governance risks and opportunities are integral to our investment process and are taken into account when considering and valuing the companies we invest in on our clients’ behalf. Alphinity is a member of the RIAA and the UN-backed Principles for Responsible Investment. Click here for a link to the most recent report.

Investing in Earnings Leadership

By ‘Earnings Leaders’, we mean the companies in our investable universe that are exhibiting persistent earnings upgrades at a point in time. This group changes constantly, so an active approach to portfolio management is required. We invest in quality, undervalued companies with underestimated earnings expectations. Earnings ultimately drive share prices over time, while a keen assessment of valuation maintains price discipline. Quality factors help control risk.

Our proven investment process, founded on qualitative and quantitative research from our highly experienced team, ensures we are investing with conviction in a diversified portfolio of companies that are at the right point of their earnings cycle, regardless of broader market conditions or style. This has allowed Alphinity to deliver consistent, repeatable excess returns over time while maintaining relatively lower levels of risk.

Responsible Investing

Alphinity has been a signatory to the Principles of Responsible Investment since 2011 and is also a member of the Responsible Investment Association of Australasia (RIAA).

The firm adopted 5 pillars of responsible investing in 2021 and reports annually in a dedicated ESG and Sustainability Report:

- ESG integration

- Stewardship and active engagement

- Sustainable strategies

- Thematics

- Transparency

The Alphinity Sustainable Share Fund and Alphinity Global Sustainable Equity Fund – Active ETF (ASX: XASG) are both certified by RIAA and have a Sustainable Plus rating.