2 quality stocks for when the tide goes out

Warren Buffett famously said that “only when the tide goes out do you discover who has been swimming naked.”

We have been hitting lower tides in recent months as the world of ‘free money’ comes to an end, which is exposing ‘naked’ companies and assets that have crashed.

The low tide is however also highlighting great companies with strong management teams that are suited up to steer their customers – and investors – to safety during these difficult times.

Great management teams can navigate challenging periods like the present and come out stronger on the other side.

There are many examples of best-in-class management teams represented across our Global and Australian funds and several management teams that have specifically done a phenomenal job managing the increasing risks. Some Australian examples include Goodman Group, Super Retail Group, CBA, Medibank, and Orora Group. On the global side, we can commend the teams at McDonalds, PepsiCo, Diageo, and Waste Connections.

Below we look at 2 lesser-known domestic and global management teams.

1. Waste Connections (WCN) – – Pragmatic & differentiated

Waste Connections is the 3rd largest solid waste services company in North America. They provide non-hazardous waste collection, transfer, and disposal services to millions of customers across the US and Canada. WCN was founded by the current Chairman and this entrepreneurial culture runs deeply through the organization.

WCN runs a decentralised structure where decisions and PNL responsibility is pushed out of HQ and down into the operating businesses around the country. You often see this type of management structure in Scandinavian capital goods companies, but we rarely see it in the US. If done well, it creates a dynamic and flexible business that can respond rapidly to a changing environment.

With the challenges that the waste companies have faced over the past 6 months, this approach has been a meaningful advantage for Waste Connections. We see the outcomes of this decentralisation through their industry leading margins and cashflow generation.

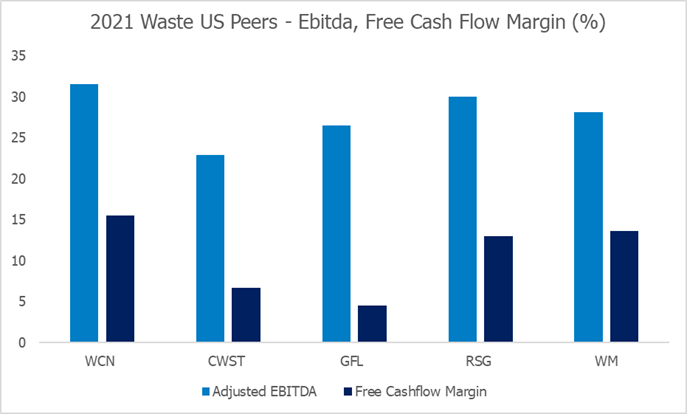

WCN has industry-leading profit margins

Source: Bloomberg

Further, the company generally seeks to avoid highly competitive, large urban markets and instead management target markets where they can attain high market share either through exclusive contracts, vertical integration, or asset positioning. WCN defines their markets as either “competitive” or “exclusive/franchise” based. Competitive markets are markets where pricing is a function of supply & demand and WCN deliberately focus on the underserved markets, which are less competitive. This affords WCN very strong pricing power and market shares. The remaining 40% of revenues are generated from markets they serve on an exclusive/franchise model basis, where pricing for contracts is done on a CPI-like or returns based basis.

Similar to its peers, WCN has faced numerous challenges of late, including input price pressures (fuel spikes), labour shortages/higher wages (with drivers and mechanics extremely sought-after) and truck shortages to name a few. Despite this, they are managing the business well and continuing to execute on their strategy. At their recent results management achieved very strong pricing outcomes, talked to building M&A momentum, and maintained their full year FCF guidance. Waste Connections is a stable, defensive grower with an enviable track record worth backing in our view.

2. Orora (ORA) – Optimise, enhance & invest

Orora (ORA) is an Australia-based company that provides packaging products and services. It manufactures glass bottles and beverage cans in Australia and manages a medium sized packaging distribution services in North America.

From China wine tariffs to old legacy IT systems to higher input cost pressures, the ORA team has not had a shortage of challenges to deal with over the last few years. In response, they have addressed each of their challenges in a logical and systematic way and announced a clear growth strategy for the next few years.

Over the last few years, ORA has done a complete SAP integration process in the US that after some significant implementation challenges are now resulting in improved operational efficiencies and management of input cost pressures.

They have also implemented a mix shift towards higher product-to-package ratios (for example the recent contract with Tesla for car parts) and enhanced their digital capabilities through an e-commerce custom design platform and diversified their product portfolio.

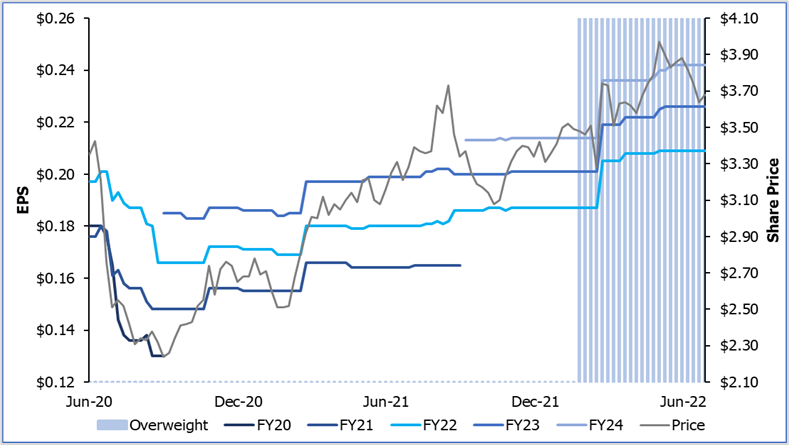

ORA — A quality, defensive enjoying earnings upgrades

Source: Alphinity, Bloomberg, 28 June 2022

ORA has also been able to find low risk capacity expansion opportunities such as beverage cans in Australia. Following a thorough review of some poorly judged and executed acquisitions in the US by previous management the company believes they are now ready to look at new M &A opportunities. While not without risk we would back management given their conservative approach and successful management of the company since taking the reins. Finally, and importantly, ORA is pivoting investment towards more sustainable products and operations with a clear commitment and path to net zero greenhouse gas emissions by 2050.

Despite the tough environment, ORA has recently reiterated their guidance for FY22 EBIT to be higher than FY21. In combination with a robust balance sheet, meaningful returns to shareholders (both dividends & buybacks) and attractive Return on Capital (25%), we view ORA as a high quality, defensive company in safe hands.

Spending more time with management

When uncertainty increases and the environment becomes more challenging, we make a concerted effort to spend even more time with the management teams that are steering our investments, to understand their thinking and approach to ongoing and new challenges.

We meet with various members of the management teams across seniority levels, responsibilities, and divisions. Our due diligence process also includes site visits and meetings with the company’s suppliers, competitors, and clients.

Through the ebb and flow of investment cycles, investors should continuously focus on identifying quality management teams that can perform well during high tides, but even better during low tides.

Author: Elfreda Jonker, Client Portfolio Manager