December 2025

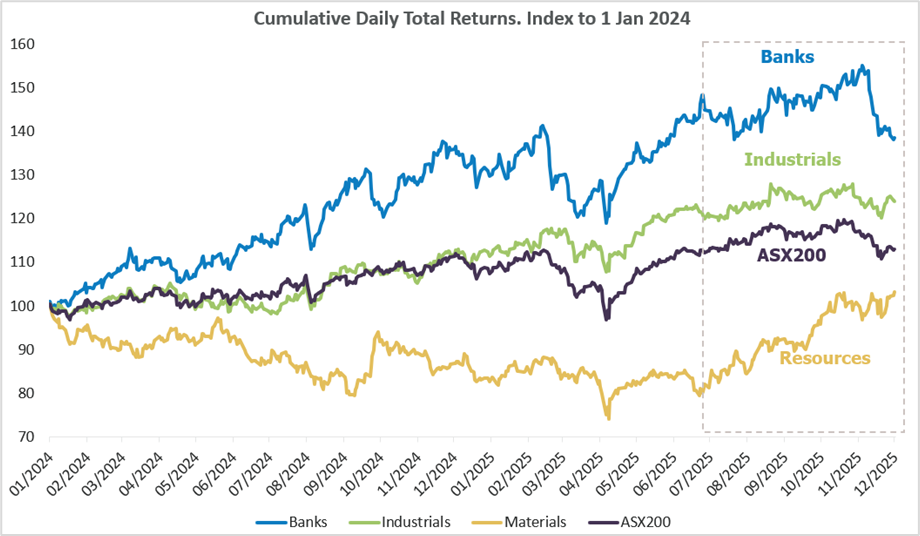

“Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.” Ferris Bueller’s wisdom rings particularly true for investors in 2025. The market has moved at breakneck speed this year—from tariff tantrums to truce, from panic to euphoria, and back again. Blink, and you might have missed one of the sharpest rotations on the Australian stock exchange in recent memory.

And what a rotation it’s been! The Australian materials sector is up c40+% from the Liberation Day trough in April, driving the year-to-date return to close to 30% and outperforming both the broader industrials and financial indices.

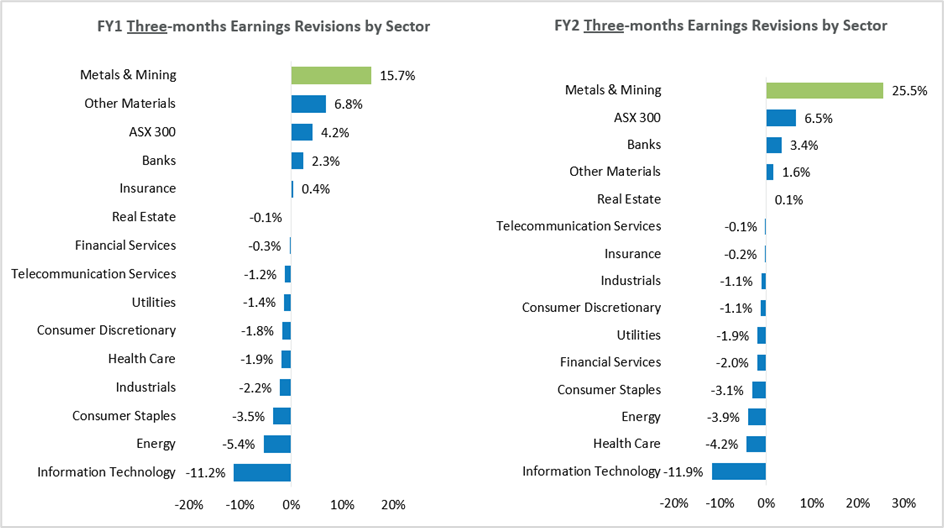

In our view, this represents a sustained fundamental shift in earnings leadership, not merely a cyclical bounce. Four key factors explain this outperformance: 1) analyst capitulation on overly pessimistic commodity price expectations after years of downgrades lowered the earnings bar; 2) a better than expected global demand, with China’s export engine remaining surprisingly strong cushioning property weakness, the US economy holding up well on AI-driven infrastructure investment, and a welcome tariff truce between these two large demand drivers ; 3) supply disruptions and constraints across multiple commodities; and 4) a weaker USD.

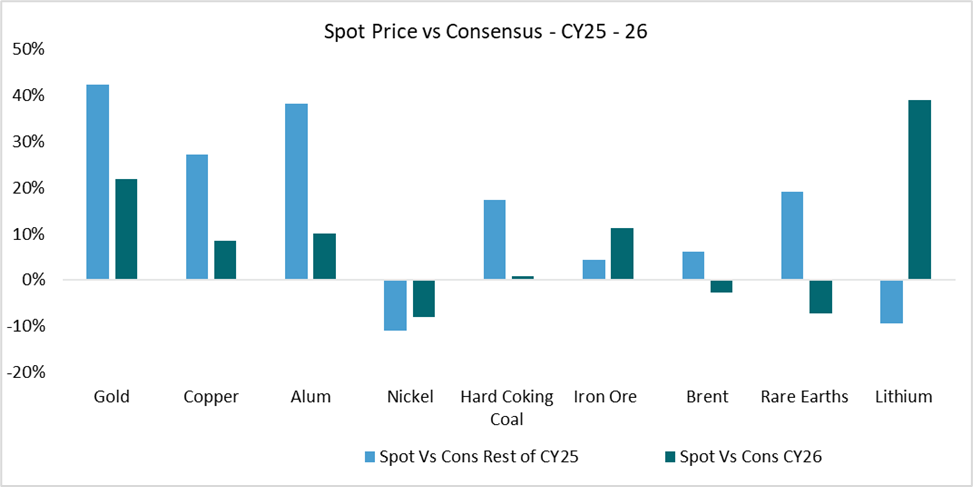

These tightening dynamics have pushed commodity spot prices well above analyst expectations, triggering substantial earnings upgrades. Our recent Resources focused China research trip reinforced the view that these trends appear durable. As a result, we believe this earnings leadership change has more to go, and we have built a large overweight to the sector as we head into 2026.

Below we dig into the underlying drivers, highlight the most compelling subsectors, and share our preferred plays.

Source: Alphinity, Bloomberg, 4 December 2025

Fundamental Improvements vs Risks

We’re seeing genuine fundamental improvements, not just momentum chasing. The key underlying driver is improving supply-demand fundamentals. Global demand has proven more resilient than expected while supply continues disappointing across multiple commodities. Each commodity has its distinct dynamics: lithium experiencing upside demand surprises from battery storage adoption; copper facing ongoing supply disruptions and structural constraints; aluminium benefiting from Chinese production caps.

A rising A$/weakening USD would also be helpful for the sector going forward, which seems like a strong possibility if the US continue to cut rates and Australia pause or lift rates.

The primary risk for the commodity price outlook is a deterioration in demand from a weakening US consumer triggering recession, new tariff escalations, and/or geopolitical tensions disrupting trade flows. Materials are inherently cyclical and vulnerable to growth slowdowns, though supply-side factors provide some commodities an elevated price cushion.

Analysts are rapidly adjusting their expectations, but while spot prices remain above expectations, producer earnings should continue to being revised upward. Since share prices are driven by changes in earnings expectations—which tend to be serially correlated—these uptrends can take months to fully play out.

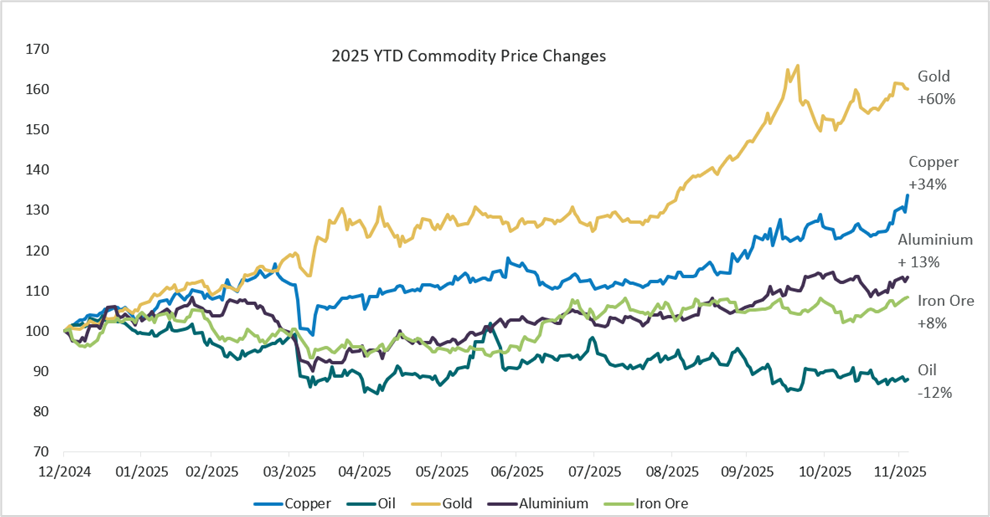

The commodity rally has been led by gold, but has recently broadened out

Source: Bloomberg, 30 November 2025

Most Compelling Subsectors

Base metals, particularly copper and aluminium, look most attractive. Copper’s supply picture remains tight—declining ore grades, a dearth of new discoveries, and recent disruptions are colliding with strengthening demand from recovering economies, energy transition, and AI infrastructure buildout. Aluminium shares these same demand tailwinds while facing its own supply constraints from Chinese tightly imposed production caps, creating a similarly compelling setup.

Lithium offers compelling near-term upside. Healthy EV demand combined with surprising battery energy storage growth (driven by lower costs and renewable firming needs globally) is pushing the market into deficit. Years of depressed prices have effectively slowed supply growth, setting up a tighter market than many expect. Supply will catch up, but for now there is upside to prices.

Gold remains attractive despite its strong run, supported by ongoing central bank diversification away from the USD amid persistent geopolitical volatility and elevated US debt levels. The structural bid from central banks and a weakening USD provide price support.

Iron ore presents a more nuanced picture. While the commodity faces medium-term headwinds from flat to declining Chinese demand and rising global supply, prices may stay elevated longer than analysts expect as this rebalancing unfolds gradually rather than abruptly.

By replacing analyst commodity price expectations with current spot prices – it implies upside for most commodities in 2025 and 2026

Source: Alphinity, Bloomberg, 4 December 2025

Portfolio Positioning

We’ve built a large overweight to materials over recent months, believing this earnings leadership rotation has further to run. Within the sector, we hold a modest overweight to iron ore and lithium, with larger allocations to base metals, while remaining neutral on gold (in our core portfolios).

Our positioning hinges on the gap between analyst expectations and spot prices. We’ll maintain exposure as long as earnings revisions remain positive. If analyst expectations catch up to current pricing, or if supply-demand dynamics shift materially, we’ll reduce exposure accordingly. The sector’s resilience depends less on absolute growth levels and more on whether fundamentals can continue exceeding lowered expectations. For now, our large overweight is well anchored.

Metals & Mining – Seeing broad-based upgrades after 3 years of downgrades

Source: Factset, 4 December 2025

Two standout positions:

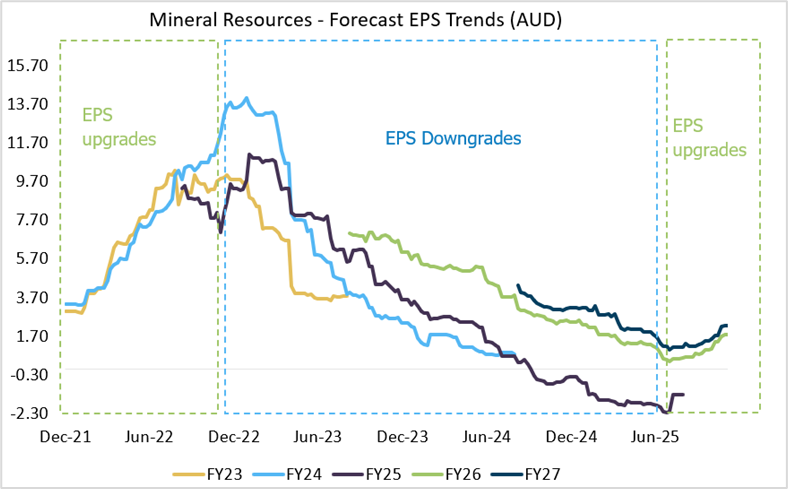

Mineral Resources – Offers exposure to both iron ore and lithium but importantly presents a compelling deleveraging story as the company strengthens its balance sheet. The primary non-commodity risk is CEO succession, which we’ve actively engaged on with the Chair to ensure appropriate planning.

Source: Alphinity, Bloomberg, 3 December 2025

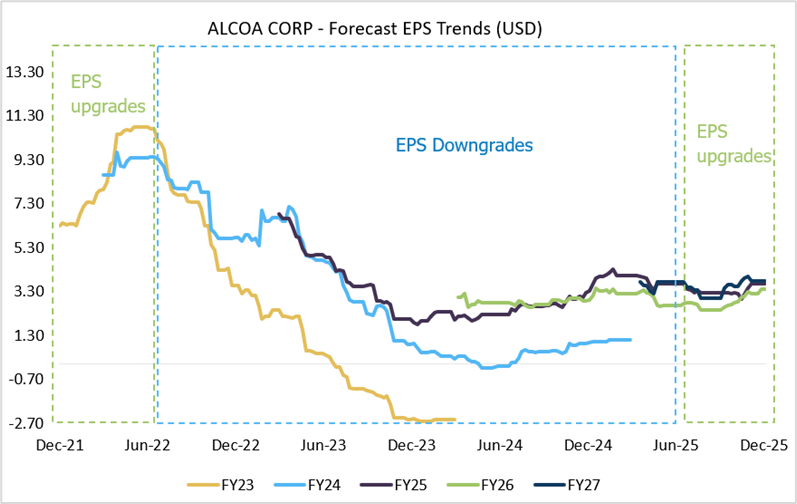

Alcoa – Provides exposure to aluminium, where upside potential remains more under-appreciated than copper. The combination of aluminium price strength, ongoing cost reduction initiatives, and potential Canada-US tariff relief could drive substantial earnings upside beyond current market expectations.

Source: Alphinity, Bloomberg, 3 December 2025

Conclusion:

The materials sector rally this year marks a meaningful shift in market leadership, driven by genuine fundamental improvements rather than fleeting momentum. While the sector’s cyclical nature means risks remain, the current environment of resilient global demand, constrained supply, and analyst expectations still playing catch-up to reality creates a compelling setup for continued outperformance into 2026.

We’ve positioned our portfolios accordingly with a large overweight to materials, focusing on base metals and select opportunities in lithium and iron ore.

For advisors looking to position clients for the next phase of the cycle, materials deserve serious consideration.