When you hear the term “The Big Three” you might instantly think of legendary Tennis players Roger Federer, Rafael Nadal and Novak Djokovic. Or if you’re into music, perhaps Kendrick Lamar, J. Cole, and Drake come to mind. Investing now has its own version of The Big Three, which consists of Amazon, Costco, and Walmart. These three ‘retail superpowers’ have experienced sustained growth and are increasingly dominating the U.S. retail landscape.

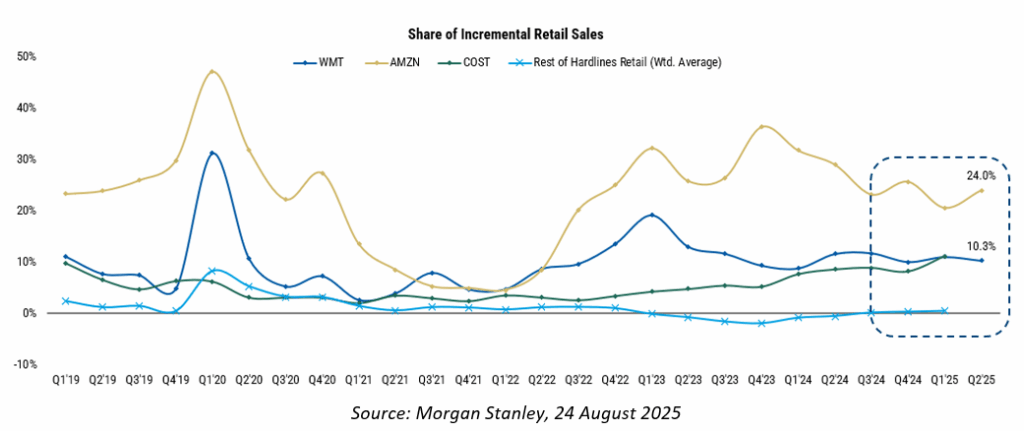

Collectively, in the second quarter 2025, the trio accounted for an estimated 45% of incremental retail sales (Amazon 24%, Costco 11% and Walmart 10%). Said another way, 45 cents of every incremental dollar of U.S. retail sales is spent with one of these three companies, against an estimated 3 million U.S. retail businesses.

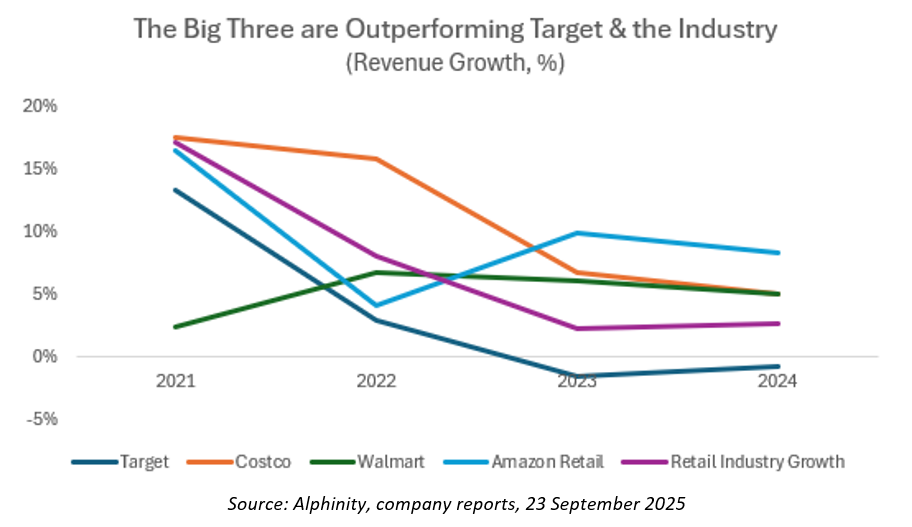

Not only are they growing at the fastest rates in the industry, but they are doing so off a much larger revenue base. For example, Walmart has continued to grow in the 5-6% range despite more than $700bn of annual revenues. Scale is an increasingly important competitive advantage, allowing the big to keep getting bigger.

The sheer size of these business drives bargaining power with suppliers and the ability to absorb any incremental cost pressures across a larger base, limiting impact to profits. Keeping prices below peers, and even expanding the value gap, creates a flywheel of higher growth and profitability which can continuously be reinvested into lower prices and product assortment. From a customer perspective, that means lower prices, higher quality products, and more convenience.

Scale advantages are more pronounced in e-commerce, with the added benefit of accessibility and delivery squeezing out traditional bricks and mortar peers and smaller players who lack the financial and logistical capabilities to compete. E-commerce is the fastest growing retail channel, and within that the share gains are even larger – Walmart grew 26% in the most recent quarter and Amazon 12%. Combined they accounted for a staggering 85% of incremental e-commerce sales.

If they are winning, who is losing?

Smaller retailers generally are in a tough spot. However simply being big isn’t enough to guarantee success. Other well-known stores such as Target are also suffering. Once labelled ‘Targét’ due to its slightly upmarket general merchandise and home goods offerings, the company has lost its way. Although much of Target’s pain is self-inflicted, The Big Three’s ability to provide an increasingly better quality of product for a lower price has led to market share losses for Target, with growth turning negative while The Big Three continue delivering solid revenue growth rates.

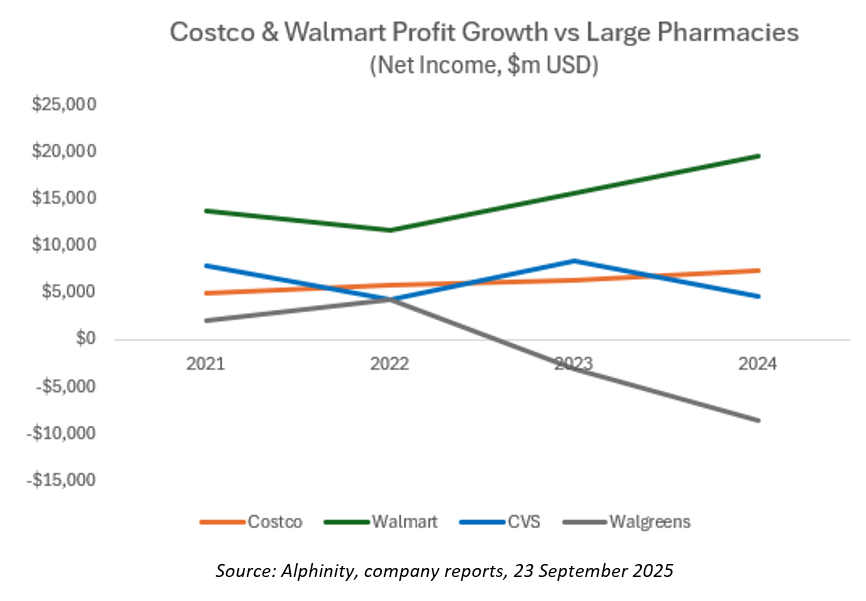

Traditional pharmacies are also challenged as Costco and Walmart expand their competing offerings, allowing trip consolidation for customers as they no longer need to make an extra stop at the pharmacy for basic products. The outcome is CVS closing stores and adjusting pricing models. Walgreens previously announced it would close 1200 stores and that 1 in 4 were no longer profitable. It was recently acquired by a private equity firm with the goal of implementing a turnaround. While Costco and Walmart have grown net income at attractive rates post-Covid, the large pharmacy chains are less profitable today than they were five years ago, with Walgreens now loss making.

Stock selection within The Big Three

It’s no surprise all three have strong earnings momentum and as such our Portfolios have significant exposure (to varying degrees) to these winning stocks. However, there are notable differences in the strategies these businesses deploy.

Amazon is the undisputed leader in e-commerce, with an estimated 80% of U.S. online shoppers having purchased from the website in the past year. Costco sits at the other end of the spectrum, with e-commerce accounting for only 7% of total sales. Instead, it sells a limited amount of high-quality goods, usually in bulk quantities, at industry-leading prices. The assortment is different to other retailers and various items on the shelves regularly change, providing a treasure hunt experience which lends itself to shopping in person and has been hugely successful.

Walmart is a blend of Amazon and Costco. With a heritage in groceries and the need to keep produce fresh, Walmart historically lent on in-person shopping. More recently the company has leveraged the >4,500 store footprint to double as distribution centres for online ordering and delivery, with the ability to reach 93% of U.S. households in under three hours, creating a promising growth avenue.

Although the approaches may differ, the common characteristics they share are scale and strong execution against their preferred strategies. We see a continuation of these recent trends and believe The Big Three will continue to dominant U.S. retail for the foreseeable future.

Retail opportunities outside The Big Three

That doesn’t mean all retail is out of bounds and will be consumed by the The Big Three. Opportunities remain in a select number of high-quality specialty retailers that are thriving despite the success of Amazon, Costco and Walmart.

One of these is O’Reilly Automotive, a recent addition to the Portfolio. O’Reilly is the second largest auto parts retailer in the U.S. and the largest supplier to the professional market. O’Reilly benefits from a dense hub-and-spoke distribution network, providing the best reliability and delivery times, which has driven customer loyalty and market share gains over decades, leading to consistent EPS growth.

Auto parts is a knowledge-based industry that is difficult to replicate by mass market retail, with customers going into the stores seeking advice and wanting to talk to an expert. The specialist sales process is especially important on the professional side where O’Reilly thrives, shielding it from competitive threats by large broadline retailers.

O’Reilly is also one of only a few companies that can benefit from tariffs. The industry has lacked price inflation over the past year, and with that coming back into the growth algorithm, combined with the needs-based sale (if your car is broken you need to fix it), revenue and earnings growth should accelerate. With tariffs potentially driving up the cost of new cars, consumers are more likely to hold onto existing vehicles for longer and forgo upgrading, leading to greater demand for repair work.

Conclusion

Alphinity remains focused on identifying quality businesses with strong momentum and expanding competitive advantages, where the risk of disappointment is low. We are positioned behind structural winners such as The Big Three, while also remaining perceptive to unique retail businesses that can continue to thrive in a dynamic macro environment.