On all accounts, the latest earnings season will go down as one of the most spectacular in recent history. Record earnings growth, large earnings upgrades across sectors, dividends returning, increased guidance and bullish outlook statements from CEO’s across the globe. This is perhaps not surprising for a post-recession early economic stage recovery, but like most trends through this pandemic cycle, it stands out in terms of its scale. Of course, with global equity market valuations well above their long-term averages, much of this earnings surprise has already been captured in the preceding months. At Alphinity we continue to focus on stock specific opportunities, where we believe the market is still underestimating potential earnings growth.

Below the Alphinity team reflects on the key themes from the latest reporting season and the standout results for our portfolios.

A few key themes to flag:

- Earnings growth continues to be the key driver of global equity market returns in 2021 as higher bond yields continue to pressure valuations.

- Strongest results season in decades (on number and size of revisions), particularly in US and Australia.

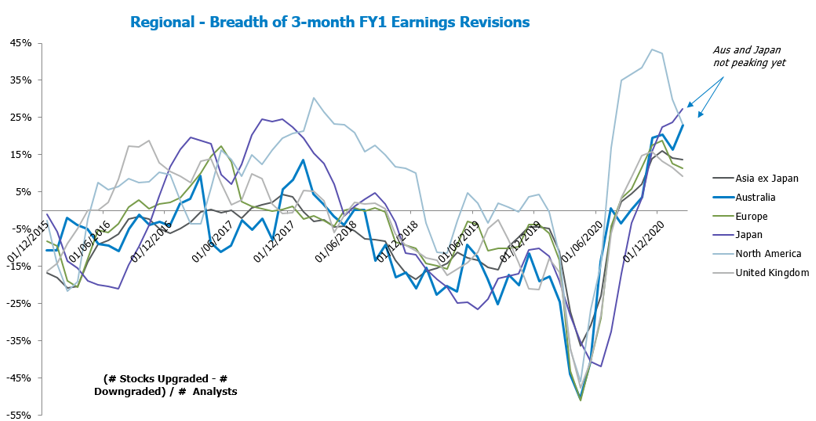

- All regions seeing earnings upgrades over the past three months, with average global revisions of +5-8% over this period.

- Earnings revisions sentiment indicators have peaked a month ago and are now reducing, with Australia and Japan the exception.

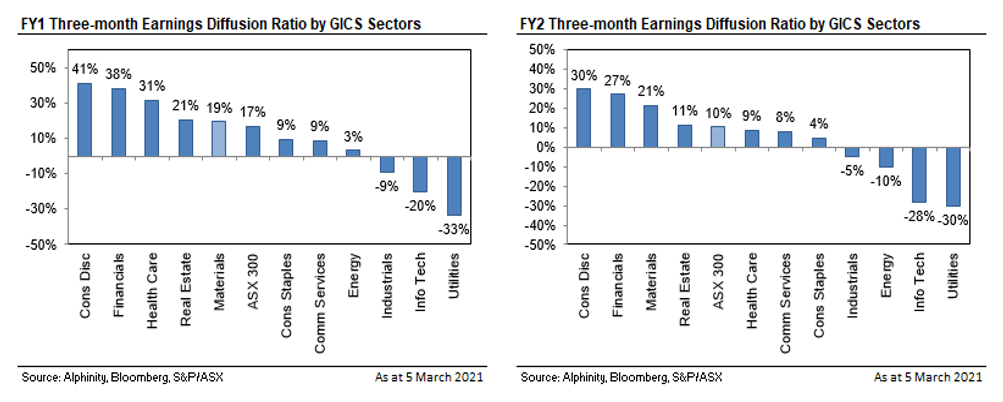

- Cyclical sectors are still seeing the largest earnings revisions, with Financials still the standout sector (on number and size of beats).

- Earnings are now back at/close to pre-COVID levels across most markets (Australia still below).

- Dividends are returning, with positive dividends per share (DPS) revisions across most regions (China the exception), with Australia well above the global average.

- Guidance increasing – the number of companies giving FY21 guidance increased with most guidance in line or ahead of expectations.

- CEO’s optimistic about consumer demand, some COVID trends expected to persist, while supply chain constraints and higher commodity prices could push costs higher.

Australian views:

The strongest results reported for the Australian Alphinity Funds included Sims, Bluescope, Fortescue, James Hardie, Macquarie, QBE, CBA, ANZ, NAB, Medibank, Goodman, Super Group, Woolworths, Bapcor as well as Ramsay and Sonic in Healthcare.

Key themes from the Australian earnings season include:

- Strongest positive surprise reporting season (by number and size) for at least two decades.

- Record rate of beats vs. misses: +51% beat consensus expectation, well above prior peaks and the long-run average (40%).

- Largely cost-driven (driving margins higher) rather than revenue and some pull forward from F22 into F21.

- Dividend payout (37% of Free Cash Flow to dividends) the highest level in 30 years, funded mostly from a lower share of spending on capex.

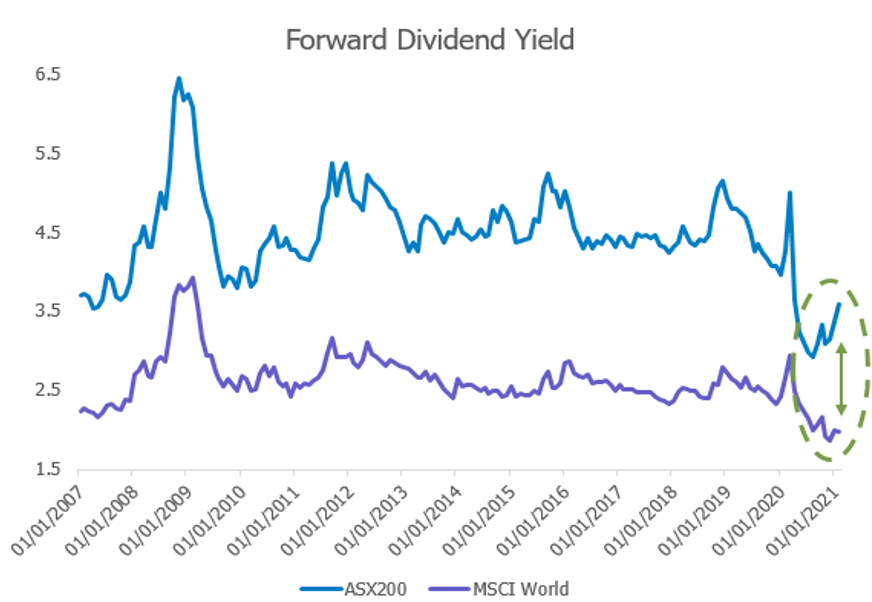

- Relative to the globe, the yield gap – which has been an important element of the Australian investment case – has started opening again.

- Out of the top 150 companies that reported earnings, 63% provided guidance commentary, up from 36% in the August reporting season.

ASX 200 vs MSCI World Dividend Yield

Source: Bloomberg

Australian earnings revisions: Continue to broaden out with dividend revisions even stronger

- Consensus is currently expecting ASX300 earnings per share (EPS) growth of +33.9% for the next financial year (FY1) and +6.1% for the following financial year (FY2).

- This is the strongest revision cycle relative to any prior recoveries, with six months of consecutive upgrades and 44% of firms seeing consensus EPS upgrades.

- ASX300 earnings for the next 12 months is currently still below the pre-COVID levels and is only expected to reach previous peak during FY2.

- DPS revisions have been even stronger than earnings revisions, with the 6.3% uplift in February the highest this century. The sectors seeing the largest dividend upgrades are Banks (+15%) and Resources (+18%). This has seen the dividend yield gap between Australia and the rest of the world increasing again (see chart above).

- Cyclical sectors have been driving the biggest earnings revisions. Resources continue to lead (buoyed by strong global manufacturing/China), Consumer Discretionary (strength from COVID related Consumer spending shifts) and Banks (mainly lower bad debt charges).

- Earnings for the ASX200 for the next 12 months are currently still circa 7% below pre-crisis levels, with the PE (12-month forward) at 18.3x are slightly ahead of pre-crisis levels (18.1x in February 2020)

Recent earnings revisions reinforcing cyclical rotation

Earnings expected to reach pre-COVID levels in 2022

Source: Bloomberg

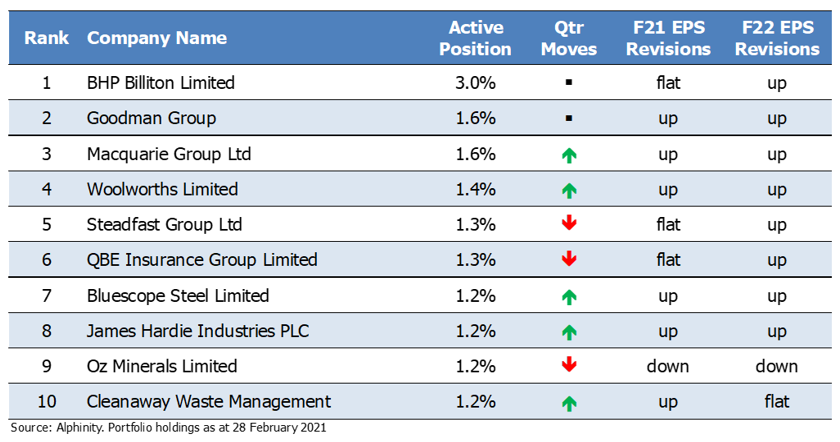

Positioning across our Australian Funds:

- Our portfolio positioning remains a mix of structural winners, some ongoing COVID beneficiaries and increasingly earnings recovery opportunities.

- We have made no kneejerk shift into low quality or ‘value’ but continue to follow opportunities for earnings upgrades which have broadly been in the more cyclical sectors.

- We see continued earnings momentum in the Resources and Consumer Discretionary sectors and continue to skew the portfolios to more cyclical exposure.

- We have however also taken profits in some areas (like Resources), where price expectations are starting to look stretched and added some laggards where earnings revisions remain positive.

Alphinity Australian Share Fund – top 10 active weights

Global views:

The strongest results across Alphinity’s global portfolio included Morgan Stanley, Bank of America, S&P Global, Amazon, Alphabet, Activision Blizzard, Nvidia, Keysight, Microsoft, Teck Resources, HCA, Infineon, Trane Technology and Prologis.

Key themes from the Global earnings season include:

- With 93% of MSCI World companies reported 4Q20 results, 63% have beat on earnings expectations and 61% on sales expectations.

- The Technology and Financials sectors saw the greatest number of beats, while Consumer goods and Materials saw the biggest beats relative to expectations.

- The Technology sector’s EPS growth significantly outpaced that of the overall market in 2020 but is expected to normalise (grow in low teens) in 2021.

- We have also seen more muted reactions to beats across global equity markets than historically the case with a lot of good news already priced in at high valuations going into the reporting season.

- Outlook statements have largely been positive, particularly from reopening stocks (hotels), pharma. A few persistent CEO comments to flag:

- Pandemic driven consumption habits may persist (online demand).

- Supply chains still seeing big backlogs.

- Input costs (such as raw materials) are on the rise.

- Reopening companies talking about good demand from 2022 onwards.

- Economic recovery remains strong and on track.

- Balance sheets are stronger, with higher cash balances expected to be deployed to grow businesses or acquire others.

- SPAC (special purpose acquisition company) is the new buzz word, with concerns around high valuations.

CEO quotes:

“In January, we had a very strong month for group bookings in 2022 and beyond.” – Marriott (MAR) Group President Stephanie Linnartz

“…we are starting to see a little bit of inflationary pressure, particularly around freight and a little bit in the supply chain as well.” – Danaher (DHR) CFO Matt McGrew

“It was a record quarter driven by our commercial cloud which surpassed $16 billion in revenue up 34% year-over-year. What we are witnessing is the dawn of a second wave of digital transformation sweeping every company and every industry. Digital capability is key to both resilience and growth. It’s no longer enough to just adopt technology.” – Microsoft (MSFT) CEO Satya Nadella

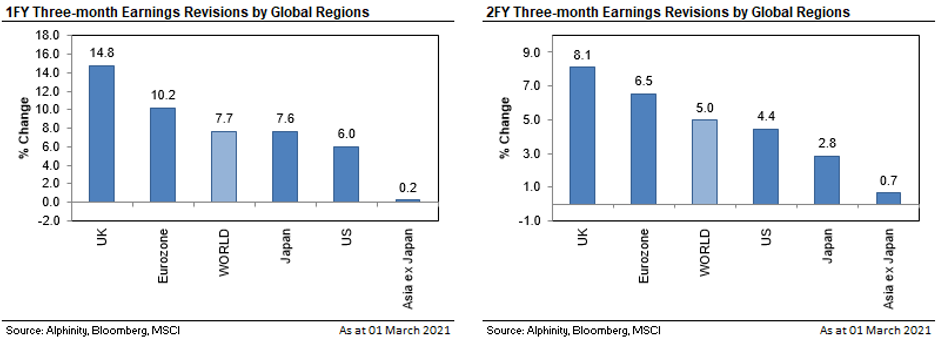

Global earnings revisions: Positive across all regions and cyclicals seeing the largest upgrades

- At an aggregate level global earnings momentum over the past four weeks has been positive for FY1 and FY2. FY1 revisions still higher than FY2.

- All regions have experienced upgrades and over the past three months, with average revisions between +5-8%.

- Global earnings sentiment (or breadth of revisions) has peaked, but size of revisions over last month still in line with last few months, which is normal for this point in the cycle (Australia and Japan the exceptions) – see chart below.

- Across sectors, cyclical sectors such as Energy, Materials, Consumer Discretionary and Financials have been leading the upgrades, while defensive sectors such as Utilities and Consumer Staples are starting to see small downgrades.

- MSCI World earnings forecast now 30% for FY1 and 14.5% in FY2, two-year CAGR of 22%.

All regions have seen positive EPS revisions over the last three months

Global earnings sentiment (or breadth of revisions) has peaked – which is normal for this point in the cycle – Australia and Japan the exceptions

Source: Alphinity

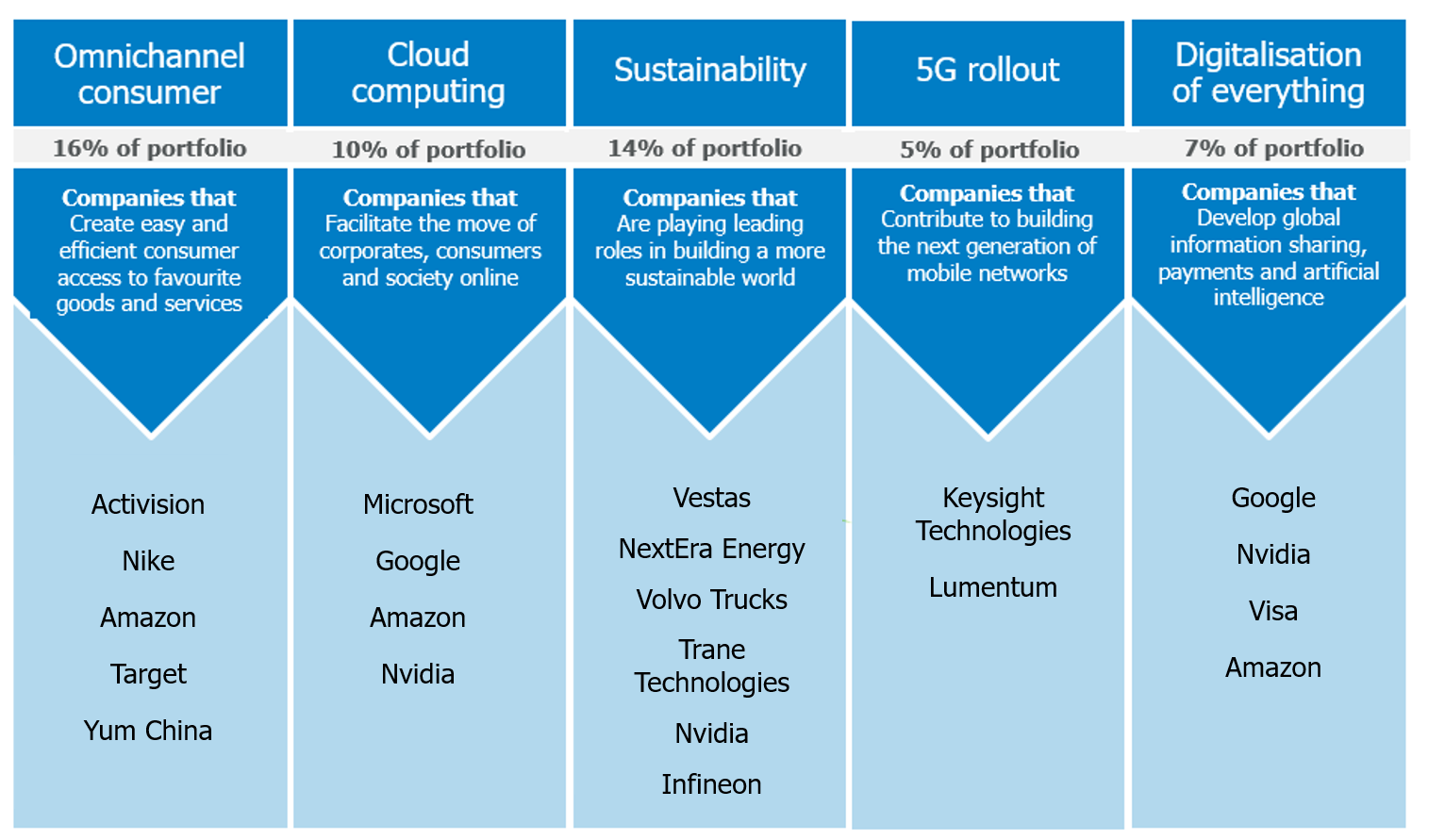

Positioning in the Alphinity Global Equity Fund – Active ETF:

- We continued to add to more cyclical exposure, particularly in financials (Bank of America) and cyclical tech (Infineon), COVID beneficiaries with structural growth stories (Danaher and HCA) and reopening plays (such as PulteGroup that will benefit from the strong US housing cycle and Otis).

- We have maintained/increased positions in some of our favourite growth stocks with secular growth themes (Activision, Amazon, Alphabet) given strong results and continued earnings upgrades coming through (see table below). We do not have exposure to unprofitable tech trading at ultra-high valuations.

- As the global economy continues to gain momentum, we prefer to fund the above-mentioned increases with defensive exposure (such as staples).

A portfolio that is consistently exposed to strong long-term trends, both through growth and cyclical stocks

Source: Alphinity

Author: Elfreda Jonker, Client Portfolio Manager

Find out more

For more information, please contact your financial adviser, call the Fidante Partners Investor Services team on +61 13 51 53.