Who: Stephane Andre

Where: USA

When: November 2015

What were you looking for?

My trip to the US in November was to better understand the economics of the various shale oil (also known as “tight” oil) basins and the strategies being pursued by oil producers, to assess whether the oil price recovery assumed by the market is realistic or overly optimistic.

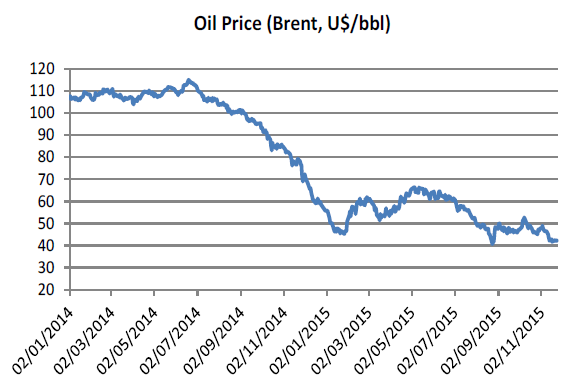

The volatility in the oil price over the past year has been by all historical references staggering, and took most investors and producers by surprise during its sharp collapse phase (2nd half 2014), its rebound (1st half 2015), and in its more recent fading phase.

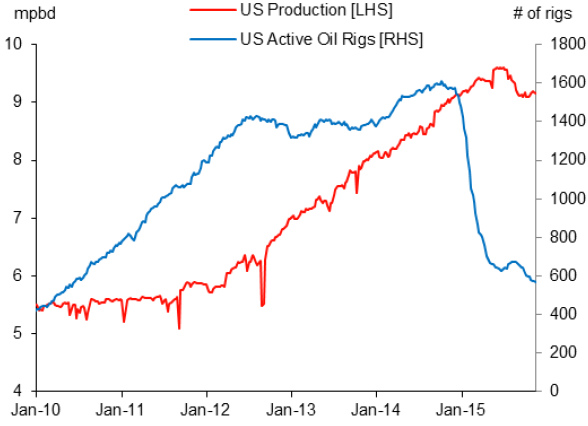

The 2014 collapse was caused by the surge in US tight oil production which resulted in global oil production exceeding the 94 million barrels per day (mbpd) demand by 1.5mbpd, shifting the global oil market into over-supply. When OPEC announced in November 2014 that it would not cut production the message was very clear: any supply cut would have to come from non-OPEC producers, and most likely from the higher cost and swift-to-flex US tight oil operators. Market forces were such that the oil price fell to a level low enough to enforce this rebalancing.

The response didn’t take long: US rig counts quickly fell by 60% and US production started to fall from April 2015. At that point the market started to expect that equilibrium was imminent which led to a new surge of buying, pushing oil prices back up. Oil investors were then disappointed as the US producers’ aggressive focus on cost reduction and efficiency improvements led to higher production per oil rig, lowering the break-even price of tight oil. This resulted in a smaller than expected decrease in production and perversely prolonged the pace of correction which triggered the second sharp fall in the oil price.

The market is now however expecting a significant rebound in prices in 2016 to around $55/barrel and around $65/barrel for 2017.

What did you discover?

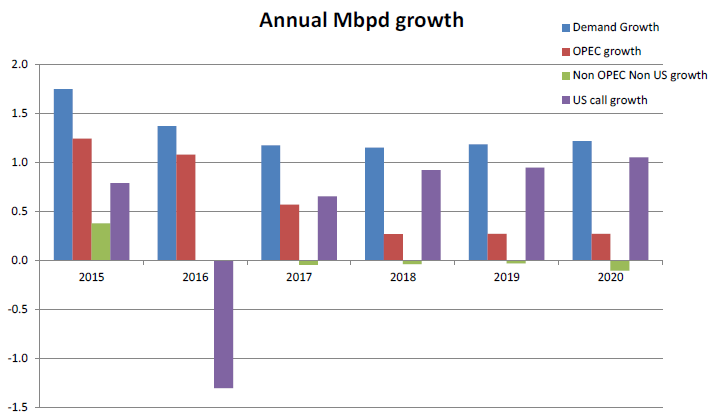

I was of the view that the current $40/barrel oil price is unsustainably low, and that a price closer to $70 would be required to stimulate the medium-term 0.5-1.0mbpd growth in US oil production that is required based on our demand and supply assumption. However from an investment perspective the pace of the recovery is a more important element in timing our exposure to the sector. I came back with a view that the oil price is more likely to remain in the $40-50/barrel range in 2016 than to move above $50, and that therefore earnings of oil-producing companies will continue to disappoint. The rationale for this conclusion is based on the following factors:

- 1. Cost reductions and efficiency improvements now allow one of the major US shale energy basins, Eagle Ford, to generate a breakeven around $45/barrel. Above $50 not only would Eagle Ford activity increase, production in other tight oil basins would also start to grow again. Should the oil price rise above $60/barrel a large proportion of tight oil production would come back online. At $70/barrel almost all tight basins would be profitable. Given that oil production needs to fall by more than 1mbpd from current levels in order to clear the excess supply, little new production should be introduced and the full

impact of the natural depletion rate of tight oil fields is required. Therefore, we feel the oil price will most likely stay low for most of 2016. - At any time over the next two years several thousand already-drilled but as yet non-producing tight oil wells could be fracked and quickly brought on line. These would add a further 1mbpd, providing a further cap to the oil price.

- Iran will likely add 0.5mbpd in 2016 once UN sanctions are removed. This additional supply would increase the production cuts already required by non-OPEC producers in order to re-establish a balance.

- Oil inventories around the world are already at a record high level and will prove a further impediment to any future oil price increases.

What does this mean for the Alphinity portfolio?

Whilst we see medium to long term value in the Energy sector, we believe earnings are likely to disappoint again in 2016. We therefore remain under-weight the sector.