Since the Australian Government introduced the Modern Slavery Act in 2018, there has been an explosion of disclosure related to modern slavery risks, management, and collaboration.

| Statistics from the Australian Government Modern Slavery Register1 |

| 8048 Entities |

3489 Mandatory |

481 Voluntary |

42 Countries |

625,044 Searches |

| Number of reporting entities covered by statements |

Statements lodged |

Statements lodged |

Where reporting entities are headquartered |

Performed in the national database |

1Source: Modern Slavery Statements Register (modernslaveryregister.gov.au), 2 February 2022

The increased disclosure from companies under the Australian and UK Modern Slavery Acts has also led to greater awareness around modern slavery risks and more sophisticated and nuanced discussions amongst investors and during engagement with companies.

In a way, this has demonstrated that risks related to modern slavery in supply chains, investments, operations and product use have been overlooked in the past. It is likely still being overlooked in some jurisdictions where the legislation is not as demanding as Australia. But the truth of the matter is every single company in the world is exposed to risks of modern slavery.

We have summarised below some of the key outcomes from our FY21 modern slavery risk assessment, some insights from engagement with global and domestic companies on modern slavery, and some of the key improvements we’re expecting to see from the second year of Modern Slavery statements now being released.

Understanding modern slavery risks

In August 2021 we completed an analysis of 136 global and domestic companies we’d held in the previous year against the three key risk factors below. The intent of this analysis was to understand the potential extent and types of modern slavery risks that are typically present across our investments, and to help inform company engagement and further analysis or research.

| Risk Factor |

Description |

Inputs / Considerations |

| Upstream supply chain risks |

Risks related to supply chain components, including key high-risk commodities, which support product development, manufacture, and company operations. |

- Number of high-risk commodities in the supply chain

- Default and adjusted sector level exposure

|

| Downstream value chain risks |

Risks related to the application and use of a company’s products or services. For example, risks to the financial sector through lending practices. |

- Default and adjusted sector level exposure

|

| Operational risks |

Risks associated with employees and/or contract workforce, operational locations including factories and distribution centres, and overall working conditions. |

- Operational location in high-risk regions2

- Potential use of contract or low skilled and/or migrant workforces

|

2Source: Global Slavery Index (for example, regions with a weak rule of law or in areas of conflict)

Our analysis found that 25% of the companies we’d held had a potential high-risk exposure to at least one of the three risk factors. We also found that global equities generally have a higher risk exposure to operational and supply chain modern slavery risks than Australian companies.

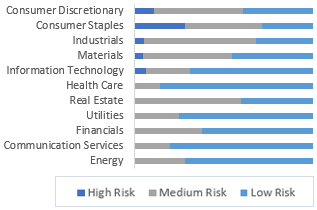

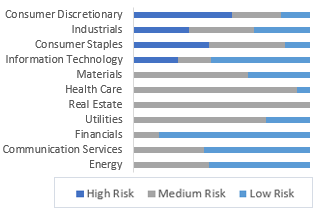

Further observations for each risk factor are illustrated below:

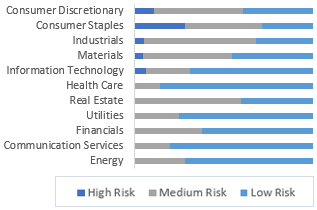

Operational Modern Slavery Risk

- 63% of companies have operational assets in a high-risk region

- Consumer companies generally have the highest overall exposure to operational modern slavery risks (low-skilled/contract workforces, global manufacturing sites)

- Real estate, industrials and materials sectors have significant health and safety human rights exposure when operating smaller sites in high-risk geographies

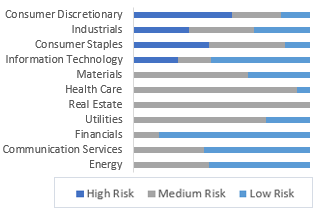

Supply Chain Modern Slavery Risk

- 45% of the companies analysed have material exposure to cotton in their supply chain

- Consumer, industrial and information technology companies have the highest risk supply chains considering the presence of high risk commodities (for example, cotton, palm oil, latex, metals and minerals including lithium, coltan, cobalt, mica) and overall sector risk

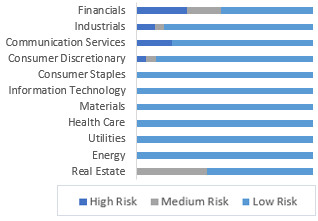

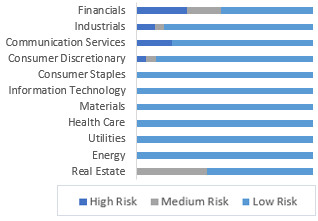

Value Chain Modern Slavery Risk

- The Financials sector is the most exposed sector to value chain risk (downstream modern slavery risks)

- Real estate, industrials, and communication services have also been identified as sectors with potential value chain exposure

- Managing this issue needs to be a governance response rather than procurement or supply chain response

Source: Alphinity, Global Slavery Index

Insights through engagement and company research

Following the implementation of the Australian Modern Slavery Act, the level of disclosure amongst Australian listed companies has increased significantly. Globally, however, the disclosure of modern slavery risks and management is still limited and varies by company and region.

As part of our ESG assessment process we review relevant modern slavery policies, statements, and other general disclosures from annual reports, to form a view on the quality of each company’s modern slavery risk management activities. We also engage specifically on modern slavery as part of our ESG engagement schedule.

Through our engagement and research, we’ve made the following observations:

| Supply chain focus |

- • Most companies are focussing more on supply chain risk than operational or downstream risk

- • Supply chain risk assessments are generally focussed on tier 1 material suppliers rather than high risk suppliers further down the supply chain, or in suppliers with lower spend

- • Leading companies are setting goals to have cradle-to-gate oversight of high- risk commodities in their supply chain

|

| Use of third-party risk tools |

- A number of global companies are using third party tools or standards like RBA, Sedex, Elevate or Ecovadis to conduct supplier assessments, share audits, and identify high risk suppliers or supplier groups

- Companies generally use the outcomes to conduct additional investigations, including audits

- Using these tools/standards helps to standardise information collection from suppliers

|

| Collaboration is essential |

- Collaboration between companies, NGOs and research organisations is key to solving complex supply chain problems

- Leading companies are disclosing information on salient risks, mitigation and roadmaps to encourage industry level change

|

| ASX leading the way

|

- Thanks to the Australian Modern Slavery Act, ASX-listed companies generally have much stronger modern slavery disclosures than global peers

- During engagements we are often asked by global companies to provide examples of good quality disclosures that can be used as a benchmark

|

What we are looking for in a good quality Modern Slavery Statement

After reviewing hundreds or Modern Slavery Statements and engaging with companies directly on modern slavery risk management, we have listed below the main criteria we will look for in good quality Modern Slavery Statement in 2022.

| Detailed and thorough risk assessments |

- Risk assessments that cover all relevant aspects of the value chain (including operational and downstream risks) and go beyond just tier 1 and/or material suppliers

- Risk assessments that cover subsidiaries and overseas offices and reference any separate disclosures or policies

- The use of on-the-ground independent third-party audits for high-risk suppliers or supplier groups

|

| Breakdown of workforce composition |

- Details on the composition of the workforce, including the percentage of contractors versus employees, use of labour hire agencies to supplement workforce, policy on recruitment fees, and percentage of factories/sites which are operated vs managed by a supplier

- Specific information on labour hire agencies and having policies in place to manage risks

|

| Measurable roadmaps with metrics |

- Inclusion of a multi-year roadmap to identify and address modern slavery risks including measurable indicators or metrics

- Detailing the way in which policies, risk assessments and training are being implemented and how their effectiveness is being both defined and measured

|

| Warts and all disclosures |

- Clear disclosure on the number and types of incidents/issues and lack of controls identified through the risk assessment and audit processes, and what remediation actions have been completed

- Statements regarding the effectiveness of remediation and the number of issues that have been closed versus ongoing

- Year-on-year progress against a roadmap or strategy

|

| Using collaboration to achieve outcomes |

- Examples of active partnership with suppliers, NGOs, operating partners, industry working groups and other multi-stakeholder initiatives to address modern slavery risks, particularly where complex supply chain risks are present (for example, the cocoa supply chain)

- Demonstrating collaboration with and input from vulnerable workers themselves to improve policies, systems and controls

- Strengthening grievance mechanisms in order to reach vulnerable groups and manage modern slavery complaints

|

Authors:

Jessica Cairns, ESG and Sustainability Manager, Moana Nottage, ESG and Sustainability Analyst, Melissa Stewart, Sustainable Compliance Committee Member

This material has been prepared by Alphinity Investment Management Pty Limited ABN 12 140 833 709 ASFL 356895 (Alphinity), the investment manager of the Alphinity Australian Share Fund and Alphinity Concentrated Australian Share Fund, Alphinity Sustainable Share Fund, Alphinity Global Equity Fund – Active ETF and Alphinity Global Sustainable Equity Fund – Active ETF (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Fund(s). To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Past performance is not a reliable indicator of future performance.Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Alphinity and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Alphinity and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.