The current global earnings upgrade cycle bottomed last year, but this has been a weaker and more mixed recovery than previous ones. This has certainly been true for Cyclicals, where individual stock selection has been key, as opposed to “the tide lifts all boats”. One of the fundamentally most cyclical sectors, Materials, rarely grabs the headlines in global equities, but in this short note we highlight some of our current thinking and investments.

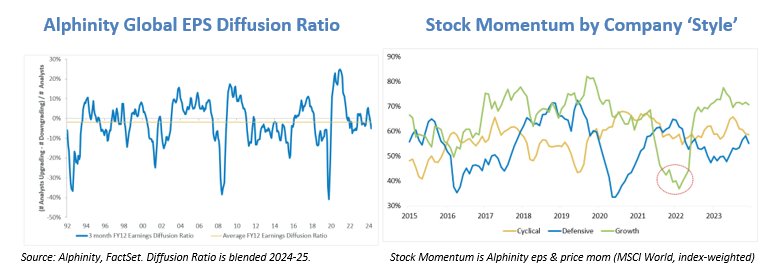

The current global earnings upgrade cycle started last year, spear-headed by the always-in-focus Technology sector (and AI as the posterchild), but also by a better economic cycle than expected, as recession fears abated. It turned out the average analyst globally had cut earnings forecasts too aggressively in the previous downcycle, a normal development as the earnings cycle bottoms and turns upwards. From a relative perspective, Growth stocks quickly resumed their strong earnings leadership after the 2022 disappointment ‘wobble’, and Cyclicals took over from Defensives (see chart below on the right). However, even though this global upgrade cycle is still in play, it’s noticeably weaker (see chart below on the left) and more mixed than the most recent ones (2016-18 and 2021-22), and this has particularly been the case for the more cyclical sectors of global equities.

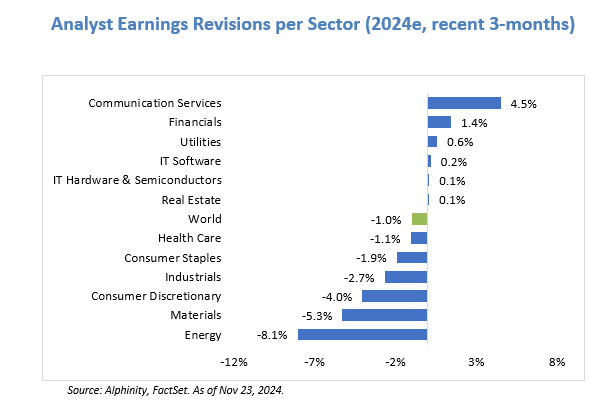

As the Alphinity global portfolios have followed and leaned into the upgrade cycle, stock picking opportunities within cyclicals have been unusually specific and selective. This has been true in the larger sectors such as Industrials, Consumer Discretionary and Financials. It has also been the case in Materials, a smaller sector but with wide-ranging touchpoints across many supply chains and products in the global economy. Earnings headwinds have persisted across many subsectors of Materials, such as Chemicals and Metals, as companies manage through both a weak global manufacturing cycle (incl. China) and the tail-end of cost input inflation. The sector remains one of the laggards in terms of earnings revisions, consistently ranking towards the bottom of global equities.

Many Materials businesses are highly cyclical in nature (macroeconomics, unpredictable raw materials) and often have lower and more volatile margins and return on capital than the average company. With the current, relatively weaker earnings cycle as a backdrop, this has been a tricky part of the market for investors. Nevertheless, we have increased exposure to the sector since the earnings cycle bottomed, currently accounting for 7-8% of portfolios. However, the stock selection reflects conviction in a slightly ‘un-traditional’ type of Materials stock – companies with differentiated earnings drivers which in reality share more characteristics with successful companies in other sectors:

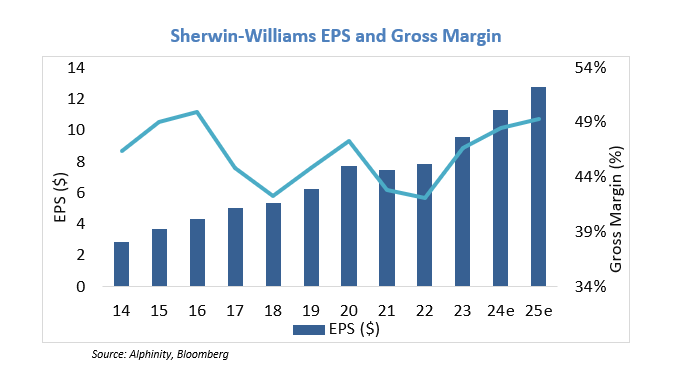

Sherwin-Williams is the leading paints manufacturer in North America, controlling 65% of the architectural paint segment and a dominant ~75% market share in the faster-growing professional painter segment. The key to Sherwin’s growth and pricing power is its unparallelled distribution and shop network of nearly 5,000 stores, coupled with paint’s general characteristic as a ‘low cost & high value’ part of a house renovation or construction. Sherwin has built its earnings growth track record (averaging +15% EPS per year since 2014) through a long-term approach and is once again investing heavily through the current US housing down-cycle, to further accelerate market share. With gross margins approaching 50% and return on equity above 60%, Sherwin has more in common with some of the well-known, compounding consumer brand companies rather than traditional chemicals/materials.

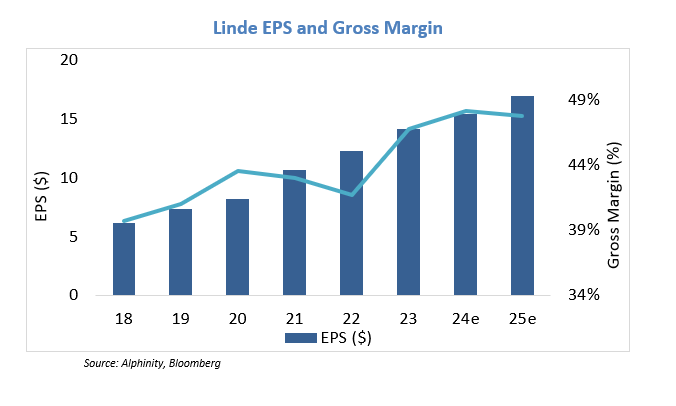

Linde is the largest industrial gas company in an increasingly consolidated global industry, with limited new capacity entering the market. The company has a very diversified client base, touching most industries and geographies ranging from smaller deliveries (Merchant gas) to large, on-site installations with take-or-pay contracts. Average contracts are long and sticky, and gas typically makes up a minor part of clients’ overall cost base (adds to pricing power). Since the company-defining merger of Linde and Praxair in 2018, average EPS growth has been 15.5% per year. Through continuous efficiency programs and pricing power, the gross margin has steadily risen towards 50% and the operating margin is approaching the high 20s. A high proportion of Linde’s business enjoys the characteristics of a structurally compounding supplier business, with additional cyclical upside potential in segments feeding into global manufacturing and consumer.

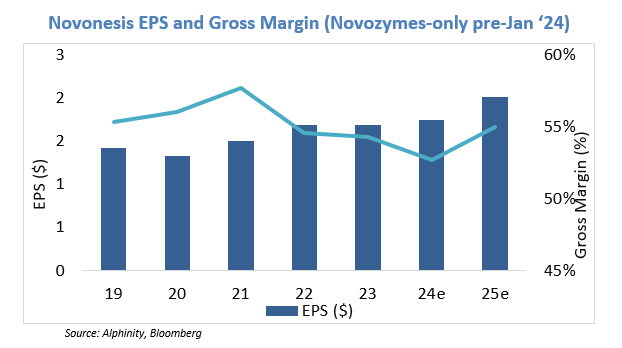

Novonesis was formed in January this year from the merger of Novozymes and Chr. Hansen, forming the leading global bio solutions company – largely replacing chemicals with biological solutions (enzymes, cultures, fungi, probiotics) across different industries such as food & beverage, household care, human nutrition and energy & agriculture. Business moats come from the science (thousands of active patents), the capital intensity of the production (fermentation) and having global commercial reach. The recent merger provided additional scale, and limited new global capacity is launched by competitors. With ~10% of annual sales spent on research & development, Novonesis’ profile is more of a ‘consumer biotech’ company rather than traditional chemicals. Gross margins are consistently in the mid-to-high 50’s and organic growth has accelerated to 8%. The stock is held in our Sustainable portfolio.

These three Materials companies recently delivered solid third-quarter results, despite a still noticeably weak economic cycle in segments such as manufacturing and housing. As industry-leaders, they are using the strength of their respective market positions, pricing power and distribution networks to manage through what is in some parts a tough cycle, whilst investing to capture an outsized share of future growth once these lagging segments improve. Unsurprisingly, high quality and structural growth does come at a persistent valuation premium, with the three stocks trading at P/E ratios between 27x-30x. This isn’t out-of-line with their history, either in absolute or relative terms, but it is a risk factor to always consider.

A broader, stronger economic recovery – for example a full return of (‘panic’) hard asset stimulus by China – could lead these compounding ‘quality growth’ stocks to lag cheaper and more cyclical stocks within the Materials sector. However, for the time being, we continue to have higher conviction in these ‘not-quite-Materials’ stocks within the Materials sector.

The Alphinity Global team

Sydney, Nov 2024