In September, all six members of the Alphinity Global investment team embarked on international travel, collectively visiting eight countries, and engaging with over 200 companies.

Here are five key themes and standout companies from our respective trips, reaffirmed during the recent 3Q24 reporting season:

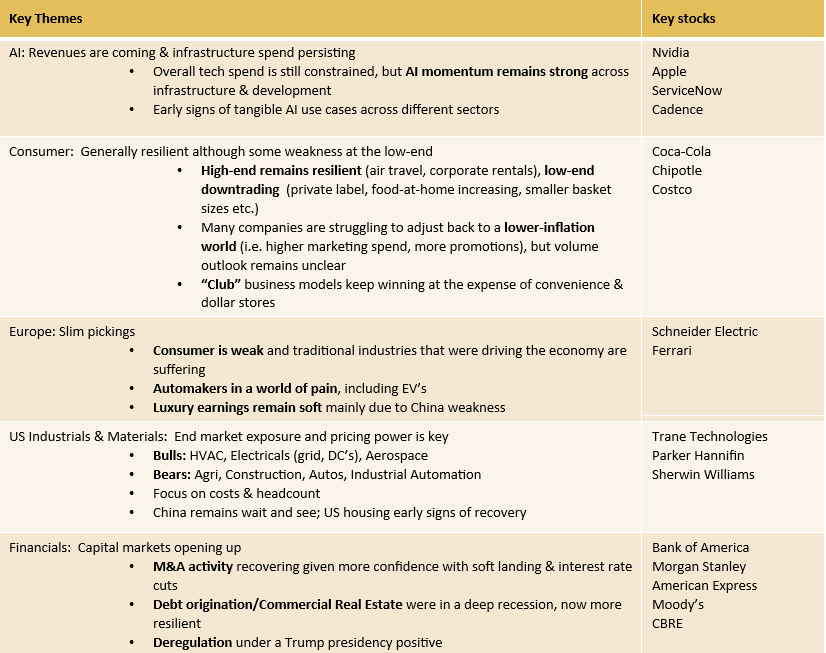

- AI: Revenues are coming & infrastructure spend persisting.

- Consumer: Generally resilient although some weakness at the low-end

- Europe: Slim pickings.

- US Industrials & Materials: End market exposure and pricing power is key.

- Financials: Capital markets opening and broadening out

Buckle up for more feedback from our current and upcoming journeys before year-end!

AI: Revenues are coming & infrastructure spend persisting

The market has moved on from the initial AI exuberance to a more rational focus on return on investment and capital requirements. During his trip to the US, Trent confirmed that while overall technology-related spend remains constrained, AI momentum remains very strong with the focus beginning to shift from the infrastructure providers to the software and services that sit on top.

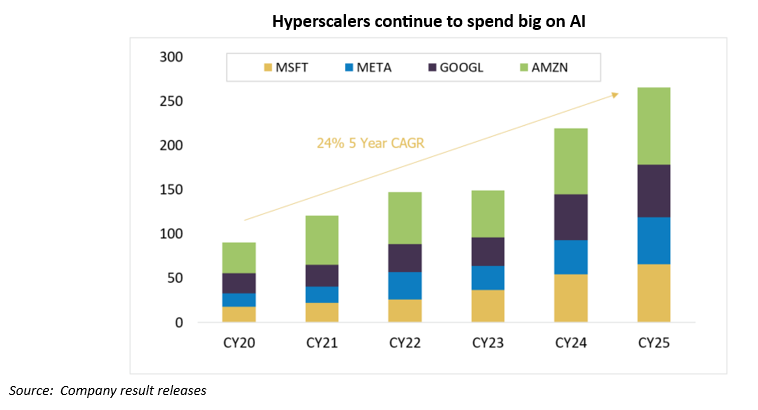

Hyperscalers continue to spend: The scale of capital investment in AI infrastructure continues to escalate and this was confirmed by the recent 3Q24 financial results that showed further increases in investment intentions across the four largest hyperscalers: Microsoft, Alphabet, Amazon, and Meta. Their combined capital expenditure is now projected to surge by c.47% year-over-year in CY24, reaching a staggering $220 billion. Notably, the outlook for CY25 spending has also seen a substantial upward revision, and now sits at >20% growth and a figure of circa $270 billion. A figure beyond $300bn is expected for CY26.

With hyperscalers contributing c.45% of revenues, our conviction in the outlook for Nvidia’s earnings remains high. Recent 3Q24 results exceeded expectations, and 4Q24 guidance was solid despite potential vagaries around ramping the new Blackwell architecture. Nvidia is set to double sales for the second consecutive year and management confirmed that the new Blackwell chip is in “full production” with demand expected to exceed supply for several quarters. In our view, Nvidia’s offering remains unmatched, stretching well beyond GPU’s to now encompass complete data centre infrastructure solutions that can be integrated into existing data centre footprints, and wrapped in a powerful software optimisation model called Cuda. Nvidia also continues to expand its software and services business that runs on its market leading infrastructure. While Nvidia and other Mag5 companies continue to show strong earnings growth, higher valuations have meant that we continue to manage position sizes by opportunistically taking profit (i.e. trimming position sizes).

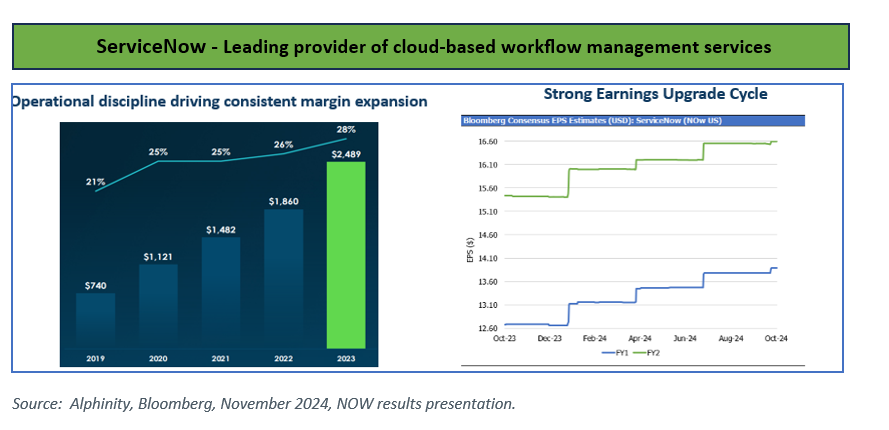

Where are the AI revenues? Despite concerns about the rapid pace of AI investment outstripping the benefits, Trent’s confidence in AI revenue opportunities and broader adoption of AI applications is growing. Salesforce, ServiceNow, Microsoft, Adobe, and Meta have already introduced AI applications, while Apple has integrated AI features into its latest iPhone iteration. Beyond large tech companies, new use cases for AI are emerging each day spanning the entire economic landscape. These capabilities are evolving rapidly, with each new generation of models bringing significant improvements in functionality and opening the potential for more sophisticated applications. In terms of investment focus, we are beginning to see a shift from enablers (semiconductors, cloud infrastructure) to beneficiaries (software and services). ServiceNow (NOW) exemplifies this trend, positioning itself as a high-quality software platform that streamlines enterprise workflows. GenAI is accelerating this process by facilitating workflow automation.

Finally, the latest earnings season has strengthened our belief that the cost savings from AI efficiencies will likely surpass the revenue benefits already being realized. Many companies across various sectors are reporting approximately 30% improvements in efficiency in functions such as sales, marketing, customer service, and operations. Also see Trent’s recent note for more colour: Artificial Intelligence will change the world (eventually) – Alphinity

US Consumers: Generally Resilient

US consumers overall remain resilient albeit with some pockets of weakness amongst lower income consumers. The high-end segment remains quite healthy, with strong performance in areas such as air travel and premium services. However, the low-end market is experiencing downtrading, with increased preference for private label, food-at-home consumption, and smaller basket sizes.

Jeff attended a Consumer Staples conference in Boston, where lower inflation and weak volumes was a prominent thematic. Many consumer companies are compensating for lower pricing by seeking to boost volumes through higher marketing spend, more promotions and an increased focus on innovation. Companies such as Colgate appear to be executing well on these strategies, with volumes already responding, while others (e.g. Nestle) appear to be behind the game and have only recently begin to take action. Interestingly, omni-channel and “club” business models (e.g. Walmart and Costco) continue to gain market share at the expense of convenience stores and dollar stores, driven by cyclical pressures, but also better relative execution and the ongoing shift toward digital e-commerce.

Matisse’s inaugural investment trip with Alphinity was a rigorous two-week experience, where she joined Chris to visit 36 companies across five U.S. cities. Highlights included a tour of Garmin’s factory and on-site research of athleisure brands like Sketchers, Lululemon, and YETI. However, the standout meeting was with Chipotle (CMG), that has subsequently been added to our global portfolio. The team was impressed by Chipotle’s positive adaptation to recent management changes. The company continues to deliver industry-leading unit economics and maintains a strong customer value proposition, driving traffic and unit expansion without relying on “value” promotions.

Slim pickings in Europe

Ty’s two-week investment trip in Europe, where he visited 28 companies across six cities in five countries, revealed limited investment opportunities amid a generally pessimistic economic outlook. The consumer sector remains weak, and traditional industries continue to struggle.

The once shining lights of luxury have faded: The message from uber-luxurious Louis Vuitton Moet Hennessy was clear: its major market, China, is bad and getting worse. A recovery in China is essential for European luxury companies, but recent China stimulus measures and retaliatory tariffs on European brands and Trump’s tariffs could complicate the situation. Long-term growth may reset at a lower rate as key drivers lose momentum. For now, we remain happy to be window shopping.

Auto markets a certified disaster zone: European automakers face a complex and challenging investment landscape. The industry is grappling with slowing electric vehicle (EV) sales, intensifying Chinese competition and a weakening consumer environment. While some of these challenges are cyclical, the structural shift caused by affordable Chinese EVs could fundamentally reshape the market in the long term. Despite Ty’s admiration for Mercedes’ innovative steering wheel-free concept car and BMW’s iconic headquarters in Munich—designed to resemble engine cylinders—both automakers face significant challenges. These German luxury carmakers have reported disappointing results and lowered forecasts, with potential policy changes further threatening profitability.

In contrast, Ferrari (RACE) stands out as a bright spot. Chris and Matisse’s visit to Ferrari’s production facilities in Maranello highlighted the company’s resilience, driven by exceptional pricing power, a strong order book, and market-leading innovation. We believe Ferrari offers unique strengths in a challenging market, with high visibility on strong earnings growth over the next two years, and the potential for a net cash position within 12 months.

US Industrials and Materials: End market matter and pricing power is key

The US industrials and materials sector is experiencing a diverse landscape, with performance heavily influenced by end-market exposure and pricing power. Certain segments, such as HVAC, electrical infrastructure (including grid and data centers), and aerospace, are demonstrating robust performance. In contrast, freight, agriculture, construction, automotive, and industrial automation sectors face significant challenges. In response to these varied market conditions, companies are prioritising cost management and workforce optimization. While some capital projects are being deferred, potentially until after the recent US election, mega-projects continue to be announced at unprecedented levels. Feedback on China was uniformly negative, though this preceded the recent stimulus measures that have been announced there.

Within these sectors, several key trends are emerging: Firstly, companies are increasingly emphasizing cost control and headcount optimization as they strive to maintain margins in a challenging revenue environment. Additionally, larger firms are benefiting disproportionately from business digitalisation, with scale advantages appearing to accelerate, allowing them to leverage technology more effectively than their smaller counterparts. Interestingly, inflation concerns have significantly diminished in recent discussions, suggesting a shift in focus for many companies. Finally, in this environment, firms that can generate high free cash flow without relying on robust macroeconomic tailwinds are likely to attract greater investor interest.

While maintaining positions in strong performers like Schneider Electric, Trane Technologies, and Parker Hannifin, the team is taking profits to explore new opportunities. In the resources sector, Jonas favours “non-traditional” exposures such as Linde, Sherwin Williams, and Novonesis. Also see his recent note: “Materially different materials”

Capital markets gaining (even more) momentum.

After a challenging 2023 for global banks and the financial services sector, there are growing signs that capital markets are gaining momentum. Investor confidence is rising as the US economy appears poised to avoid a recession, aided by recent Federal Reserve rate cuts and a resurgence of market optimism. Jeff’s September trip to New York, and the latest 3Q24 earnings season, confirmed this trend. Most banks reported healthy trading revenues and a recovery in Investment Banking fees. Rate seeking behaviour from clients appears to be abating, increasing confidence that net interest margins are bottoming. Credit trends overall remain resilient. Expectations of deregulation and tax cuts under a potential Trump administration have further energized the sector. Current positions within US Financials currently include Bank of America, Morgan Stanley, and American Express.

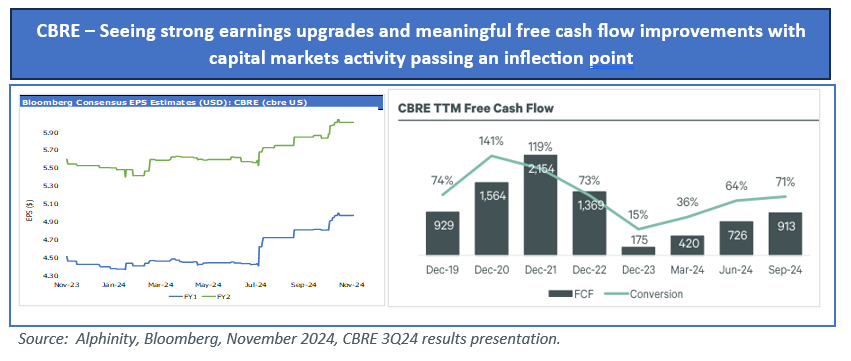

Following Matisse’s recent trip, we expanded our capital markets exposure in our Global Sustainable strategy by including CBRE, a leader in commercial real estate (CRE) leasing and sales. After a slowdown during COVID, CBRE has diversified its revenue exposure across asset and client types, lines of business and geographies. Capital markets are now seeing improved bidding activity, larger deal sizes, and increased institutional capital allocation. The demand-supply imbalance—driven by a flight to quality and reduced supply from low construction starts—suggest a multi-year recovery is underway in this segment.

Overall, these themes reflect a dynamic global investment landscape characterised by technological advancements, shifting consumer behaviours, a challenging environment in Europe, strategic positioning in industrials and resources, and an evolving financial sector. The Alphinity Global investment team looks forward to sharing more insights from our ongoing journeys as we continue to monitor existing and new trends leading into the end of the year.