There is currently a lot of uncertainty in the market about the outlook for risk assets as long-term bond yields continue to grind higher. These fears are particularly prevalent in global equity markets given near multi-decade peak valuations. Since the end of September 2020 when real rates reached a trough, we have seen a big divergence in stock price reactions. Not just on the back of a typical early economic cycle style and sector rotation playing out, but also due to the big difference in starting valuations and earnings growth profiles within sectors.

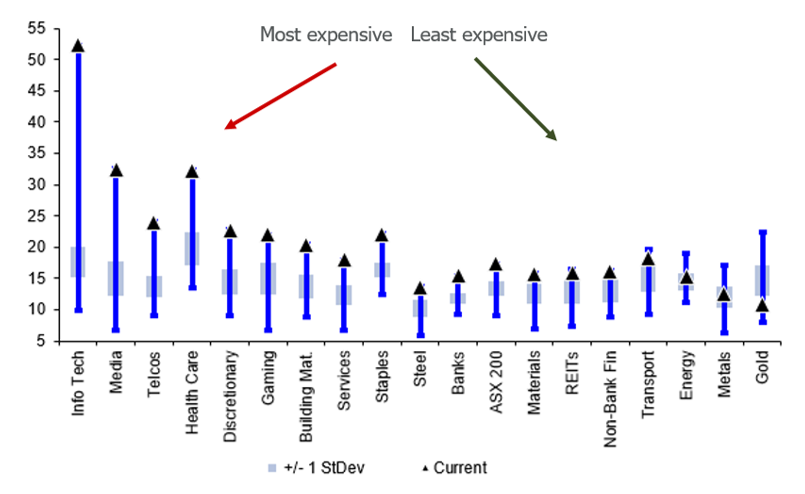

Most ASX200 sectors are trading at the upper end of the long-term range

ASX 200 current PE (12 month forward) vs 20 year range (5th to 95th percentile)

Source: Goldman Sachs, FactSet as at 15 March 2021

In addition to the uncertainty around the speed and extent of a higher inflation and rate cycle path, investors today also need to keep the varying complications of Covid on countries, consumers, and companies in mind.

Alphinity sees this as the perfect opportunity to look under the hood for alpha opportunities using our agile and proven process focused on earnings leadership, regardless of the market cycle.

Higher yields, inflation, and earnings expectations…

Since the trough in August 2020, US 10-year yields have increased by 1.2% to a recent intra-day peak of 1.75% (on 19 March 2021), while the 30-year yield jumped to 2.45% (on 18 March 2021) for the first time since 2019. At these levels, the market is effectively pricing in two rate hikes by 2023 and nine by 2030. In Australia we have experienced the same moves, with the Australia 10-year yield jumping by >1% to a circa 1.8% year-to-date (YTD) high and the 30-year to circa 2.7% over the same timeframe.

Equally, we have seen a jump in inflation expectations (with breakeven rates currently suggesting 5-year US inflation ahead of 10-year/30-year) implying that the market is expecting a sharper economic recovery and pick-up in inflation/interest rates than current Fed/RBA guidance suggests and is exacerbated by their rhetoric of lower for much longer.

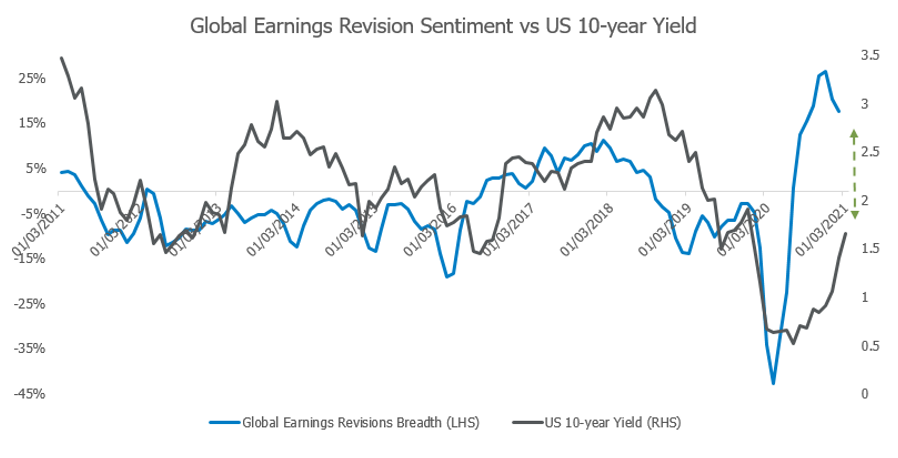

In tandem, equity investors have just been treated to one of the best earnings seasons on record over the last few months, as reflected in forward earnings expectations that are now back at pre-Covid levels and earnings optimism (or the breadth of earnings revisions) topping out across most markets.

Earnings growth optimism well reflected in global markets as yields continue to rise

Source: Alphinity, Factset, Bloomberg

…and the impact on equities

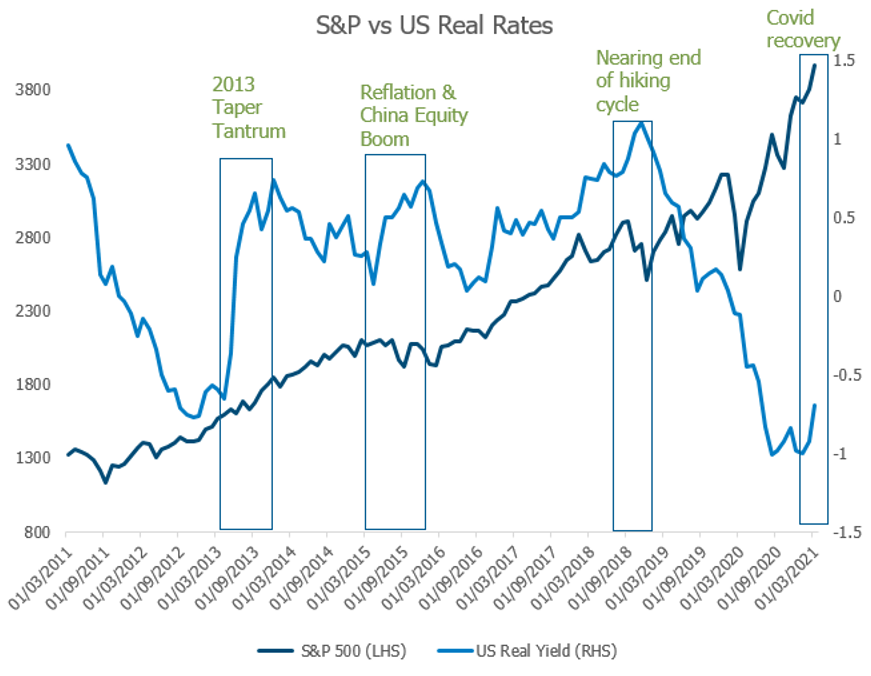

While the general perception is that higher rates are bad for equities, this does not necessarily play out in practice. Yes, all things equal, a higher discount rate may imply a lower valuation for equities. However, looking back over the last year and decade, global stocks did better on weeks when US 10- year yields rose, particularly if it was accompanied by higher inflation expectations. So, it isn’t just a steepening yield curve that matters, it is the reason why yields are rising that matters, as does the size and speed of the move.

The reason, size and speed of rate moves matter for equities

Source: Bloomberg as at 29 March 2021

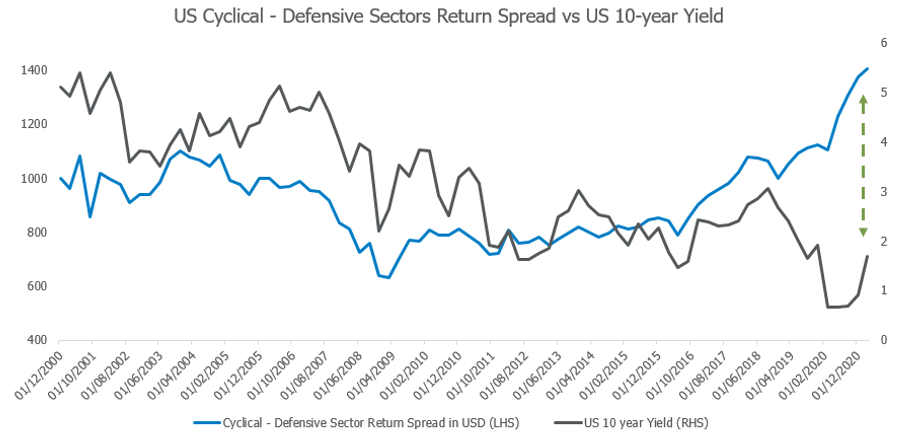

In addition, history has taught us that higher interest rates and inflation impact sectors differently. Certain cyclical sectors such as financials and miners normally benefit from rising rates, while defensives like staples and healthcare normally do not.

The valuation (or multiple) and earnings outlook of a company also play an important role in assessing the potential impact of rising rates on a stock’s share price. Expensive stocks, especially longer dated growth stocks, trading at high valuations are more exposed to rising rates (or discount rates) as their multiples can reduce more than lower rated stocks. Add the structural and temporary Covid implications to the mix and active fund managers have their work cut out to find alpha opportunities in the current environment.

Recent performance deviates from long term trends

Source: Bloomberg as at 29 March 2021

Time to look under the hood for style agnostic alpha opportunities

Alphinity’s investment process, which focuses on earnings leadership, has already tilted our portfolios to the companies that are exhibiting better earnings revisions in this phase of the cycle, which on average have been the more cyclical areas of the market over the last seven months (now overweight financials, materials, and industrials). As uncertainty reigns, we continue to do what we have done for more than 10 years – finding alpha by focusing on quality stocks, trading at reasonable valuations experiencing earnings upgrades. These can be found at any point in the cycle.

With many pockets of cyclical and Covid beneficiary stock valuations already reflecting the economic recovery, our focus turns to stocks benefiting from the next phase of the global economic reopening and structural Covid beneficiaries.

Recent examples of companies we have added to our Australian Funds (Alphinity Australian Share Fund and Alphinity Concentrated Australian Share Fund) are CSR, Medibank, BlueScope and Domino’s Pizza. In our Alphinity Global Equity Fund – Active ETF we have added names like Infineon, Volvo, PulteGroup and Daimler.

Australian Funds – alpha opportunity:

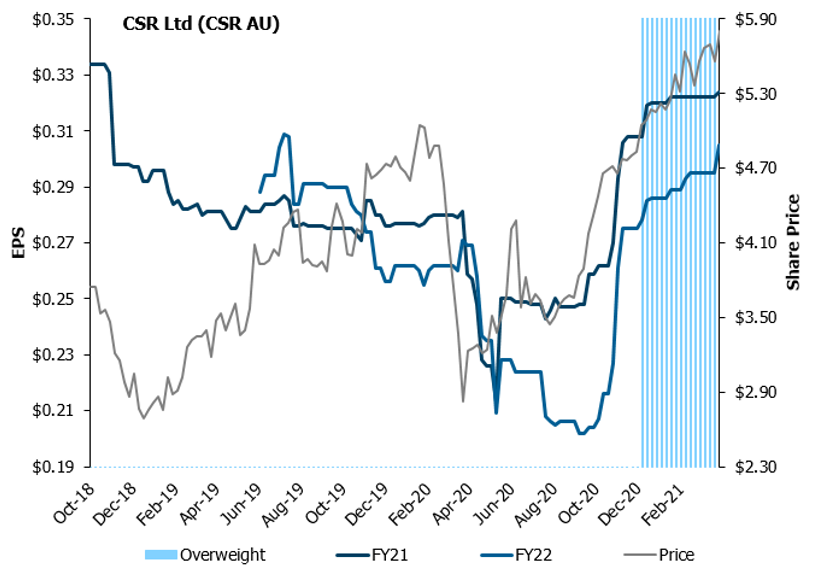

CSR – Economic reopening play through the Australian housing market

- CSR Ltd manufactures and supplies building products, including bricks, rooftiles, plasterboard and insulation used in residential and commercial construction. CSR also has a minority stake in the Tomago Aluminium smelter.

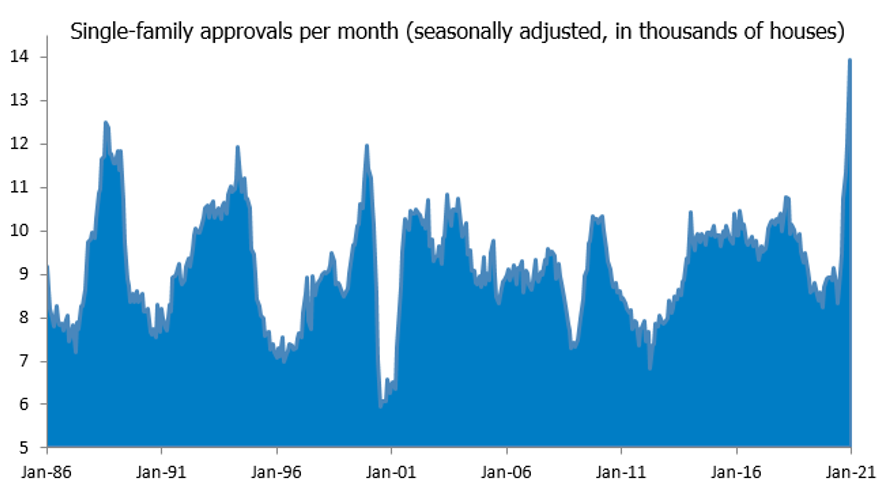

- CSR provides exposure to an improved Australian detached home building market through their building products division (>70% revenue). Since July 2020 building approvals for detached houses have increased 40% relative to prior year levels driven by a combination of low interest rates and stimulus packages including the Home Builder grant. Relative to peers CSR’s product portfolio is the most levered to the detached housing market strength with bricks, tiles, plasterboard and insulation products contributing roughly 90% of the building product division’s revenue.

- Margins are expected to improve, driven by a combination of strong sales volumes and solid operating leverage (building products have large amounts of fixed costs), reasonable pricing increases and efficiency initiatives.

- There is also upside to earnings forecasts in their two other divisions. The Tomago smelter is relatively high cost (4th quartile) making it highly levered to recent aluminium price strength. CSR is also rationalising their property portfolio by rehabilitating, developing and selling old manufacturing sites. There is potential upside to values as CSR continues to find higher value use cases allowing them to outperform previous assumptions. Currently market valuations of their property portfolio look conservative in our view and we see likely upside in the near to medium term.

- The key risk is demand for housing decelerates driven by a combination of stimulus running its course and the lack of migration.

Australian housing market recovery post Covid

Source: JP Morgan data

CSR – Owning during an earnings upcycle

Source: Alphinity, Factset

Global Fund – alpha opportunity:

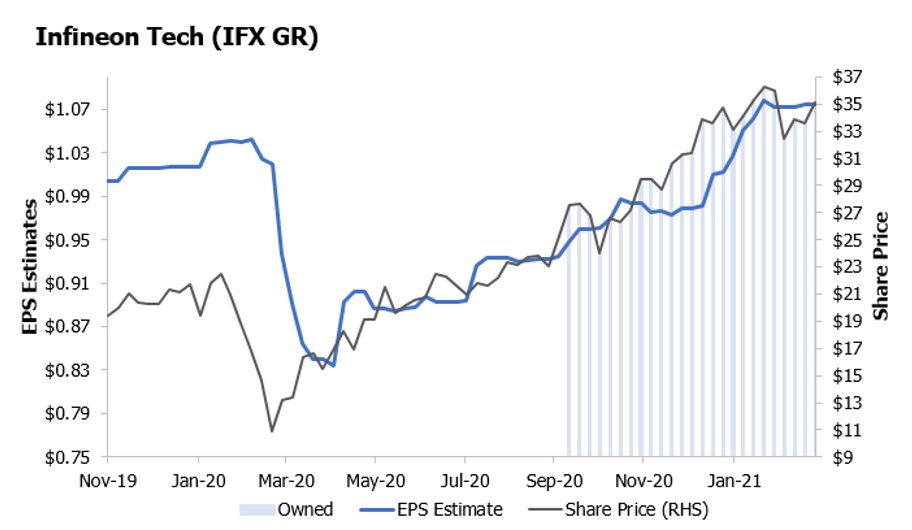

Infineon Tech (IFX GR) – A play on the electric vehicle (EV) mega trend from a different angle

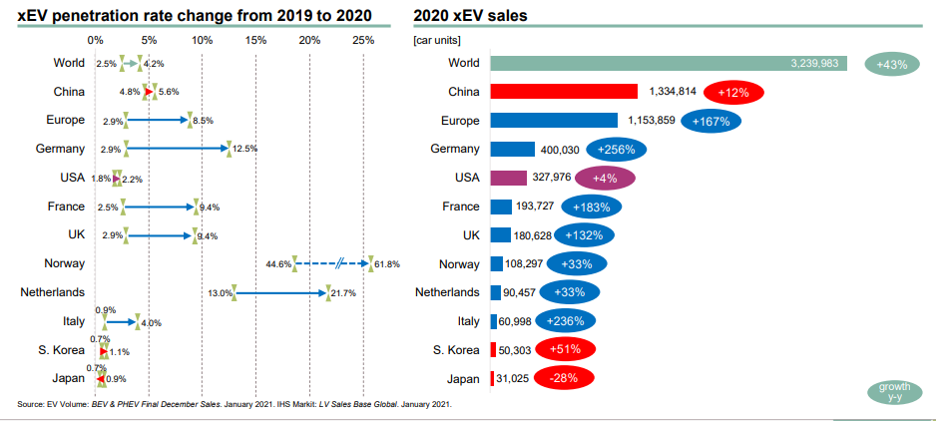

- In the next decade it will be illegal to purchase a car with a petrol or diesel engine in many countries, with a race to announce tighter emissions standards and even earlier bans on fossil fuel vehicle sales. According to the International Energy Agency (IEA), some $60 million electric vehicles will be on the roads world-wide by 2026, up from $7.2 million in 2019. Car manufacturers are accelerating their own plans for electrified vehicles in response, with all the major manufacturers including Daimler, GM, Volvo, Volkswagen and more joining Tesla in the race to the top.

- Infineon is one of the best placed companies in any industry to benefit from the shift to electrification. It is the largest automotive semiconductor company globally, and the undisputed leader in automotive power semiconductors with twice the market share of its nearest rival.

- A battery electric vehicle has approximately $330 of additional power semiconductor content, over 80% of the incremental semiconductor content from electrification. This is a new market worth $10 billion by 2027 on current projections, and we expect the transition to electric vehicles will happen more rapidly.

- In addition, the company has strong or leading positions in other critical components to help cars become electric and automated.

- Importantly, Infineon also has strong ESG scores with a very big focus on climate change through their products and productions. Infineon is committed to become carbon neutral by 2030.

- Outlook from here: In our view, Infineon is one of the best placed companies in any industry to benefit from the shift to EV’s. The company is at the start of a cyclical recovery with strong earnings momentum and rising confidence in the EV trajectory. We expect a combination of strong top line growth and improving margins to drive growth well ahead of peers.

The unstoppable trend in EV’s – Driven by triple-digit year on year growth in most countries, EV penetration rate tripled from 2019 to 2020 – years earlier than previously expected

Source: Infineon 1Q 2021 Investor Update

Infineon Tech – A long term secular growth investment

Source: Alphinity, Factset

Author: Elfreda Jonker, Client Portfolio Manager

Find out more

For more information, please contact your financial adviser, call the Fidante Partners Investor Services team on +61 13 51 53

Important information

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity), the investment manager of the Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund and Alphinity Global Equity Fund – Active ETF (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The PDS for the Funds, issued by Fidante, should be considered before deciding whether to acquire or hold units in the Funds. The PDS can be obtained by calling 13 51 53 or visiting www.fidante.com. Neither Fidante nor any of its respective related bodies corporate guarantees the performance of the Funds, any particular rate of return or return of capital. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Alphinity and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Alphinity and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties.