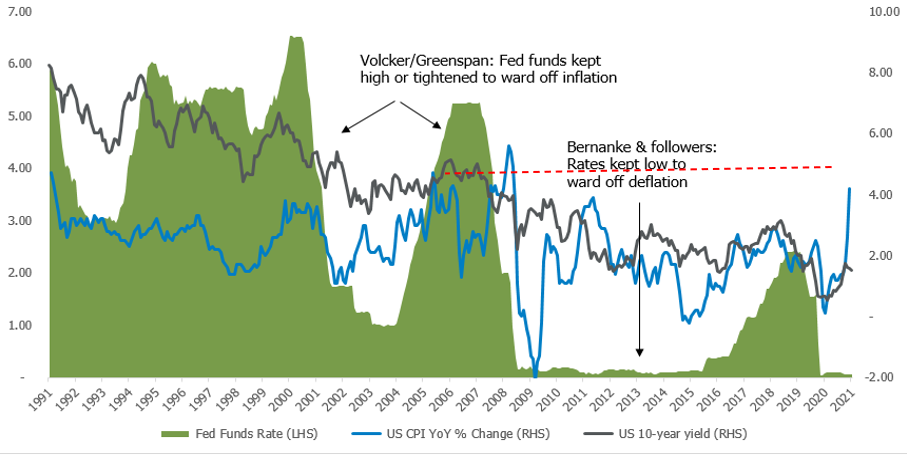

The past week has been an eventful one for markets. Firstly, we received the much-anticipated US Consumer Price Index (CPI) print for May 2021 that spiked by 5% year-on-year (yoy) above the market’s expectations and the highest yoy level since 2008 (see chart below). Secondly, and as a result, Fed Chair Powell at the June Federal Open Market Committee (FOMC) meeting started the ball rolling on taper discussions and moved from a median interest rate projection of no hikes in 2023 to two hikes in 2023. In addition, China is stepping up its campaign to rein in inflation, reaffirming its intention to cool commodities, and said it will release metals from state reserves in a timely manner to push prices back to a normal range.

To date the market reaction to the first two events has been interesting, with US 10-year and 30-year bond yields declining rather than increasing as most commentators would have expected, the VIX Index (fear indicator) staying very low and equity markets mixed, with growth stocks back in favour after the recent cyclical rally. The Commodity Index is however seeing the worst week since the start of the pandemic.

US Inflation vs US Fed Funds Interest Rate vs US 10-year Yield – inflation breaking out

Source: Bloomberg

Some market commentators are attributing this to an extreme technical positioning in the bond/derivatives markets and the calm before the storm. But as we have commented before, the market is a discounting machine, higher inflation has become consensus and the Fed’s new dot plot is just repositioning the Fed in line with what is already discounted in the market. Both higher inflation and the Fed’s comments are hawkish (i.e. indicates the potential for higher rates ahead), but positive hawkish, as it is aligned to stronger growth in an economic outcomes-based policy setting regime. In our view, this all remains consistent with a compelling economic backdrop which has the potential to offset the headwinds from higher interest rates for equity investors investing actively within markets. Given elevated valuations, this is a time to be nimble, active and disciplined.

Higher inflation, rates and equities

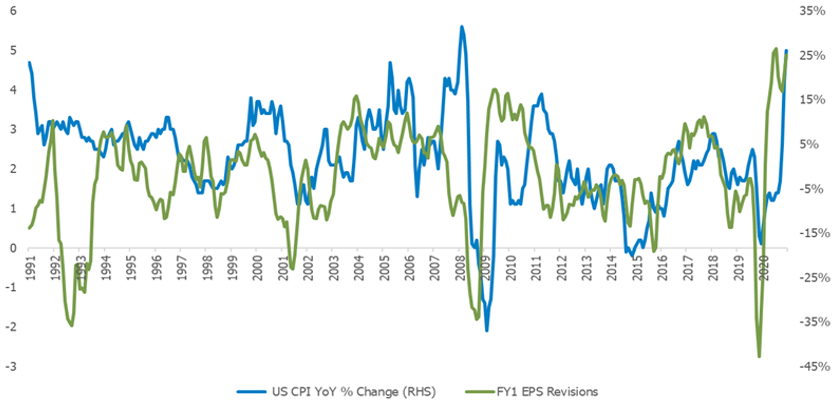

The recent equity market cycle has been driven by strong earnings growth/momentum, whilst equity market valuation multiples de-rated from very high levels. Earnings revisions have run in line with higher economic activity and inflation expectations (see chart below), with cyclicals outperforming defensives, while the recent value vs growth trend stalled.

US Inflation vs MSCI World FY1 Earnings Revisions – a tight relationship

Source: Bloomberg

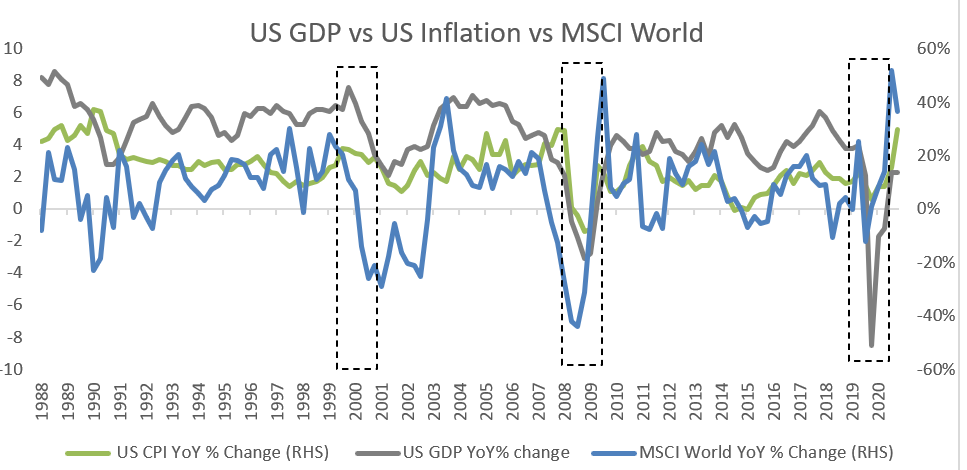

The impact of higher inflation on equities is a function of three factors: the speed of the move in inflation, the reasons for the move and what is happening to growth expectations at the same time. In terms of the speed of the move, the recent rise in inflation expectations has been swift with the market suggesting that the Fed was behind the curve, whilst growth expectations/earnings revisions have continued to grind higher, recently starting to peak out.

As we have seen in the past, equity markets can still do well during periods of higher inflation when accompanied by strong economic growth. Equity returns tend to be lower after peak growth, sector and factor leadership becomes more ambiguous.

US GDP vs US inflation vs MSCI World YoY Change – Growth the key ingredient

Source: Bloomberg

Alphinity – Looking through the noise and staying nimble

At Alphinity we do not position our portfolios for specific economic cycles or indicators, but rather continue to be driven by bottom up stock selection, focused on quality companies in or about to enter an earnings upgrade cycle at a reasonable valuation. Our agile investment process continues to shift our portfolios to earnings leadership opportunities, be it value, growth, cyclical or defensive companies.

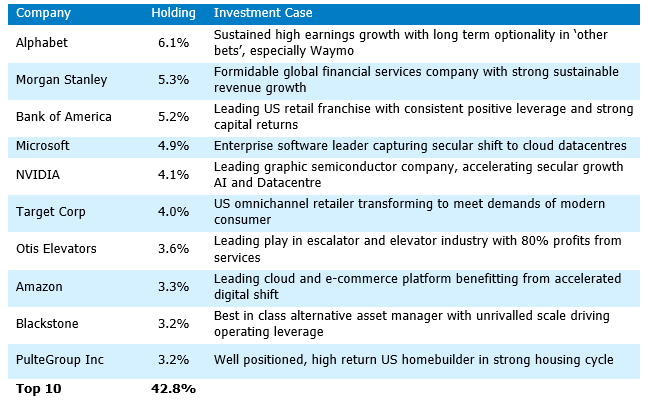

Alphinity Global – A well balanced portfolio for a changing world

The Alphinity Global portfolios remain well positioned to capture strong returns looking forward. We have good exposure to companies with pricing power, and thus positive leverage to any sustained uptick in inflation, as well as capturing upside coming from robust growth in many industries – including US financial services – as loan growth likely expands. Secular tailwinds around sustainability, especially addressing climate change, automation, digitalisation and cloud remain large exposures. We continue to hunt for companies where earnings expectations look likely to surprise positively while maintaining a well-diversified portfolio.

Alphinity Global Equity Fund – Active ETF – Top 10 holdings

Source: Alphinity as at 31 May 2021

Alphinity Australia – Staying focused on company specific factors

The Alphinity Australian portfolios continue to reflect companies where we expect earnings growth ahead of investors’ current expectations, with a balanced exposure across cyclical and defensive plays. Earnings outcomes over the last 12 months have seen our portfolios skew more cyclical at the expense of defensives. We have gradually taken profits in Resources after a very strong run and commodity prices reaching decade highs and in Q1 took advantage in some stocks that corrected with the rise in bond yields. Short term earnings upside has been the strongest in the Resources and Energy sector, followed by Banks and Insurers. Macro drivers mentioned above will drive a change in these relative winners and losers over time and as a result one must stay nimble. Company-specific factors will most likely turn out to be far more important drivers of earnings versus market expectations than what is (hopefully) the last phase of the Covid pandemic.

Alphinity Australian Share Fund vs ASX200

Source: Alphinity, Datastream, 31 May 2021

Author: Elfreda Jonker, Client Portfolio Manager

Find out more

For more information, please contact your financial adviser, call the Fidante Partners Investor Services team on +61 13 51 53.

Important information

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity), the investment manager of the Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Sustainable Share Fund, Alphinity Global Equity Fund – Active ETF and Alphinity Global Sustainable Equity Fund – Active ETF (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The PDS for the Funds, issued by Fidante, should be considered before deciding whether to acquire or hold units in the Funds. The PDS can be obtained by calling 13 51 53 or visiting www.fidante.com. Neither Fidante nor any of its respective related bodies corporate guarantees the performance of the Funds, any particular rate of return or return of capital. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Alphinity and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Alphinity and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties.