The Alphinity Global Sustainable Equity Fund – Active ETF (Fund) is committed to supporting companies that do good and do it well. We invest in companies that offer attractive financial returns, have strong Environmental, Social and Governance (ESG) practices and make a positive impact on society by contributing to the United Nations Sustainable Development Goals (SDGs).

As shown below, SDG 7 addresses the global transition to affordable and clean energy, and SDG 13 addresses climate change. Given the alignment of renewable energy stocks with these two goals, investors often ask why there aren’t more renewables in the Alphinity Global Sustainable Equity Fund – Active ETF (AGSEF) portfolio.

The answer is simple: we do not invest in companies simply because they are sustainable. To enter the AGSEF portfolio stocks must also meet Alphinity’s fundamental investment criteria and have strong ESG practices.

UN Sustainable Development Goals

Multiple Criteria for Portfolio Inclusion

The following analysis has two parts. The first part provides examples of stocks that are in the renewables sector and align with the SDGs, but do not meet Alphinity’s investment and/or ESG criteria. The second part provides a detailed example of Schneider Electric, a stock that is not a renewable per se, but aligns closely with SDGs 7, 8, 9, 11 and 13 and also meets the necessary investment and ESG hurdles.

Investment Criteria: Earnings Leadership, Quality and Valuation

The Alphinity investment process is based on identifying high quality stocks with earnings leadership and reasonable valuations.

Earnings Leadership: One reason the renewables sector often struggles from a stock price performance perspective is that the earnings trajectories of these companies can be unattractive. Examples of well-known European renewables companies that are struggling with earnings issues are Siemens Gamesa and Nordex, both of which will be loss making in 2021.

Vestas Wind Systems is an example of a renewable stock that the Alphinity Global Sustainable Equity Fund – Active ETF owned in the past but divested of due to earning concerns. Vestas is a global wind power leader that designs, manufactures, installs and services wind turbines in over 80 countries across the globe. However, throughout 2021 the company consistently downgraded earnings due to logistics issues, raw material costs, lingering COVID effects and offshore wind consolidation. As a result, Vestas no longer met Alphinity’s earnings leadership criteria and we divested of the stock.

Quality: Two metrics Alphinity uses to measure quality are return on equity (ROE) and balance sheet strength. The average ROE for the GICS Renewable Resources & Alternative Energy Sector is below the average for the MSCI World Index and the debt/asset ratio for the renewables sector is significantly higher than for the benchmark as a whole. As such, adding renewables just for the sake of having “green” names in a portfolio may be ROE dilutive and could reduce the balance sheet quality of the portfolio overall.

Valuation: Recently a new type of investor has emerged in global equities – those who buy stocks purely on sustainable thematics regardless of valuation metrics. Sustainable At Any Price (SAAP) is a very high risk strategy because these investments may not be backed up by fundamentals and therefore have very little downside valuation support. For example, PlugPower, which manufactures and commercializes fuel cells for electric industrial vehicles, is loss making so has no price-to-earnings (PE) and trades at 30x price to sales. Enphase, a manufacturer of solar inverters, is another example, trading at 86x 2021 PE and 36x price to book.

Sustainable products but poor ESG practices

There are some renewables stocks that meet Alphinity’s earnings leadership and valuation criteria but have unacceptable ESG risk. The best example of this is solar stocks that have supply chain exposure to Xinjiang.

Roughly half of the global supply of solar grade polysilicon currently comes from Xinjiang, a region of China where human rights abuses and forced labour are a serious concern. In June of this year the US Department of Commerce added five Xinjiang firms onto the Entity List causing problems for global solar panel companies already grappling with higher raw material prices and logistics issues.

The Solar Energy Industries Association responded with a Forced Labour Prevention Pledge. However, given the size and dominance of Xinjiang in the solar supply chain it is difficult for these companies to quickly diversify out of Xinjiang. In sum, solar companies may make renewable products that have strong sustainability credentials, but the strong E may come at the expense of poor S and G.

Schneider Electric: A sustainable stock that ticks all the boxes

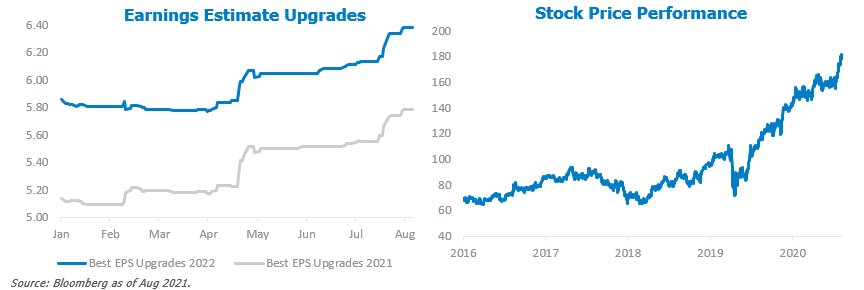

Schneider Electric is a 180-year-old company based in France that has built leadership positions in energy management and industrial automation. Both the energy and industrial divisions use EcoStruxture, Schneider’s open, interoperable, IoT-enabled system architecture and platform. Schneider is a high-quality stock with a market cap of EUR88b, an ROE of 15% and strong free cash flow. The stock continues to see consistent earnings upgrades, has an earnings compound annual growth rate (CAGR) of 15% and has strong ESG practices. Schneider trades at a reasonable 24x forward PE and 16x enterprise value/earnings before interest, taxes, depreciation and amortization (EV/EBITDA). The stock aligns positively with SDGs 8, 9, 11, 12 and 13 and has performed well since its entry into the portfolio.

Schneider Electric SDG Alignment

Conclusion

We do not invest in companies simply because they are sustainable but because they are good investments. Therefore, sustainability is a necessary but insufficient condition for inclusion in the Alphinity Global Sustainable Equity Fund – Active ETF.

Our analysis of the renewables sector shows that it’s not easy being green. As a result, it’s not easy to find renewable stocks that meet our sustainability and investment criteria simultaneously.

Over time we expect there to be a larger pool of high quality, reasonably valued renewables companies, but for now, we continue to find better ideas in other sectors that also align strongly with the clean energy and climate change related SDGs.

Author: Mary Manning, Global Portfolio Manager

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity), the investment manager of the Alphinity Global Sustainable Equity Fund – Active ETF (Fund). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante), is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The PDS for the Funds, issued by Fidante, should be considered before deciding whether to acquire or hold units in the Funds. The PDS can be obtained by calling 13 51 53 or visiting www.fidante.com. Neither Fidante nor any of its respective related bodies corporate guarantees the performance of the Funds, any particular rate of return or return of capital. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Alphinity and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Alphinity and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties.