Market continues to assign less relative importance to big energy plays.

The focus on climate action and de-carbonisation is increasing and will continue to have a big impact on everything from policy making to investment decisions for years to come. Even though the actual shift of society to more sustainable energy sources will be a multi-decade story, global equity markets (as always) have their tentacles out into the future.

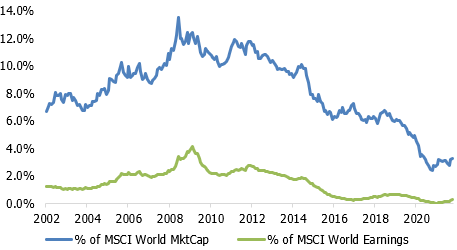

The Energy sector in the global MSCI World Index, has shrunk from 12% to 3% since the GFC, despite containing huge businesses such as ExxonMobil, BP, Total and Chevron. It has been a consistent under-performer in global equities since then, with the market clearly assigning less and less relative importance to them. Unsurprisingly, the performance mirrors the fact that energy companies also have a diminishing share of global earnings as reflected in the chart below.

MSCI World Energy Market Cap & Earnings declining vs overall index

Source: Macquarie

This reminds us of how the Telecom sector, a poster child of the millennium stock bubble, gradually lost its relative value and interest, only to be swallowed up by the fast-growing Communication Services sector a few years ago. Will Energy eventually quietly fold into Utilities?

Does this mean Energy is a sector to completely disregard from here?

Certainly not, as we should always try to keep an open mind about the future. Since inception the Alphinity Global Equity Fund – Active ETF (Fund) had 2.7% of the portfolio invested in the Energy sector on average, including Royal Dutch, Exxon Mobil, Conoco Phillips and more, but currently has no exposure. Most importantly, these traditional energy companies are waking up to the shifting future, trying to turn their considerable investment capacities towards renewable energy sources. This drive to adjust to the future partly comes from within the companies, but there is also pressure building from both world-class activist investors, as well as court action by governments and environmentalist shareholders. With big legacy ‘baggage’ in the shape of carbon-based assets and organisations, it will be a challenging path, but some could very well succeed and morph into more sustainable, long-term growth businesses. Or, perhaps more likely, at least split up in ‘sustainable’ vs ‘carbon’ companies.

The tricky part however is how to look at the earnings cycles of energy companies. Driven by oil and gas prices, there are periods when these stocks see big earnings upgrades, and participate in the global earnings leadership. 2021 has been one such period, with the oil price rising from $50 to $85/barrel, generating strong recent earnings upgrades for oil stocks relative to the overall market.

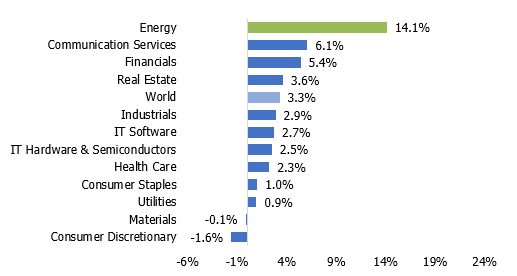

3 Month 2022 EPS Revisions – Oil enjoying big earnings upgrades during 2021

Source: Alphinity, Bloomberg, 15 Nov 2021

Beyond these occasional earnings rotations, there are some fundamental challenges around building a lasting, high conviction investment case:

- The near-term earnings case largely relies on OPEC+’s ability to manage the delicate supply-demand balance of global oil markets. The alliance is still holding back spare capacity of ~6mn barrels of oil production per day, with a strategy to ‘gradually open the taps’ by an additional 0.4mn per month (for context, total global oil demand is c. 99mn barrels per day). OPEC+ is trying to thread the needle between maximising the value of its oil reserves, and awakening responses from competition and accelerating replacement by renewables.

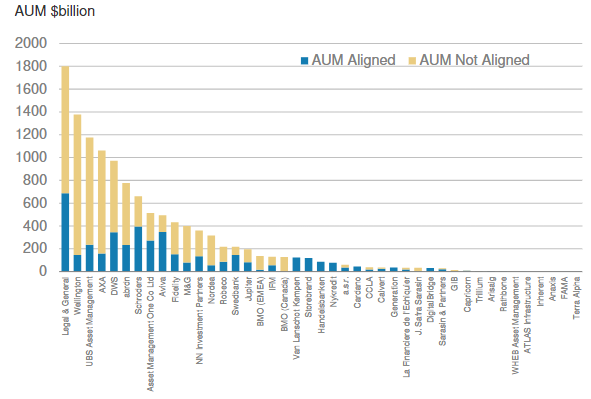

- Even as we’ll continue to depend on carbon-based energy for decades to come, there’s a continued ‘value-trap’ risk in the sector. The ongoing, grinding financial pressure on the valuation of carbon energy assets complicates the investment case. According to Morgan Stanley, to date around 220 institutional investors representing some US$57tn in assets have committed to align their portfolios with net zero. In addition, 88 banks, representing a third of global banking assets, have promised to decarbonise their lending and investment portfolios.

Net Zero Asset Management Initiative – Target to get to 100% of AUM to be managed in alignment with Net Zero

Source: Morgan Stanley

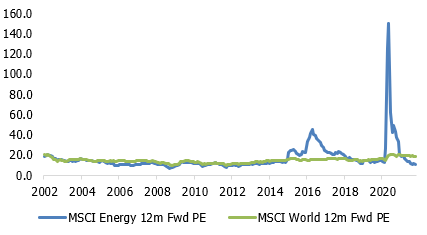

What is the appropriate long-term valuation multiple for ‘carbon assets’?

Historically, the market has been fairly consistent in applying a price/earnings multiple of just over 10x to the Energy sector – apart from occasional spikes in periods of big earnings drops for the sector, driven by temporary oil price collapses. But in a future greener world, what is the appropriate valuation multiple for ‘carbon assets’, especially as they are increasingly seen as eventually ‘stranded’? Global equity markets have always been a willing, ruthless participant in the creative destruction of old industries, and the birth of new ones.

MSCI World Energy Index Valuation – Driven by oil price movements

Source: Macquarie

In summary, since the world started shifting its focus to renewable options, the global energy sector as an investment opportunity has been behaving like that proverbial ping-pong ball bouncing down the stairs: a persistent under-performer, with occasional rallies and recoveries. Obviously, whoever can time the up-bounces well can make additional investment returns, but the staircase itself is still heading in the opposite direction – down. We can’t rule out investing in the ‘old guard’ of energy stocks again at some point, but their market significance is falling, and the fundamental hurdles seem to be rising.

Author: Jonas Palmqvist, Global Portfolio Manager

This material has been prepared by Alphinity Investment Management Pty Limited ABN 12 140 833 709 ASFL 356895 (Alphinity), the investment manager of the Alphinity Global Equity Fund – Active ETF (Fund). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Fund. Other than information which is identified as sourced from Fidante in relation to the Fund, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Fund(s). To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Alphinity and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Alphinity and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.