Crossing the T’s and dotting the I’s

Tightening, Tanks, Trade Wars, Inflation and Interest rates. These were just some of the themes that dominated headlines and impacted equity markets during 2022. Many significant market factors changed during 2022 and is likely to change again during 2023.

At Alphinity we invest in leading global companies at the right time in their earnings cycles. Whilst being aware of the broader market trends, our disciplined investment process guides us to “Cross the T’s and Dot the I’s” of each company. Bottom up.

Below we share two examples of companies still enjoying earnings upgrades, regardless of a tough outlook for overall market earnings in 2023.

A tough outlook for global earnings

2022 was a year when many significant market factors changed. Economic growth slowed, inflation increased, central banks increased interest rates, China re-entered lockdowns and Russia went to war. All impacting the earnings global companies can generate.

During 2022, the global earnings cycle peaked and entered a broad-based downgrade cycle. Earnings leadership rotated to more defensive sectors with previous leaders, such as the Technology and Communications sectors, the biggest laggards.

Despite the year-to-date rally across global equity markets, earnings expectations continue to adjust lower across nearly all sectors. Consensus is now expecting negative earnings growth for the MSCI World Index for four consecutive quarters to 3Q23. We view this as a healthy and necessary step for a future de-basing and recovery.

Our work on earnings cycles indicates that our Global Diffusion Index (number of analysts upgrading expectations vs number of analysts downgrading expectations) normally bottoms around 3-6 months before actual earnings revisions (see chart below). Our recent international company visits and research insights, as well as ongoing 4Q22 result releases, suggest analysts will continue cutting their numbers.

Alphinity Global Diffusion index suggests more global earnings downgrades ahead

Source: Bloomberg, February 2023

Finding upgraders in an earnings downcycle

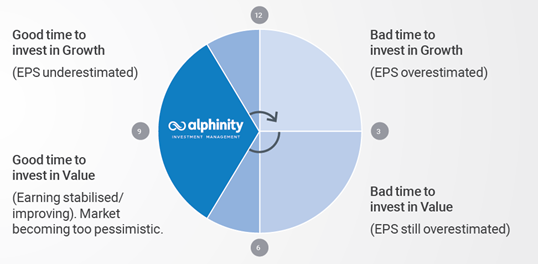

The Alphinity global funds invest in quality global companies which are in an earnings upgrade cycle, and undervalued. The diagram below illustrates Alphinity’s investment style in the context of a company’s earnings life cycle. The approach is agnostic to different market environments, as attractive earnings cases can always be found.

Alphinity combines fundamental and quantitative analysis to find earnings upgraders

Source: Alphinity

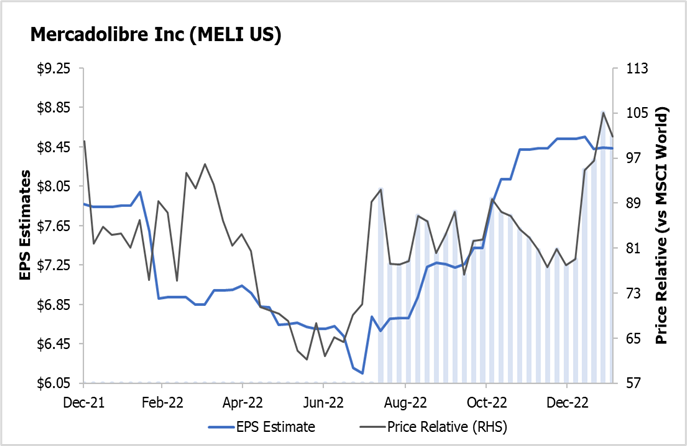

Mercado Libre (MELI) and Keysight (KEYS) are two portfolio stock examples of diverse global companies seeing earnings upgrades, despite the overall market being in a downcycle.

MercadoLibre (MELI) – Eco-systemic philosophy creates huge competitive advantages in e-commerce and fintech

MELI is the largest online commerce ecosystem in Latin America, with 88 million active users across 15 countries. MELI’s platform is designed to provide users with a complete portfolio of 6 integrated e-commerce and digital payment services.

Once a customer is in the MELI ecosystem, it’s very easy to keep them and cross-sell different products. Looking ahead, we see additional upside from increased monetisation of its online marketplace through expanded value-added services such as advertising and payment verticals.

MELI’s exposure to emerging market countries also adds regional and macro diversification to our portfolios. MELI’s biggest market, Brazil, is currently ahead of the rest of the world in terms of macro. They have already raised interest rates 13 times, with the market now expecting cuts in 2023. Unemployment and inflation are also past peak levels. In contrast with ongoing rate hikes and slowing growth still expected for developed markets this year.

MELI has delivered impressive top line growth across all its key markets with market share gains and scale driving profitability. Additional logistic leverage, stability at Mercado Credito and disruptions at MELI’s competitor, Americanas, are all supportive for MELI’s 2023 earnings outlook in our view.

MELI enjoying positive momentum in earnings, with positive revenue growth in all markets

Source: Alphinity, Bloomberg, 5 February 2023

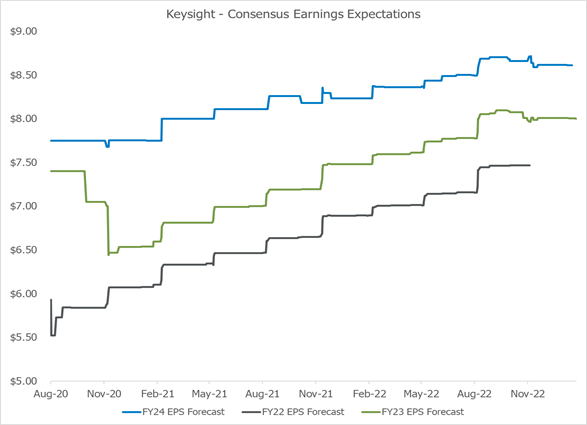

KEYSIGHT (KEYS) – The quiet tech hero benefiting from connectivity complexity

The technology sector is incredibly dynamic. From the mad rush in 2020 to buy any technology name, to unprofitable technology companies crashing in 2021, and concerns and earnings headwinds spilling over into the big technology names during 2022. Throughout this tumultuous period, KEYS has been a consistent part of our portfolios.

KEYS is the global leader in test and measurement technology equipment. The world is getting more connected daily with faster data driving an explosion of applications. Keysight’s exposure to powerful secular trends such as 5G and automotive innovation drive consistent growth. In addition, Keysight’s Research and Development spend levels (16% or revenue) and market position (circa 25% share and rising) allows for investment well ahead of peers in developing new products and solutions.

KEYS is not only taking market share in a growing market but is also exhibiting operating leverage, leading to margin and return on equity expansion (KEYS generates 25-30% operating margins and 30-35% return on equity).

Increased connectivity complexity underpinning demand for KEYS products and services & driving consistent earnings growth

Source: Bloomberg, 5 February 2023

With the ebb and flow of market and earnings cycles, leadership constantly changes. At Alphinity we remain nimble and let our bottom-up work on company specific earnings drive our investment decisions. We will continue to “Cross the T’s and Dot the I’s” to find exciting new earnings leaders, to enter our portfolios and drive consistent performance through various market cycles.

Author: Elfreda Jonker, Client Portfolio Manager