a) Summary

The Alphinity Global Equity Fund (the ‘Fund’) promotes environmental and social characteristics and limits its investments to only companies that follow good governance practices, but does not have sustainable investment as its objective.

The Fund integrates ESG factors (including the consideration of Sustainability Risks) into the investment decision-making process. Through exclusions, ESG risk management, and active engagement, the Investment Manager avoids investments in companies significantly involved in controversial weapons, tobacco products, and thermal coal. This ensures the Fund does not support harmful industries and promotes improved sustainability practices through stewardship activities like active engagement and proxy voting.

The Investment Manager recognises that Sustainability Risks can have a material impact on the performance of companies (positively and/or negatively) and as such, it aims to understand the Sustainability Risks involved for each company in which it seeks to invest. The process can mean that the Investment Manager determines certain stocks are not suitable (or are no longer suitable) as investments for the Fund as the risk/return trade-offs are not appropriate. Accordingly, while there may be a limited number of investments that are deemed not to be investable, the universe of investments of the Fund may be smaller than that of other funds that do not incorporate any Sustainability Risks.

The Fund also emphasises stewardship by engaging with companies on ESG issues. Each year, it undertakes several ESG-specific engagements for global equities and tracks the outcomes. When an ESG issue poses a material risk or opportunity, an engagement objective is set, and progress is monitored and reported.

b) No sustainable investment objective

The Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. While it does not have sustainable investment as its objective, it will have a minimum proportion of 80% of assets aligned to the environmental and social characteristics of the Fund.

Sustainability factors are considered through the stock selection process. This includes indicators for adverse impacts relating to Green House Gas (GHG) emissions and other indicators such as human rights, anti-corruption and anti-bribery indicators. This is achieved through Alphinity’s ESG Framework (the “Framework”). This Framework applies a proprietary methodology to identify and assess ESG risks and opportunities and integrate ESG into investment decision making. The Framework covers more than 40 environmental, social and governance factors including the issues linked to each mandatory principal adverse impact (PAI) and some voluntary indicators. The Framework process assists the investment team to confirm the material ESG topics per investee company and develop action plans to manage risks where relevant. For each relevant topic, an opportunity-threat scale is considered with a score assigned depending on the specifics of the issue. Whilst the Investment Manager considers the PAIs, such consideration does not necessarily eliminate the Fund’s exposure to the PAIs altogether. Further information on principal adverse impacts on sustainability factors is available in the annual financial statements of the Fund.

PAI indicators may also be used in engaging with investee companies. Mandatory indicators are monitored and reported on at least annually. Any material change to an indicator is investigated with further action taken where appropriate. Voluntary indicators are not monitored for every investee company, which is determined through the process of confirming materiality.

For the purpose of the Taxonomy Regulation, the Fund does not presently intend to be invested in investments that take into account the EU criteria for environmental sustainable economic activities. Therefore, 0% of the Fund’s investments will be invested in economic activities that qualify as environmentally sustainable under the Taxonomy Regulation.

The “do no significant harm” principle applies only to those investments underlying the Fund that take into account the EU criteria for environmentally sustainable economic activities. The investments underlying the remaining portion of the Fund do not take into account the EU criteria for environmentally sustainable economic activities.

The Fund does not have exposure to Sustainable Investments that, in the reasonable opinion of the Investment Manager, (which opinion may be based on external analysis) have violated the minimum standards of practice represented by widely accepted global conventions including, but not limited to, the OECD Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights, the ILO Declaration on Fundamental Principles and Rights at Work, and the UNGCP. The alignment of Sustainable Investments with such conventions forms part of the Investment Manager’s ‘do no significant harm’ investment process/criteria. The Investment Manager’s assessment of Sustainability Risks is based on both internal and externally sourced research and analysis. The Investment Manager utilises external research on the compliance of companies with global norms and conventions, including the UN Global Compact, the OECD Guidelines for Multinational Enterprises, ILO Tripartite Declaration of Principles, UN Draft Human Rights Norms for Business, UN Guiding Principles on Business and Human Rights, and other sector specific standards.

c) Environmental or Social (“E/S”) characteristics of the financial product

The Fund promotes a range of environmental and social characteristics. The characteristics promoted by the Fund are:

- Reduction of harmful practices through exclusions. The Fund achieves this through activity exclusions to the production of thermal coal (10% gross revenue threshold), the manufacture or production of controversial weapons (0% revenue threshold), and the production of tobacco products (0% threshold).

- Promotion of improved sustainability practices through stewardship activities. The Fund uses stewardship activities such as active engagement and proxy voting with the aim of minimising Sustainability Risks and, over time, promoting better sustainability practices in the companies in which the Fund invests. The Investment Manager will engage on ESG issues that it deems are a priority for the portfolio company (more details on how these are determined is below). These are issues that, for each company, the Investment Manager believes can impact the Sustainability Risk applicable to the porftolio company and/or investment return opportunity.

Priority ESG issues for the portfolio companies are identified using the Investment Manager’s ESG Framework, which includes a materiality assessment tool. The materiality assessment includes a comprehensive list of ESG topics which are assessed at a company level to identify the most material risks and opportunities and the associated engagement priorities. The following topics are assessed to determine the list of material issues.

Environmental:

- Physical climate risk

- Transition climate risk

- Water use

- Waste

- Pollution

- Biodiversity

Social:

- Labour management

- Health and safety

- Diversity, equity and inclusion

- Psychosocial safety and culture

- Modern slavery

- Cyber crime

- Data privacy

- Product ethics

- Social licence

Governance:

- Corruption and bribery

- Board composition

- Remuneration

- ESG leadership

- Sustainability strategy

- Stakeholder impact

- Controversy exposure

- Regulatory exposure

Sustainability:

- Circular economy

- Animal welfare

- Responsible AI

- Health and nutrition

- Green products

A reference benchmark has not been designated for the purposes of attaining the environmental characteristics promoted by the Fund.

d) Investment strategy

The Investment Manager’s aim is to identify opportunities across market cycles and invest in quality, undervalued companies with underestimated forward earnings expectations. The Investment Manager is an active equities manager that believes that a company’s expected earnings will ultimately drive its share price over time, and that there is a systematic mispricing of individual equities over the short to medium term due to under or overestimation of a company’s earnings ability. This provides an opportunity for outsized investment returns as the true earnings trajectory becomes apparent to the market.

Specifically, the process searches for businesses with:

- Momentum: expected positive earnings and price momentum;

- Quality: backed by real cash flows and return on capital; and

- Value: trading at an attractive valuation.

To identify such companies, the Investment Manager uses a combination of in-depth, fundamental qualitative research and specific quantitative factors throughout the process.

The Fund aims to outperform the MSCI World Net Return Index (AUD) after costs over rolling three-year periods. The Fund will typically hold 25 – 30 companies which the Investment Manager believes are high quality (for example, where the company has a track record of stable and growing revenues and profits over multiple financial years, with robust financial metrics and/or which has historically delivered returns on invested capital or return on equity that are consistently above average for their sector) and has high conviction that the market is currently underestimating the outlook for earnings.

The Fund can invest in equity-related securities (including ordinary shares or common stocks, REITs, depository receipts, redeemable preference shares, partly-paid shares, convertible securities, stapled securities, warrants and rights), IPOs and additionally Derivatives such as exchange traded share price index futures, foreign currency forwards and options, and unlisted securities provided these are expected to list within six months of purchase.

To provide liquidity and to cover the exposures generated through the use of Derivatives, a portion of the Fund’s assets may at any one time be invested in cash or money market instruments and other short-term debt obligations. The money market instruments and other short term debt obligations the Fund may utilise may include deposits and bank accepted or endorsed bills, cash equivalents with a duration of less than one year and cash management trusts.

The Investment Manager believes that the integration of ESG considerations into investment management processes and ownership practices is essential, as these factors can have a significant impact on financial performance and valuation. The investment team, with support from internal ESG specialists, identifies and assesses material ESG issues for any stock actively being considered for investment, as well as on an ongoing basis for all stocks in the Fund. The outcome of this assessment is an overall ESG risk level. Any stock that is assessed at the highest risk level of ‘avoid’ has not met Alphinity’s minimum ESG criteria and consequently is not considered for inclusion into the Fund

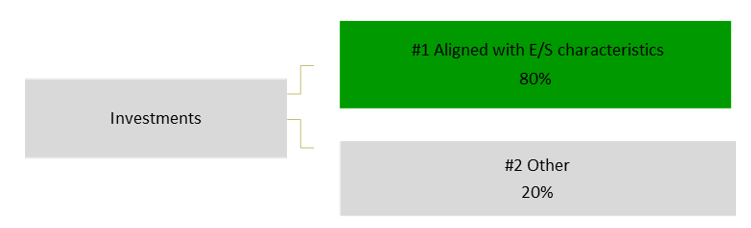

e) Proportion of investments used to meet E/S characteristics

Category #1 investments (i.e. those aligned with E/S characteristics) comprise all equity investments of the Fund. These are all assessed using Alphinity’s investment process including the ESG Framework. Category #1 investments comprise the entirety of the Fund except for cash and derivatives. Cash and derivatives are only held for efficient portfolio management purposes (cashflow and currency management for example). 80% is the minimum Fund exposure to Category #1 investments. In practice, the Fund will aim to hold significantly less cash with exposure to Category #1 investments being well above 90%.

Category #2 investments are cash deposits (including cash held at the Depositary), cash equivalents (including treasury bills, investment grade commercial paper, certificates of deposit, money market funds, cash management trusts and short term government obligations), certificates of deposits and/or money market instruments and derivative investments held only for efficient portfolio management purposes. These investments are not assessed using the Investment Manager’s equity process or Framework.

f) Monitoring of E/S characteristics

Please see section b) and c) above for detail about the screens applied to the investment universe and section g) below on the scoring methodology applied to the Fund.

As part of the investment process, the Investment Manager considers a varierty of sustainability indicators to measure each of the environmental or social characteristics promoted by the Fund. These are set out below:

- Exclusion of investee companies engaged in harmful practices:

- Exclusion of investee companies with revenue linked to negative screens: Using internal and third-party data sources, the Investment Manager will assess the investment opportunities of the Fund for the purposes of excluding all companies that derive revenue from the manufacture of controversial weapons (0% revenue tolerance), the production of tobacco products (0% revenue tolerance), and the production of thermal coal (10% revenue tolerance). The Fund will not invest (or remain invested) in companies whose activities are linked to these activities.

Compliance with this negative screen is monitored through pre and post trade compliance controls and is considered an indicator for the Fund to measure compliance with its stated environmental or social characteristics.

- Promotion of improved sustainability practices:

- Number of sustainability related engagements with companies per year: As part of the portfolio construction process for the Fund, the Investment Manager tracks the number of ESG-specific engagements it has with investee companies each year. These engagements aim to address material ESG risks and opportunities and form an important sustainability indicator to measure the attainment of the environmental or social characteristics promoted by the Fund.

- Number of engagement outcomes achieved with companies per year: Where an ESG issue presents a material sustainability risk and/or opportunity for an investee company, an engagement objective may be set by the Investment Manager with that investee company to mitigate that risk, or achieve that opportunity, over time.

Progress against the absolute objective or incremental milestones are tracked and reported as engagement outcomes and used for measurement of the sustainability indicators.

The Investment Manager will track and report on the performance of the sustainability indicators applied to the Fund. These sustainability indicators will be used to measure the attainment of each of the environmental and/or social characteristics promoted by the Fund and will be included in the mandatory periodic report, as per the requirements of Article 11 of SFDR.

g) Methodologies

Please see sections b) c) and f) above for details about the screens and risk management process for the Fund.

h) Data sources and processing

Data sources

- External ESG research and data

- Bloomberg ESG research and data

- Investee Company reporting

- Local news agencies and media outlets

- Broker research from various international research providers

Data quality

- Data quality can be ascertained by the quality of the auditors who have conducted reviews of the respective investee companies’ reports and accounting standards adopted.

- Norms-based and controversy screening provided by external providers is cross-checked through news service screening with the aim of ensuring that no material information is omitted.

- Information from media outlets is treated as non-verified information. The Investment Manager uses other sources such as company contacts and other forms of research to triangulate and cross-check such information for accuracy

How the data is processed

- Data is processed through a centralised ESG Framework and process. This data, along with qualitative information, informs a set of material ESG issues and risks for each company. Each analyst uses this information to inform their view on the ESG standing of the investee company and the subsequent impact, if any, on investment decision making.

i) Limitations to methodologies and data

Environmental and social data availability is limited in many cases.

For example, data for factors such as water use, biodiversity impacts and waste recycling are not yet reported on by all investee companies. In such cases, the Fund looks to consider the overall level of E/S impacts the industry with which the company sits within to form a view on the relative level of E/S impact the company might have.

Data constraint is one of the biggest challenges when it comes to providing sustainability related information to end-investors, especially in the case of principal adverse impacts of investment decisions. There are also limitations on sustainability and ESG-related data provided by market participants on comparability. These disclosures may develop and be subject to change due to ongoing improvements in the data provided to and obtained from financial market participants in the emerging markets to achieve the objectives of SFDR in order to make sustainability-related information available.

j) Due diligence

Material sustainability risks and opportunities are assessed using an in-house methodology and process; ESG Framework. This is made up of three main components: Thematic frameworks, ESG materiality and risk levels, and ongoing risk management. There is close collaboration between the ESG and portfolio management teams to implement the ESG Framework. These activities are supported by stewardship activities that span engagement, proxy voting, research and external reporting.

Assessments under the ESG Framework are completed as part of pre-investment due diligence and on an ongoing basis for existing holdings. We document the outcomes of our analysis using a standard company ESG review template, in internal thematic research reports, and as part of a live risk register.

We utilise a materiality approach to analyse the balance of ESG factors for a particular company and determine the best path forward. When completing this assessment we include issues across the short, medium and long term and those that potentially create impact at a systemic, industry and company level.

To ensure that all material and relevant ESG issues are considered, Alphinity seeks to access multiple sources of ESG information, with a preference wherever possible for firsthand insights obtained by the portfolio management and ESG teams from direct company engagement, industry experts or other third parties.

k) Engagement policies

The Fund uses stewardship activities such as active engagement and proxy voting with the aim of minimising Sustainability Risks and, over time, promoting better sustainability practices in the companies in which the Fund invests. The Investment Manager will engage on ESG issues that it deems are a priority for the portfolio company. These are issues that, for each company, the Investment Manager believes can impact the Sustainability Risk applicable to the portfolio company and/or investment return opportunity. Active engagement involves direct communication and setting expectations with portfolio companies to positively influence their sustainability practices. The goal is to encourage them to adopt more sustainable practices where the Investment Manager, as an investor or potential investor in the company, believes doing so will improve the risk/return trade off.

l) Designated reference benchmark

A reference benchmark has not been designated for the purposes of attaining the environmental or social characteristics promoted by the Fund.

The following Funds have been classified as Article 8 products for the purposes of SFDR:

- Alphinity Global Equity Fund

Sustainability risk policy statement:

The Fund promotes environmental and/or social characteristics in a way that meets the specific criteria contained in Article 8 of SFDR but does not have sustainable investment as its objective in a way that meets the specific criteria contained in Article 9 of SFDR.

Notwithstanding this, the ICAV still considers that the Fund is managed responsibly. The Investment Manager evaluates and integrates Sustainability Risks and other relevant ESG factors at multiple stages throughout the investment process. This is considered an important element in contributing towards long-term investment returns and an effective risk-mitigation technique. The Investment Manager has carried out an assessment of the likely impacts of Sustainability Risks on the returns of the Fund and does not expect that it will materially impact the expected risk or return characteristics of the Fund currently. The Investment Manager takes a precautionary approach to Sustainability Risks. Based on the assessment of the Investment Manager, the Investment Manager will exclude companies considered to have serious ESG violations or facing acute Sustainability Risks (outlined in further detail below in the section titled “The ESG Policy”). The Investment Manager also applies a positive screen in order to determine investments to be made by the Fund when seeking sustainable investment opportunities.

Risks and factors considered by the Investment Manager include but are not limited to:

- Environmental factors such as physical climate risk; transition climate risk; water use, waste; pollution and biodiversity.

- Social factors including labour management, health and safety, diversity, equity and inclusion, psychosocial safety and culture, modern slavery, cyber crime, data privacy, product ethics, social licence

- Governance factors such as corruption and bribery, board composition, remuneration, ESG leadership, sustainability strategy, stakeholder impact, controversy exposure, regulatory exposure

- Sustainability factors such as circular economy, animal welfare, Responsible AI, health and nutrition, green products

The Investment Manager’s assessment of these Sustainability Risks is based on both internal and externally sourced research and analysis. The Investment Manager utilises external research on the compliance of companies with global norms and conventions, including the UN Global Compact, the OECD Guidelines for Multinational Enterprises, ILO Tripartite Declaration of Principles, UN Draft Human Rights Norms for Business, UN Guiding Principles on Business and Human Rights, and other sector specific standards.

Consideration of Principal Adverse Impact Statement:

The Fund considers principal adverse impacts in its investment decisions on sustainability factors.

The indicators for adverse impacts on sustainability that the Fund considers relating to GHG emissions are:

- GHG emissions (scope 1,2 &3)

- Carbon footprint

- GHG intensity of investee companies

These indicators are monitored at least annually where relevant data is available and any material change to an indicator is investigated with further action taken, such as divestment or engagement, if appropriate.

The Fund also considers other indicators for adverse impacts on sustainability factors included in Annex 1 (Tables 1, 2, and 3) such as human rights, anti-corruption and anti-bribery indicators. These metrics and any related controversy are assessed as part of the stock selection process. These indicators are also used in the engagements with investee companies, as described above.

ESG factors, including the consideration of these indicators, are assessed by the Investment Manager at the Fund and investee company level using the the Investment Manager’s ESG Framework (the “Framework”). This Framework applies an in-house methodology to identify and assess the materiality of ESG factors and ultimately integrates ESG into investment decision making. The Framework covers over 40+ environmental, social and governance factors including the issues linked to each mandatory PAI indicator. The indicators are integrated into the Framework and therefore considered in the assessment of Sustainability Risks and are assessed as part of the stock selection process.

The Fund does not intend to make any Sustainable Investments as set out under SFDR.

Remuneration Policy Summary:

The Investment Manager has put in place a Remuneration Policy which governs the fixed and variable remuneration structure of its employees. The Investment Manager is committed to implementing a remuneration framework where adherence to the principles set out herein is part of the performance management framework and can directly impact the overall remuneration of employees.