Christmas fever is running high with beautifully decorated trees and colourful lights cheering us on every corner. The tone was however a lot less cheery when Amazon recently reported their 3Q22 results and downgraded their 4Q22 revenue guidance.

Similar sentiments were reflected across a large range of consumer names noting pricing pressure and a lack of holiday shopping visibility. There is also clear evidence that inventories have been building across US retailers with supply chain constraints lifting and post covid “revenge spending” tapering off.

As we head into the new year, we maintain our preference for companies with strong pricing power, exposure to the more resilient high-end consumer and companies with global reach that can also benefit from a China reopening.

LVMH, MercadoLibre and Starbucks are three diverse consumer names that we believe can withstand a less cheery Festive Season.

Why Amazon’s revenue downgrade is a concern

Amazon is a behemoth e-commerce platform with tentacles across most consumer channels and verticals. They have access to extensive supporting data that can paint a clear picture of the general consumer outlook.

Historically we have seen Amazon downgrade earnings expectations, but this is the first time in many years that they’ve downgraded revenue expectations. The fourth quarter outlook is specifically prevalent given that it includes big spending days in the US, such as Black Friday, Cyber Monday, and Christmas. Amazon cited slowing consumer trends particularly in the US and Europe and a lack of holiday season visibility.

Whilst there were several consumer companies that reported relatively good 3Q22 results, outlook statements echoed Amazon’s concerns and remained cautious around peak season sales and beyond.

Consumers are still nervous and hunting for bargains

Softer economic data points are now becoming more frequent following the flurry of central bank interest rate hikes year to date. The US composite PMI slipped to just 44.6 in December, US housing continues to cool down, layoffs are surging, and consumer sentiment remains at levels last seen in 2009 despite a recent recovery.

US consumer spending has remained relatively resilient during 2022 as households continued to draw on excess savings accumulated during the pandemic. Post COVID pent up demand have been driving a revenge spending cycle focused on travel, leisure, occasion-based spending (for example weddings), beauty, entertainment and more. Recent data points however suggest a softening in these trends with consumer wallets facing more constraints (softer macro/inflationary pressures).

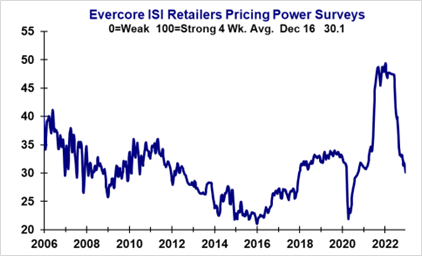

According to Evercore ISI’s December company surveys, current holiday sales remain focused on consumer staples products while discretionary category sales are slow, and consumers are focused on discounted goods. More broadly pricing power continues to soften across industries from elevated levels as global growth slows.

Pricing power continues to soften across industries

Source: Evercore ISI, December 2022

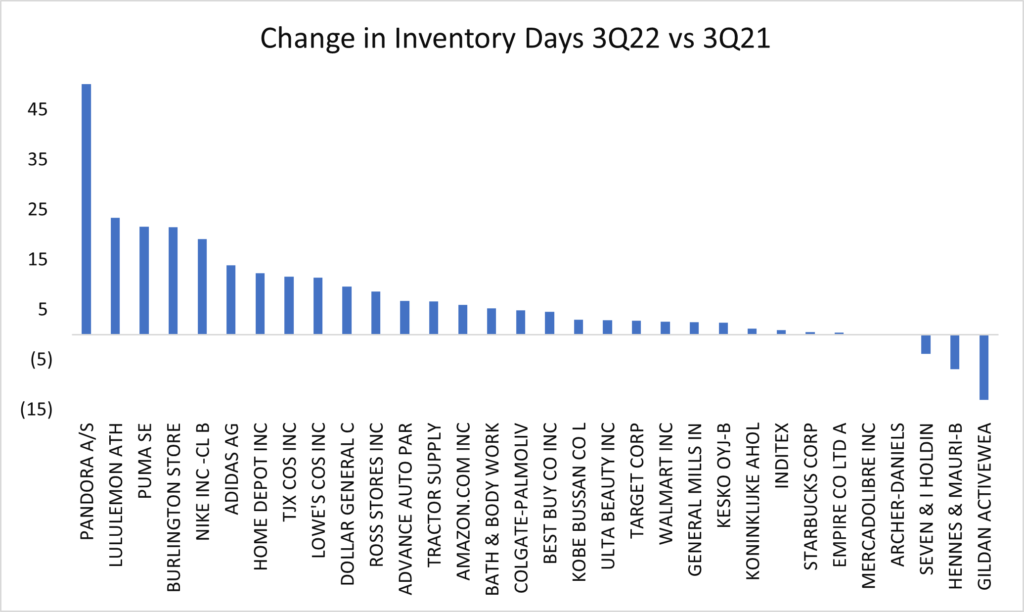

Signs of inventory build are intensifying

Many companies across a range of sectors reported higher inventory levels during the 3Q22 results season. A result of continued supply chain disruption improvement and softer demand. Target (US general merchandise discount store) and Nvidia (inventor of graphics processing units) were two examples of big bellwethers that guided to big inventory build, – adjustments, and/or write-offs.

Our detailed analysis of inventory levels for a sample of 30 global consumer stocks across retailing, food, and apparel, suggest a sobering level of inventory build across the consumer landscape. We looked at the change in inventory as a % of sales and inventory days (average number of days a company holds its inventory before selling it) between the latest reported quarterly numbers (3Q22) and the same quarter last year heading into the Festive Season (3Q21).

The results showed that there are only 3 stocks with lower inventory days and only 5 stocks with lower inventory as a % of sales in our sample. There is specifically a clear inventory build in sportswear with Adidas, Puma, and Lululemon the worst offenders. For example, Adidas’s inventory to sales is now almost 30% up from c17% at 3Q21 and Lululemon’s inventory days are up from 126 days to 150 days (see chart below for the change in Inventory Days) over the same period.

Increased inventories a concern across many consumer names

Source: Alphinity, Bloomberg, December 2022

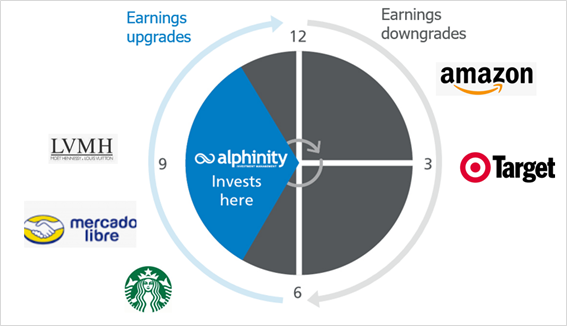

Positioning in companies with strong inventory management and pricing power

Alphinity invests in quality companies that are in an earnings upgrade cycle that trade at a reasonable valuation. In our view, excellent inventory management skills and strong pricing power will be critical in determining the winners vs losers in the 2023 consumer race. Companies that can withstand margin pressures in an environment where business offload excess inventory and consumers hunt for bargains.

Investing in quality companies at the right time in their earnings cycles

Source: Alphinity, December 2022. Note: Alphinity currently owns LVMH, MELI & SBUX, but not AMZN & TGT.

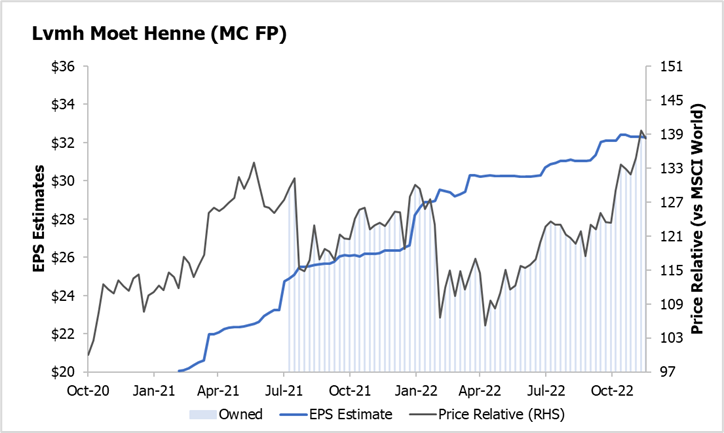

Pricing power remains critical: LVMH, the world’s largest luxury group, is currently our biggest position in our Global Equity Fund as we head into 2023. Demand for their luxury products have remained resilient despite slowing macro trends, with the company able to pass through inflation given their very price insensitive customer base.

LVMH has been in an impressive earnings upgrade cycle since 2020, delivering earnings growth across sub-segments, brands and increasingly across geographies. Management also remains confident in a demand recovery in China once restrictions have lifted.

Despite the relative strong performance of the last 12 months, the company still trades at an undemanding 22x 12-month forward Price to Earnings, which is at the bottom of its 5-year trading range (20-35x)

LVMH – Strong pricing power & resilient demand drive an impressive earnings upgrade cycle

Source: Alphinity, Bloomberg, December 2022

The US consumer is not the global consumer. Certain emerging market countries, such as Brazil, are ahead in the business cycle vs major developed markets, where inflation, interest rates and unemployment are already past peak levels.

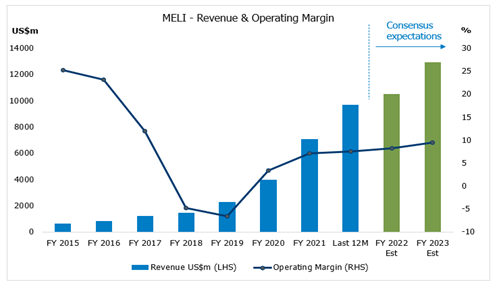

MercadoLibre (MELI), is the largest e-commerce and fintech company in Latin America, with over 88 million subscribers and exposure across 15 countries. MELI has a unique eco-system model with their marketplace, payments, credit, logistics and other services all reinforcing each other, driving strong top line growth.

MELI’s reported very strong 3Q22 results well above their peer group, with accelerating sales growth and margin expansion reflective of their core strengths, including their broad category base, continued logistics improvements and a step change in marketing. Management noted they continue to “manage for growth and market share leadership”

MELI consistently delivering strong Revenue growth and Operating margin expansion

Source: Bloomberg, December 2022

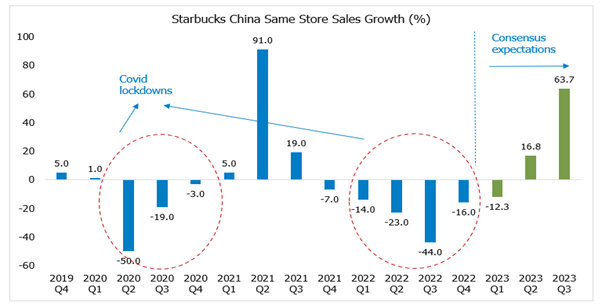

China reopening will be an important earnings driver of 2023 earnings for multi-national companies: Starbucks (SBUX), is the leading specialty coffee retailer in the world, operating across more than 80 markets through company-operated and franchised stores. SBUX experienced a tough time during COVID, with many store closures resulting in a big drop off in sales and margins across all markets.

Looking ahead, we expect their new strategy to drive a strong recovering in same store sales growth across their international markets and a return to profitability. SBUX is also well positioned to benefit from a China reopening, where they continued to open new stores during the pandemic (going from 4123 stores at the end of 2019 to 6000), that can return to profitability.

China Same Store Sales Growth – Potential to rebound on reopening

Source: Bloomberg, December 2022

We will only know during the first quarter of 2023 if Amazon did indeed cancel Christmas and if general market jitters were justified. Regardless, good inventory management, strong pricing power and the right geographical exposures will remain critical elements for consumer companies as they navigate yet another tough macro year ahead.

At Alphinity we will continue to do bottom-up analysis and global company visits to find the highest quality companies that have these attributes and can deliver higher than expected earnings.

Author: Elfreda Jonker (Client Portfolio Manager)