At Alphinity, we anchor our investment approach in identifying earnings leadership, seeking to profit from gaps between market expectations for earnings and actual company results. Despite 18 months of turbulent markets – from AI developments to oscillating trade policies – our earnings focus has delivered strong, consistent performance. While major macro events have always shaped markets, the sheer frequency and layering of these developments in such a short period have created a uniquely challenging environment for investors.

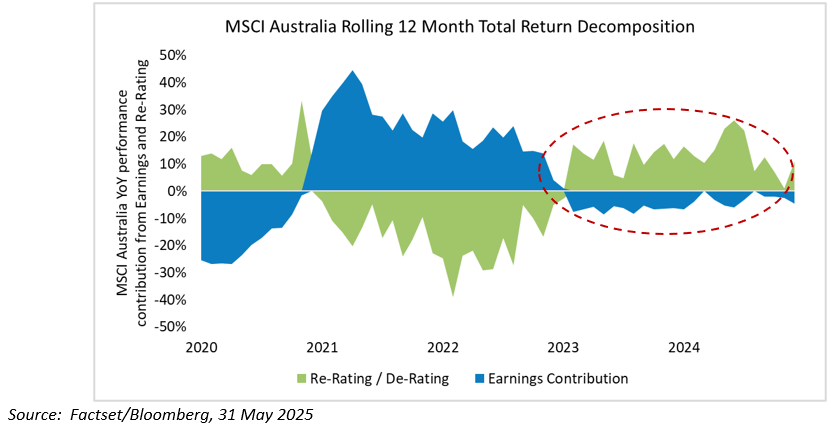

Despite this backdrop, most major global equity markets have offered strong returns for shareholders over the last year and a half, ranging between c35% in the US to c7% in Japan (in AUD). In contrast, Australia’s 17% return relied heavily on multiple expansion amid declining domestic earnings. This scarcity of earnings growth has made our focus on earnings revisions even more valuable in navigating challenging conditions.

Australia’s recent performance relied heavily on investors’ willingness to pay higher prices for scarce earnings

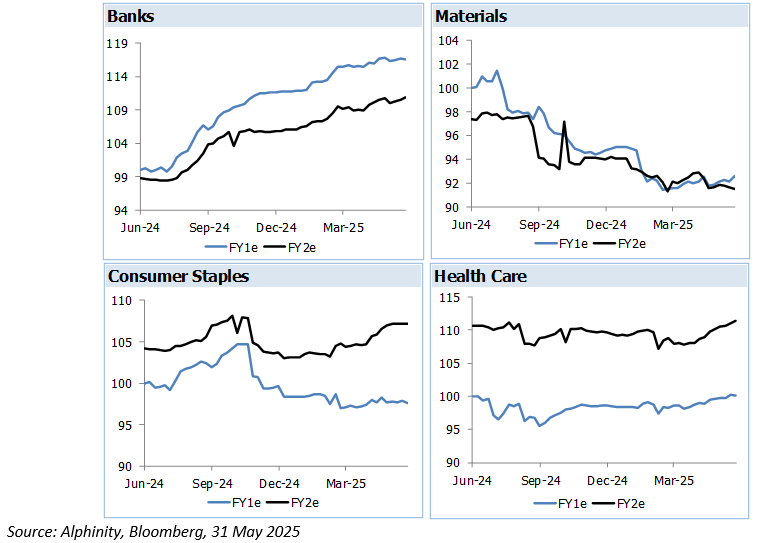

Australian Banks: An Exception in the sea of earnings downgrades

Australia’s major banks emerged as one of the few sectors delivering material outperformance, despite widespread investor scepticism.

Two competing forces influenced our decision: extreme valuations versus consistent positive earnings revisions. While banks traded at expensive multiples with dividend yields below bond yields, we recognized that post-GFC structural changes – higher capital, strengthened provisions, tighter credit standards – justified higher valuations than historical norms. More importantly, banks distinguished themselves as one of the few sectors experiencing continuous positive earnings upgrades, driven by resilient economic conditions, excess provision utilization, supportive interest rate environment, and effective cost management.

Individual stock selection created substantial alpha opportunities. Westpac, our largest overweight, outperformed the market by 40.4%, while ANZ, our biggest underweight, delivered just 5.5%. This demonstrates how astute selection could generate market-beating returns even for investors cautious on sector valuations.

Looking ahead: The earnings picture has started to soften in 2025. Lower rates and competitive pressures are squeezing margins, and we’re likely approaching the end of provision release tailwinds. Recent buybacks have thinned capital buffers just as regulatory requirements rise. However, there’s no dramatic earnings collapse ahead, and both capital and provisioning remain robust. We’ve increased our underweight position marginally as the sector has continued to outperform, while maintaining preferences for Westpac and NAB.

Australian Sectoral Earnings Revisions – Banks a standout vs other sectors

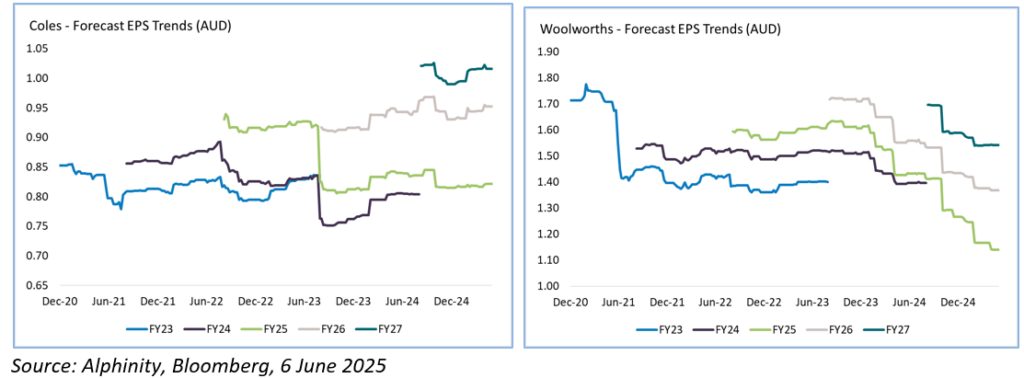

Consumer Staples: The divergent journeys of Coles vs Woolworths

Consumer staples typically offer defensive characteristics, yet the sector has seen persistent earnings downgrades. However, individual stock selection within the sector created significant opportunities. We switched from Woolworths to Coles in March 2024, capturing very different return journeys despite similar business models.

Woolworths faces challenges across Big W and New Zealand operations, plus a bloated Australian cost base. Coles has benefited from sharper cost focus, increased promotional activity, and smaller exposure to peripheral businesses. An earnings-focused approach uncovered this compelling opportunity within an otherwise unattractive sector.

Looking ahead: Despite rate cuts and tight labour markets, consumer sentiment remains weak. Cost-of-living pressures continue driving value focus and increasing competition. We maintain our Coles preference, underpinned by superior own-brand, promotional, and automation strategies.

Coles vs Woolies – Divergent earnings trends within the same sector

Insurers: General insurance– Timing the tides

The insurance sector often gets overlooked due to complex accounting and unpredictable earnings. However, those who read the market correctly find lucrative opportunities, as scepticism creates embedded discounts. After years of flat premium rates, insurers were caught in a perfect storm: pandemic, surging inflation, then natural catastrophes. The global reinsurance industry responded decisively, demanding proper pricing or threatening capital withdrawal, delivering consecutive years of double-digit premium increases.

We captured Suncorp’s strong performance by recognizing converging factors: premium increases flowing through as inflation moderated, strategic restructuring focusing on general insurance, and significant excess capital for returns. However, we held Steadfast too long as their narrative shifted. While brokers capture rate increases first, they also feel slowdowns earliest. The company’s US expansion pivot altered risk profiles just as regulatory scrutiny emerged.

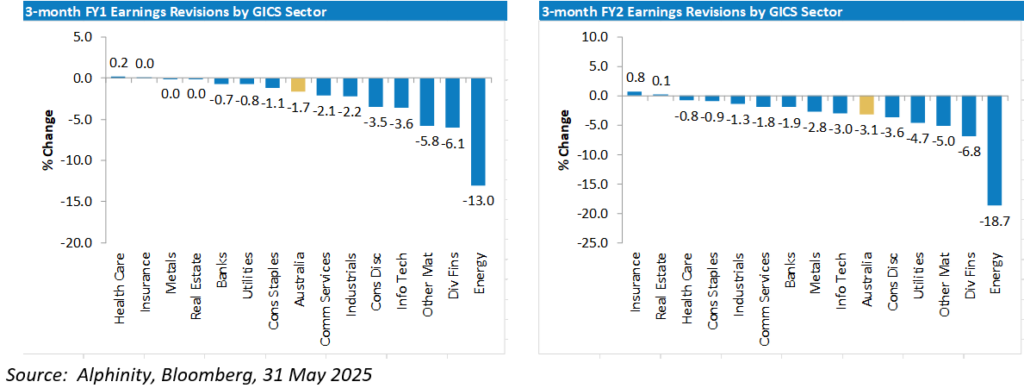

Looking ahead: Insurance stands out as one of few Australian sectors still delivering earnings upgrades in 2025, though these are now marginal. After years of compounding increases, global commercial pricing is decelerating, suggesting the sector’s most substantial gains have been captured.

ASX200 Sector Earnings Revisions for FY1 and FY2 over the past 3 months

These case studies reinforce our view that earnings revisions drive long-term performance more reliably than most other factors, individual stock selection typically outweighs sector allocation, and maintaining process discipline is crucial. In volatile markets, charting your own course through company-specific analysis delivers superior results to following the fleet.