The emergence of Chat GPT in late 2022 triggered an explosion in AI related capital expenditure as tech giants raced to dominate this generational technology frontier. Consensus estimates now estimate that spending on the requisite AI infrastructure will soar to an aggregate of ~$3 trillion in the coming years. This escalating investment commitment crystallises two critical, interconnected questions for investors:

- Who can fund it?

- What are the returns generated from it?

In terms of funding, we divide the landscape into “Big Tech” and “The Rest.” Microsoft, Alphabet, Meta, and Amazon come into this build-out with fortress balance sheets and strong free cash flow that can underpin their significant funding needs. However, outside of Big Tech the funding ability becomes more questionable without a clearer path to monetisation.

In terms of returns, while AI is an extraordinary technology which will create significant returns for investors, the sheer scale of capital deployment is set to fundamentally recalibrate the future return profile for participants. While we still expect returns for Big Tech to be strong, the era of sustaining >30% ROE’s while running asset light business models appears to be in the past. On average, our calculations indicate that for big tech companies to maintain current company ROE’s after accounting for their full AI investment commitment, Big Tech must generate additional incremental earnings equal to their current total earnings. This mandate, to double the existing profit base of the world’s largest companies, represents an enormous, unprecedented challenge.

While AI is a generational technology, the questions around funding and returns combined with rapid share price gains in speculative areas of it has raised the prospect of a potential AI bubble. Along with the interconnected nature of recent transactions within the ecosystem, there are certainly echoes with other speculative boom bust cycles. The build-out is now transitioning into a critical second phase; one where the required capital exceeds even Big Tech’s organic cash flow and reaches a quantum that will depress profitability metrics across the industry in the medium term.

Our Stance

To be clear, Big Tech and AI-themed stocks remain firmly anchored as earnings leaders within our investment framework justifying their notable allocation of portfolio capital. However, in response to these rising financial and speculative risks, we are proactively managing our overall portfolio AI exposure and maintaining a strong bias toward the highest-quality, financially resilient names in our stock selection.

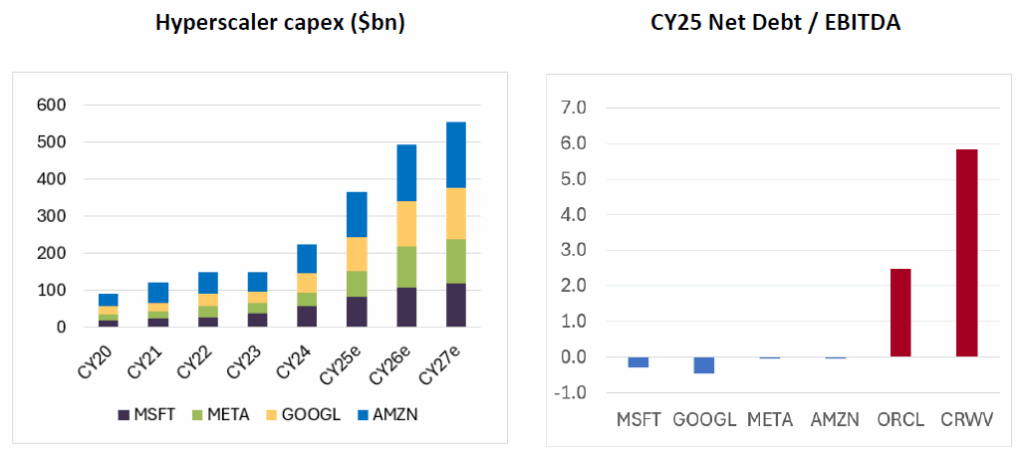

Funding the AI capex expansion

The expansion of capex to fund the AI buildout is extraordinary, with hyperscaler capex projected to exceed 3x the levels of 2023 by 2026. Despite this escalation in spending by Big Tech, we do not have concerns about their balance sheet positions at this time. Microsoft and Alphabet possess significant net cash reserves, while Meta and Amazon maintain negligible net debt. Vulnerability in the AI infrastructure trade in our view lies elsewhere, with companies such as Oracle and CoreWeave entering this capital-intensive arms race with measurably weaker balance sheets.

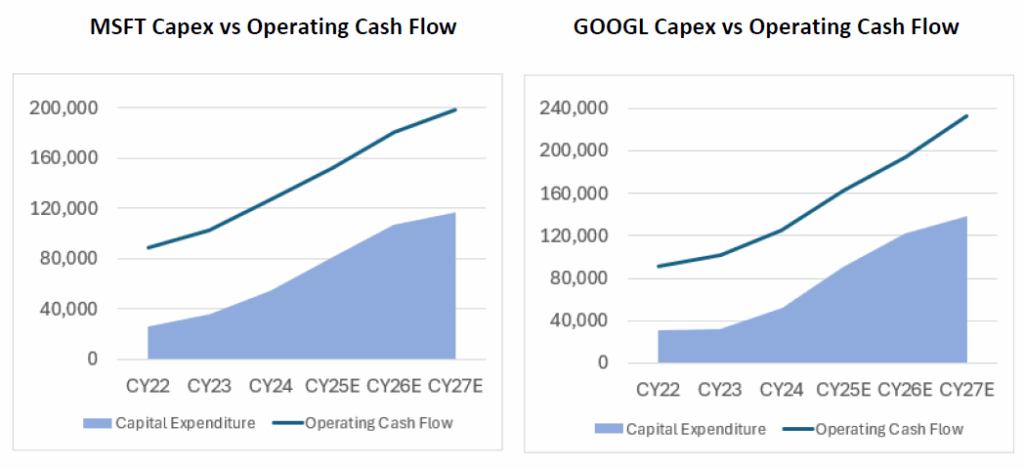

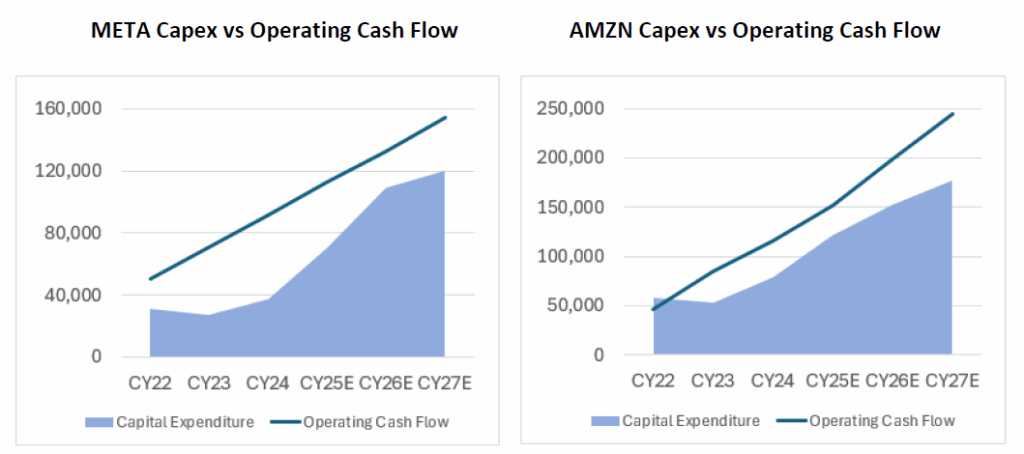

A similar dynamic exists looking at the funding of future capex for the big tech players. While capex is escalating considerably, it continues to be funded from operating cash flow rather than by taking additional debt onto their books. Although the major players are routinely accessing the bond market, this activity represents a normalised, opportunistic component of their diversified funding mix and not a sign of balance sheet strain or financial distress.

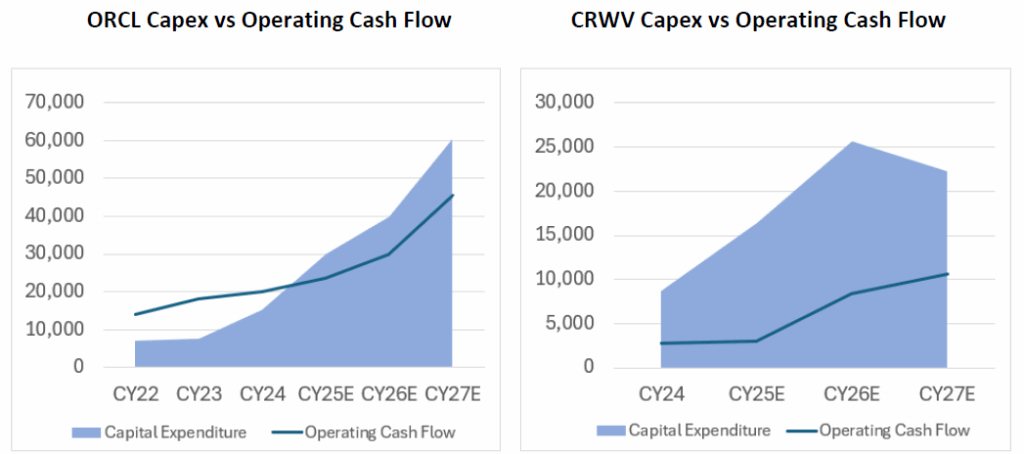

The most significant risk in the AI buildout does not lie with the mega-caps but in the smaller, more recent entrants to the AI race. For example, in companies such as Oracle and CoreWeave the estimated AI-driven capital expenditure materially exceeds their free cash flow generation, making their expansion dependant on securing external capital including taking on additional debt. Such a situation is replicated across a number of smaller neoclouds.

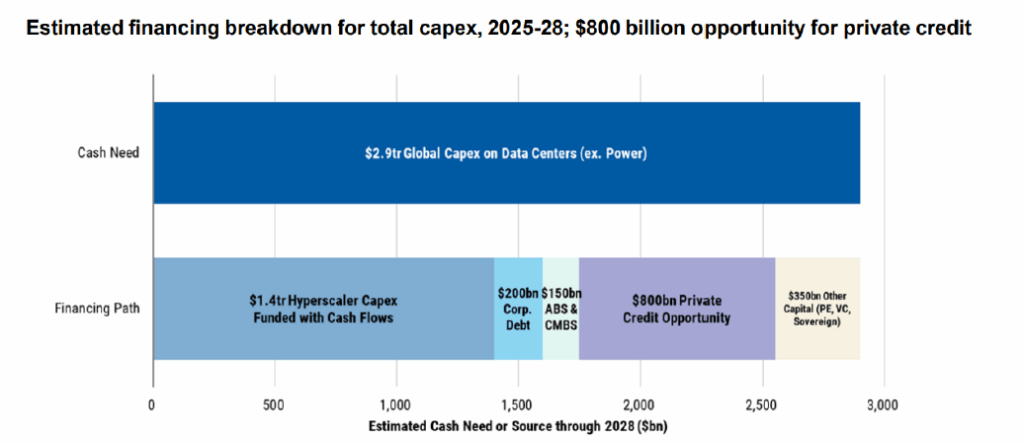

Viewing the AI infrastructure through an aggregate lens, the funding challenge is substantial, with an estimated ~$2.9tr to be spent in the coming years. While hyperscaler operating cash flow is expected to cover approximately half of this sum, the remaining half must be sourced from external capital. This gap will be filled in part by traditional corporate debt but more significantly by the burgeoning private credit market. Should the market’s conviction in the future returns generated by AI begin to erode, this reliance on external debt and private credit could rapidly transform from a source of liquidity into a significant vulnerability.

Returns from AI

For Big Tech, the core debate pivots away from funding capacity and towards the generation of returns. Traditionally, Big Tech companies sustained asset-light models characterised by capex to sales ratios in the low double digits and the delivery of exceptional Return on Invested Capital (ROIC) and Return on Equity (ROE) that were consistently at or above 30%. But this intensive capital expenditure cycle fundamentally alters that profitability equation.

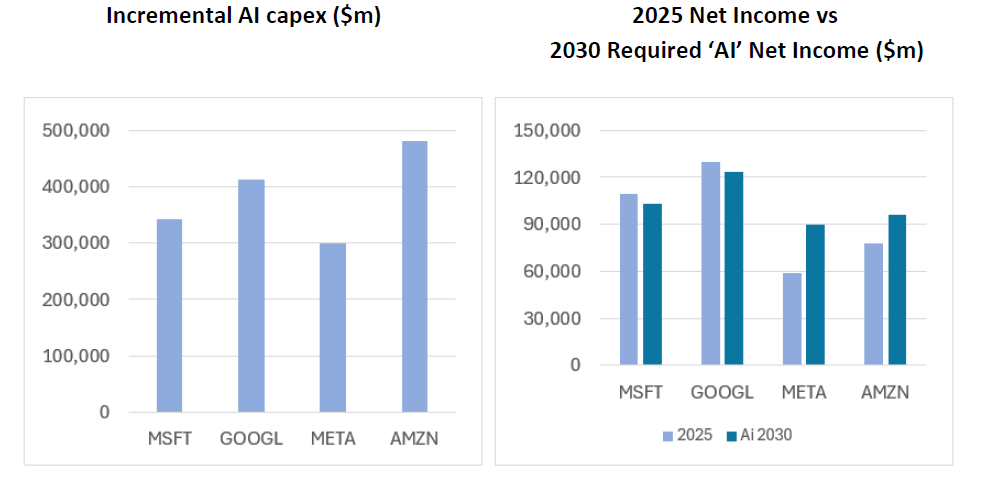

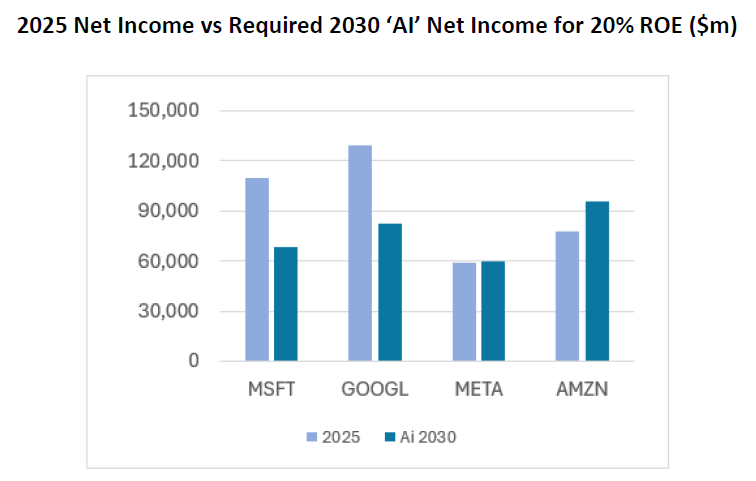

The scenario with maintaining current ROE’s: Our analysis using CY22/23 capex to sales ratios as the baseline implies a total incremental AI capital commitment of between $300bn-$500bn for each Big Tech company until 2030. To simply maintain the premium ROE levels that are a hallmark of Big Tech requires an extraordinary feat; the creation of net new AI-driven earnings that are equal to or greater than the companies’ current total profit generation. So, the question becomes can Microsoft and Alphabet ‘create themselves’ all over again in terms of new AI-earnings? And can Meta and Amazon create even bigger versions of their current selves (see chart below)?

The scenario of lower future ROE’s: The most probable path involves a moderation of overall business return metrics, while they simultaneously retain a decisive competitive advantage globally. As of December 2024, Big Tech’s average ROE of 28% dwarfed the 17% achieved by the remaining 496 constituents of the S&P 500.

Even under a more conservative assumption that Big Tech generates a still excellent 20% ROE on their significant AI investments, the scale of the required earnings generation remains formidable. Microsoft and Alphabet must successfully launch and scale new business units equivalent to two-thirds (2/3) of their current total operational size while Meta and Amazon must engineer entirely new divisions that mirror the scale of their existing current operations. While this 20% ROE scenario is more likely than maintaining 30% returns, it underscores that the market’s current valuation premium still depends on the successful, large-scale monetisation of AI investments.

This ‘push-pull’ of Big Tech is a key thing to consider going forward: these companies will still generate very strong absolute returns when compared to the average global company, but this will be weighed against a compression of these returns; an occurrence which has tended to correlate with weaker stock performance historically in markets. We will be continuing to closely monitor incremental earnings to ensure that the thesis of ramping returns from AI investment justifying current investment levels is on track.

Cross Linkages between Companies

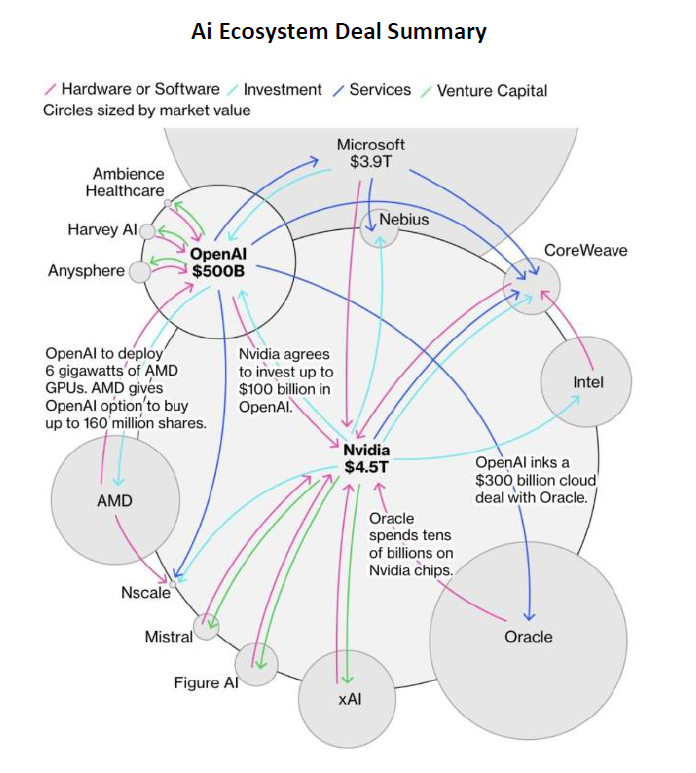

Another area of concern is the interconnected and circular nature of several AI related transactions given the echoes it has with the fibre buildout. While subtle differences exist, such as Nvidia generating such excessive levels of free cash that they can deploy some of this to invigorate the broader ecosystem, the rise of such transactions in a historical context does ring some alarm bells. Is there a risk that Nvidia ends up becoming ‘the bank’ of the AI trade? The most complete depiction of the inter-related nature of these transactions is shown below, with the main features that stand out being the centrality of both Nvidia and Open AI:

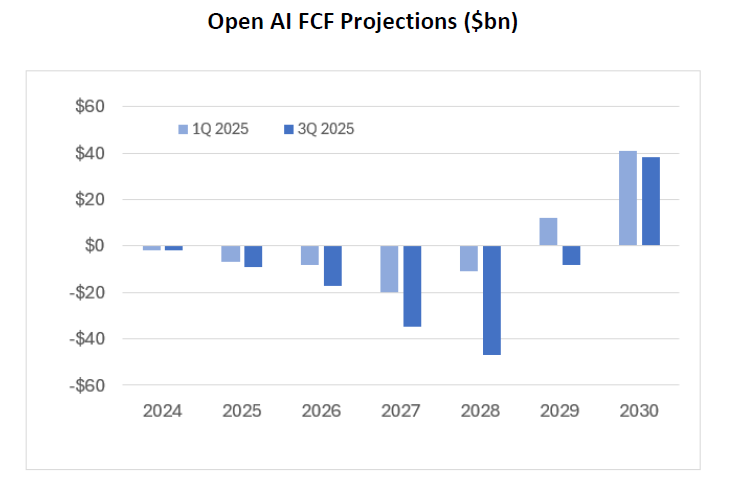

While Nvidia is investing from a position of strength, questions have been raised about the ability of Open AI to fund what has been an extraordinary level of commitments in the past six months. This in the context of a business which in 3Q had a projected total cash burn of $116bn, before turning FCF positive in 2030 (up from a projected total cash burn of $46bn as at 1Q25). Furthermore, these projections were before the recent spate of announced deals:

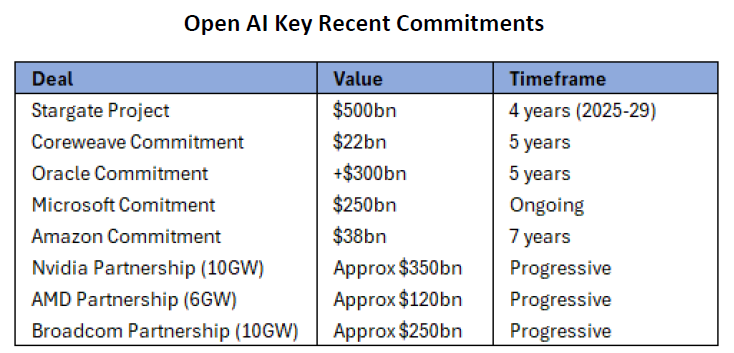

A summary of key Open AI commitments is below. Most notable are the contracts for capacity with Oracle (>$300bn) and Microsoft (>$250bn) along with commitments to deploy capacity using Nvidia chips (up to 10GW), AMD chips (up to 6GW) and Broadcom chips (up to 10GW). Note that each GW of capacity can cost up to $50bn implying up to $1.3tr of commitments across these 3 deals alone, and the total value back to the provider varies with content per GW which varies by chip type:

While Open AI is an extraordinary company and has reached 800m Weekly Average Users in a short period of time, momentum needs to continue to give the market confidence that the recent spate of commitments will be fulfilled. This explains why the Oracle stock, which saw an initial large price reaction on its announcement of an Open AI-deal, quickly reversed.