A message from Alphinity’s founders

At Alphinity, we are always striving to do things better. We believe that continuous improvement is essential for running our business well and serving the best interests of our clients. Responsible investing is a dynamic and ever-evolving space. It’s important that we stay on top of these changes, continue to expand our thinking as fund managers and raise the bar in the responsible investment landscape.

We are pleased to present Alphinity’s second annual Environmental, Social and Governance (ESG) and Sustainability Report. This report demonstrates our efforts in responsible investment across FY22 and highlights key ESG and sustainability outcomes and achievements across all Alphinity funds including the Australian Share Fund, Concentrated Australian Share Fund, Australian Sustainable Share Fund, Global Equity Fund, and Global Sustainable Equity Fund.

[button-link link=”https://www.alphinity.com.au/wp-content/uploads/2023/01/Alphinity-ESG-and-Sustainability-Report-2022_2023.pdf”]2022 ESG and Sustainability Report[/button-link]

[button-link link=”https://www.alphinity.com.au/wp-content/uploads/2022/12/Alphinity-ESG-and-Sustainability-Report-Summary-2022.pdf”]2022 ESG and Sustainability Report Summary[/button-link]

About this report

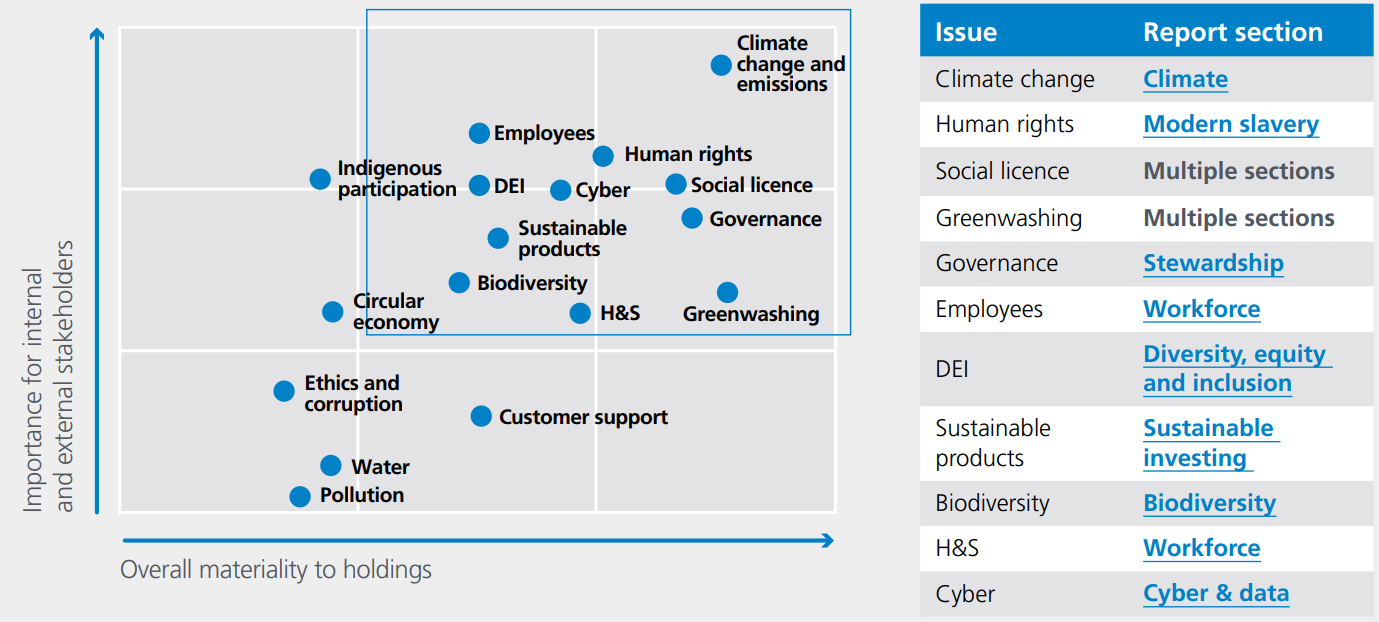

This report has been structured around a set of material issues. To identify the most material ESG issues we completed:

- Analysis of Alphinity’s internal ESG materiality assessment and main data outputs

- A workshop with Alphinity team members in which each was asked to identify the most relevant ESG aspects for the

firm’s holdings and the investment process - Interviews with clients to identify the ESG topics they would like to see included in this report

The outcomes of the above activities are shown below:

To view the full report and findings in more detail, please click here.

To view a summary of the 2022 ESG and Sustainability Report, please click here.