What the market needs in 2021 is the “E” (earnings) in PE (price/earnings multiple) to come through! Global equity markets desperately need earnings growth in 2021 to justify the current lofty multiples they are trading at. As 2021 gains momentum, it is comforting to see the continued positive earnings momentum broadening across regions and sectors. Alphinity’s agile and style agnostic process has allowed us to opportunistically tilt our Australian and Global portfolios to the more cyclical part of the market over the last 6 months, following new earnings leadership opportunities in a timely manner.

The majority of 2020 market returns were driven by multiple expansions

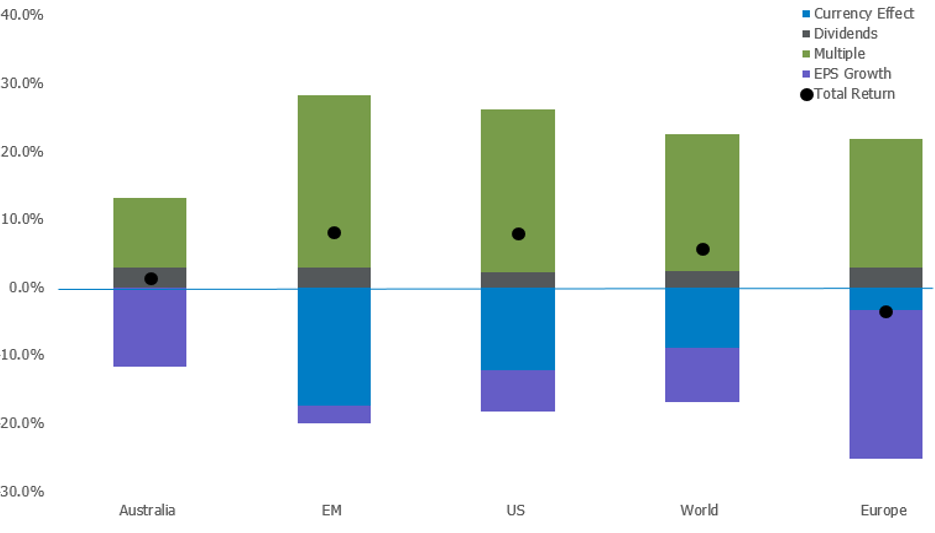

Despite the significant negative impact of COVID-19 on the global economy during 2020, many major global equity markets managed to eke out positive returns in local currencies, largely thanks to big re-ratings across global indices. Global equities are now trading at a forward PE ratio of 21x, and Australia of 20x, both well above the 30-year average.

2020 Total Return (AUD)

Source: Bloomberg

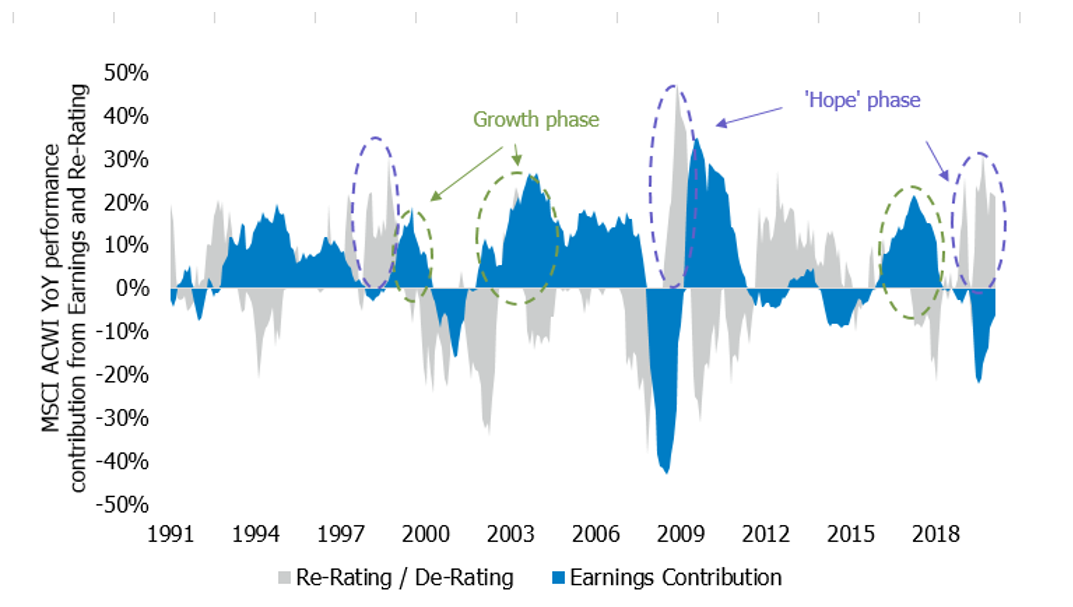

The strongest market returns are typically generated during the PE expansion phase

These movements are typical of the PE expansion (or ‘Hope) phase of the market cycle, as markets are forward looking and already pricing in high expectations of an earnings recovery.

Valuations (PE’s) are of course also influenced by low discount rates, which has been persistently low and supportive over the last number of years (so not just ‘Hope’). There is a reasonable chance that valuations don’t come all the way back to long term averages unless interest rates rise, but the sheer size of the re-rating overall has been notable.

The subsequent earnings ‘Growth’ phase of the market typically sees earnings drive market returns, with value, cyclical and/or smaller size companies normally outperforming larger, growth and quality companies.

As the chart below reflects, the current move from the ‘Hope’ to the ‘Growth’ phase reflects historic patterns last seen after the GFC (2009/2010) and the 1999 Tech Bubble.

Global YoY performance – contributions from earnings and re-rating/de-rating

Source: BofA, MSCI, IBES

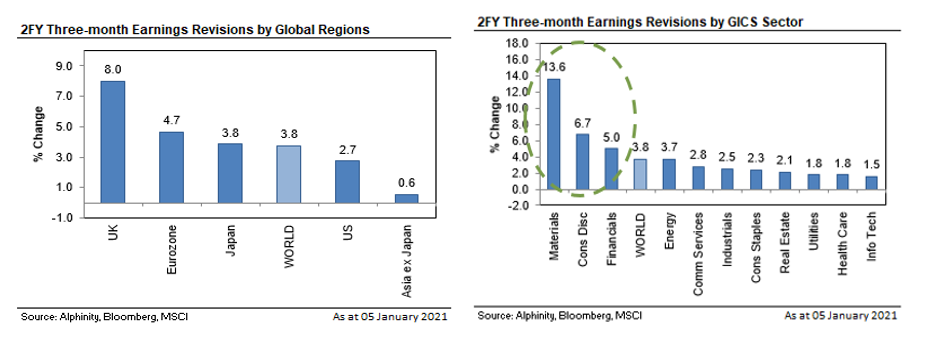

Earnings revisions are now positive across all key regions and titling towards cyclicals

Global and Australian equity markets are now entering the “Growth” phase with Global Earnings revisions now positive across all major regions and leadership shifting from defensives to cyclicals.

In our view, one of the main investments themes for 2021 will not only be whether the earnings recovery will come through to justify the current market valuations, but the extent of that recovery compared to expectations, and which sectors/companies will benefit the most.

At Alphinity, we invest in quality, undervalued companies entering an earnings upgrade cycle. We specifically look for opportunities where the earnings growth is underappreciated by the market and has valuation support.

Importantly, these opportunities can be found at any point in the market cycle.

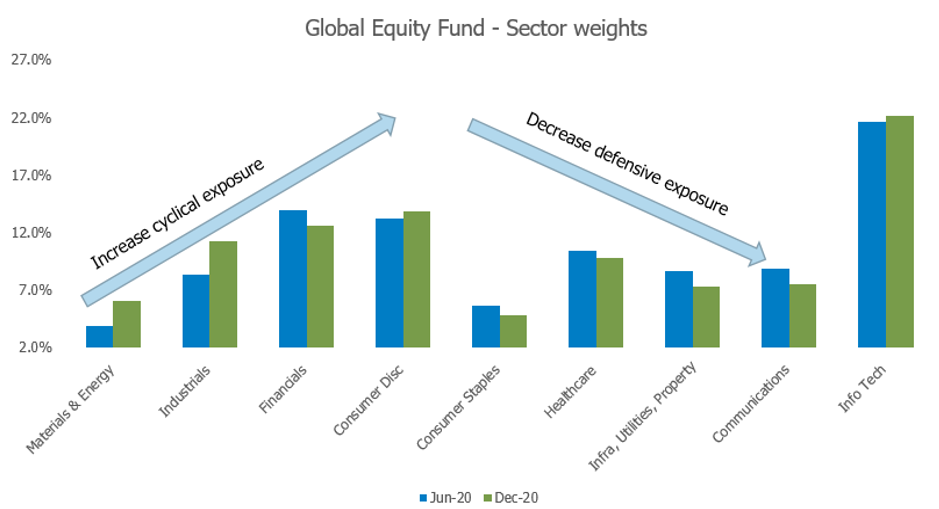

Over the last six months our agile and style agnostic process has allowed us to opportunistically tilt our Australian and Global portfolios to the more cyclical part of the market, following new earnings leadership opportunities. We have however maintained our positions in quality companies with a secular growth thematic. It will be important to obtain confirmation of earnings trend and company execution during the current reporting season.

Tilting portfolios to cyclicals in favour of defensives as earnings leadership evolves

Source: Alphinity as at 31 December 2020

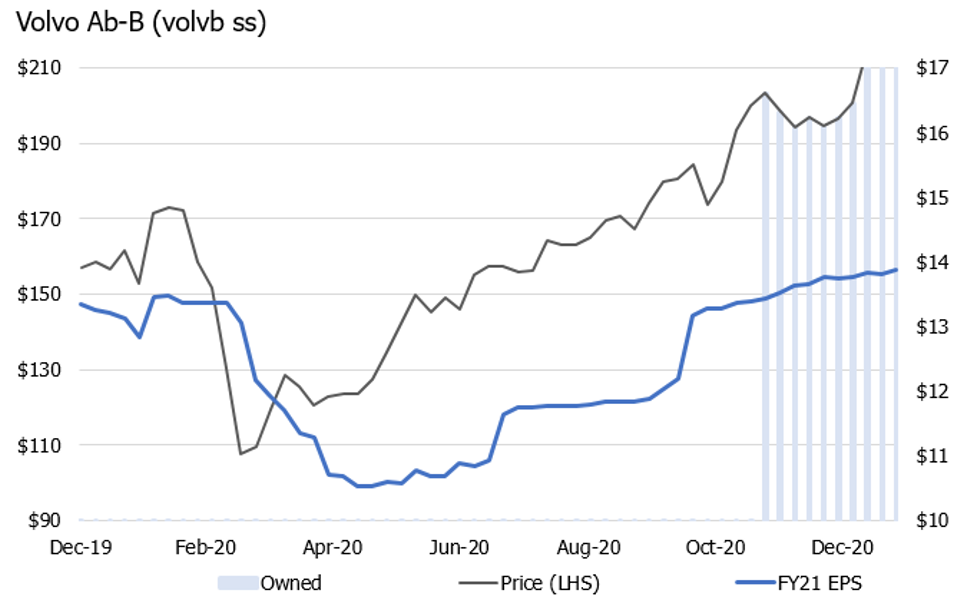

Volvo AB – Earnings leadership, underpinned by the secular long-term EV trend

Our fundamental, bottom-up stock selection process has recently identified several quality industrial companies that are not only seeing persistent earnings upgrades, but also play leading roles in sustainability.

Volvo AB is one such example, that we recently added to the Alphinity Global Equity Fund – Active ETF. Volvo is currently a European leader in the manufacture of trucks and buses, with a commitment to >35% electric vehicles by 2030 and 100% ‘fossil free’ vehicles from 2040. They are at the forefront of the transition to a more sustainable, electric future and already offer a range of hybrid and full electric buses, short-haul distribution and waste trucks, as well as complete solutions for transport, including charging stations.

Volvo AB-B: Forecast EPS trends (SEK)

Source: Bloomberg, Alphinity

Author: Elfreda Jonker, Client Portfolio Manager

Find out more

For more information, please contact your financial adviser, call the Fidante Partners Investor Services team on +61 13 51 53