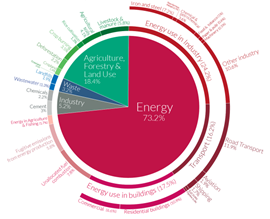

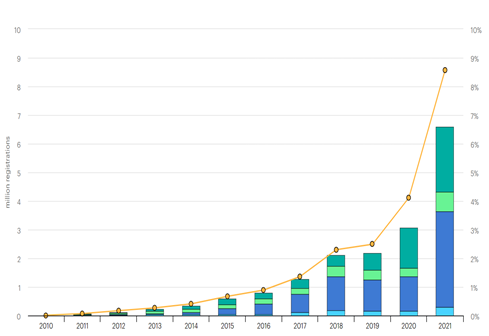

Transportation is one of the single largest sector contributors to Greenhouse Gas (GHG) emissions in the world. Unlike other sectors however, the transport sector already has the technology available to transition to a greener future, namely Electric Vehicles (EVs). Despite rapid growth in the last 10 years, EV market share remains less than 10% of total auto sales. However, by 2030 almost 50% of all new vehicles sold globally are expected to be EVs.

GHG Emissions by Sector

Global Sales and Market Share of EVs 2010-2021

Source: Climate Watch, the World Resource Institute and the IEA.

There currently 48 auto companies in the MSCI All Country World Index (ACWI) with a combined market cap of over $2 trillion. The transition to EVs will produce both winners and losers from this group of stocks. Picking the winners and avoiding the losers can be a significant of source of investment returns and alpha generation in the coming decade.

The Winners

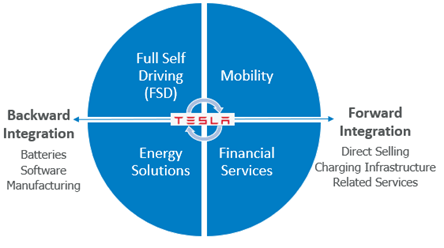

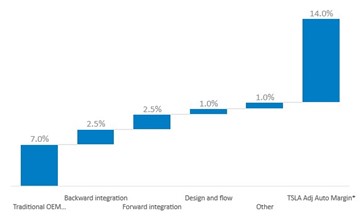

Two auto companies that we believe will be long term winners are Tesla (TLSA) and Mercedes Benz (MBG). Tesla is not just an automotive vehicle manufacturer. The company has multiple business units including Core Auto, Full Self Driving (FSD), Mobility, Energy Solutions and Financial Services that all act to create a Tesla ecosystem. In addition, Tesla’s integrated business model provides backward integration into batteries, software and manufacturing and forward integration via direct selling, charging stations and services. Combined, this provides a unique competitive advantage for Tesla which results in higher margins, higher growth and impressive operational efficiencies.

Tesla’s Integrated Business Model

Margin Advantage from Integration

Mercedes Benz Group (MBG) will also be a winner in the transition to a decarbonised world. From 2025 onwards, customers will be able to choose an all-electric alternative for every Mercedes model. MBG aims to drive the EV share up to 50% by 2025 and be all-electric in terms of new cars by the end of the decade. These initiatives, combined with pricing power and brand loyalty, have already resulted in a significant increase in the average revenue per unit for Mercedes vehicles.

Additionally, Mercedes recently spun off Daimler Trucks & Buses into a separate listing. This unlocked value through delivering a more focused product strategy and better capital allocation. MBG is currently trading at an undemanding valuation of 6x PE. We believe this multiple doesn’t capture the quality of the business and the positive earnings outlook from the transition to EVs. While the stock may face some immediate term headwinds due to supply chain exposure to Eastern Europe, the long term story for MBG is intact.

The Losers

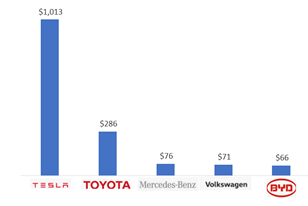

Size matters in the auto industry. The chart below shows that the 5 largest companies account for 65% of the total industry market cap, with the other 43 companies combined accounting for only 35%. The biggest potential losers from the transition to EVs are therefore the long tail of second tier OEMs that have neither the scale, operational efficiency or technological expertise to compete in a decarbonised world dominated by EVs. Examples include European auto companies like Renault and Stellantis and Japanese and Korean auto companies like Honda, Nissan, Isuzu, Kia and Hyundai.

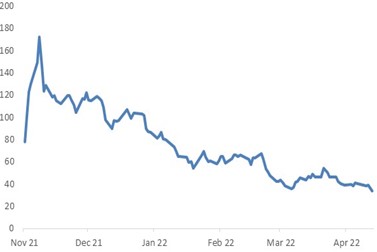

A second category of potential losers, and by far the most controversial, are EV pure play companies like Rivian and Lucid. These start up EV companies listed with significant hype but to date, appear to be all sizzle and no steak. Lucid for example, is expected to remain loss making until at least 2026 and is down 67% from its high in November 2021.

The much-anticipated Rivian IPO tells a similar tale. The stock listed at a price of $80, rose to high of around $180 last late year and has since fallen 81% to its current price of around $33. Like Lucid, Rivian remains deeply unprofitable and is expected to lose over $6 billion of net income and burn through approximately $7 billion of cash in 2022. The company delivered less than 1000 vehicles in 2021.

Top 10 Auto Stocks by Market Cap ($US b)

Rivian Stock Price Performance Since IPO

Source: Bloomberg and MSCI.

As Elon Musk consistently emphasises to investors, manufacturing EVs is hard and developing advanced technology to accompany EVs and enable self-driving is even harder. The hype and valuations put on companies like Rivian and Lucid appear unjustified, even after their recent sell offs. Both have no manufacturing expertise and no advanced technological track record, which implies they will not be winners in the race to an EV dominated future.

To Be Determined (TBD)

In addition to the bifurcated outcomes discussed above (winners and losers), there are also a number of stocks where it is too early to tell if they will win or lose in the auto industry’s transition to a decarbonised future. Key stocks in this category and the questions that will determine their trajectory include:

- Will Chinese EV companies like Nio, XPeng and Li Auto be winners because of the size of the domestic EV market in China and the government’s push towards China Net Zero?

- Will Uber and Lyft be winners, as the simultaneous transition of EVs and AD reduces the need for car ownership? Or will they be losers, as Tesla’s Robotaxi and Google’s Waymo capture this market and make Uber and Lyft obsolete?

- Can the very high-end luxury brands like Porsche, Ferrari and Aston Martin cater to their customer base with EV models, or will they be relegated to ICE dinosaur status, despite their highly recognisable brands?

Conclusion

The transition to an auto industry dominated by EVs is too big to ignore. Within the auto sector there will be both winners and losers. We believe Tesla and Mercedes Benz are long-term winners but that second tier OEMs and unproven EV companies with no manufacturing or technological experience will lose out. Stick with the winners for a better ride into a decarbonised world.

Author: Mary Manning, Global Portfolio Manager