Vestas Wind is the leading wind power company in the world with ~30% market share ex-China. It manufactures and sells new power equipment around the world, as well as servicing wind farms. Its R&D spend also dwarfs other players, producing leading-edge technologies that improve the efficiency and recyclability of its turbines.

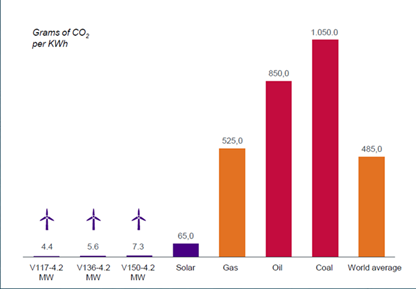

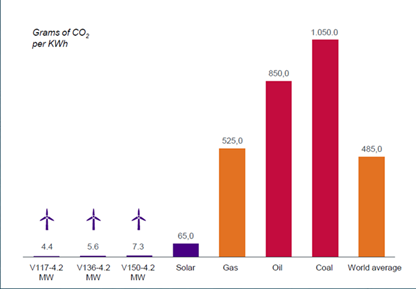

Source: Vestas Wind Systems

Making a significant contribution towards a sustainable world: The chart above shows that wind has significantly lower carbon emissions versus other fossil fuels and consequently will play an essential role in decarbonising the power industry (~42% of global carbon emissions today). With the growth anticipated from the electrification of transport, buildings and industry (i.e. replacing fossil fuels), the switch to renewable power generation is even more important. We expect solar and wind generation to grow materially over the next decade, making up over 30% of global power generation by 2030.

Wind power is now also cheaper than most legacy generation sources: The cost of generation via onshore wind has declined significantly over the last ten years making it cheaper than most existing generation sources. At the same time, the industry has consolidated to a few leading players with significant scale advantages, the largest being Vestas. This means that government subsidies are less important for industry profitability, making a decision today to choose wind both economically and environmentally sound. Vestas’ order backlog is currently >€16Bn and new equipment sales are likely to grow over 20% in 2020 to exceed €12Bn.

Attractive long-term service contracts are another source of sustainable growth: Servicing of wind towers is an increasingly significant part of Vestas’s business, where its competitive advantage today is, if anything, even higher. Its new service contracts are being signed for around 20 years, with an average existing contract life across its service book of ~9 years. This high margin (~25%), capital-light and recurring business segment, is growing at ~10% p.a., and represents around half of Vestas’s operating profits today.

Vestas is well-placed to continue growing faster, and for longer, than currently forecast: Vestas’s business is strongly aligned with the global push towards a more sustainable, carbon-neutral world. This is manifesting in tighter policies around carbon emissions, but also in new fiscal initiatives like the ‘EU Green Deal’ and Biden’s proposed ‘Green New Deal’. These powerful tailwinds mean that Vestas is likely to grow faster, and for far longer, than currently appreciated.

Important information

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.