Technology can be a powerful force driving progress towards the SDGs. Technology companies build out digital infrastructure, enable digital inclusion, drive innovation, enhance knowledge sharing and facilitate delivery of health and education services.

However, some the world’s largest technology companies are under intense scrutiny for their immense market power, data privacy concerns, supply chain management and questionable corporate governance. This so called ‘techlash’ has led to a debate among investors as to whether the Big Tech stocks are sustainable and should be included in sustainable investment portfolios.

We assess the sustainability of these businesses by considering the positive and negative contribution of their revenues towards individual SDGs. A materiality factor is also applied to represent the degree of alignment with the goals. We assess ESG separately in the context of a company’s operational metrics, mitigation strategies and governance practices.

The following discusses the sustainability and ESG credentials of five of the largest and most important technology companies in the world: Apple, Microsoft, Amazon, Google and Facebook. Our analysis shows that the Big Tech companies are sufficiently differentiated on sustainability and ESG outcomes.

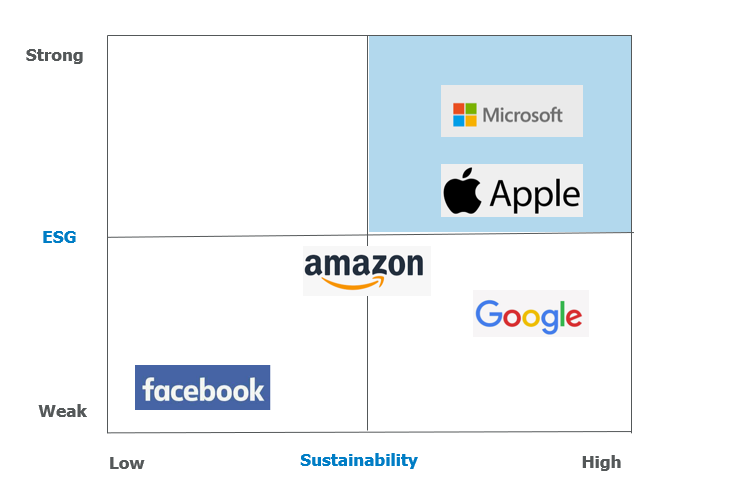

Sustainability / ESG Matrix for Big Tech

Source: Alphinity

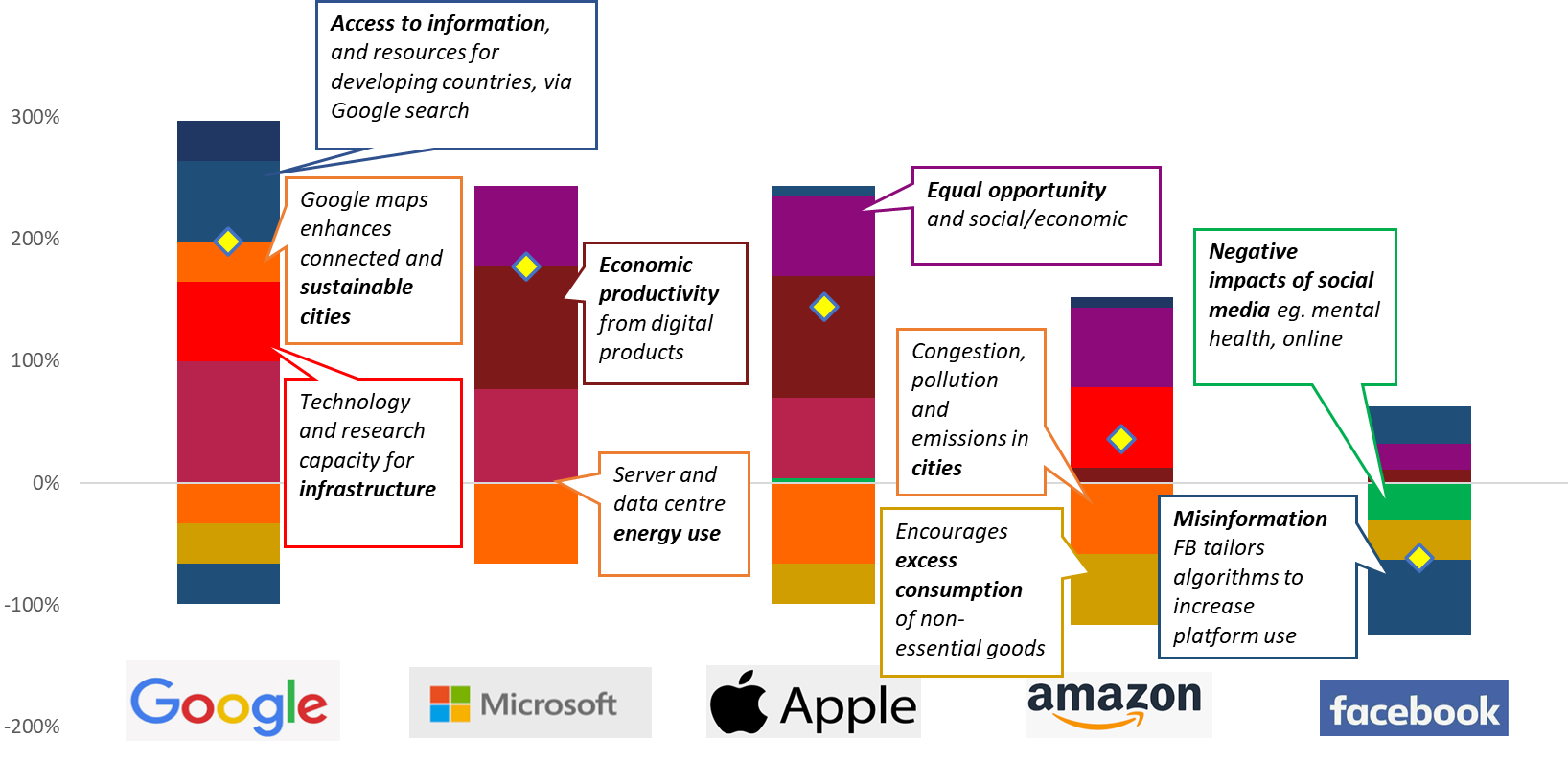

Big Tech and the SDGs: Technology as a force for good

These Big Tech companies positively align with SDG 4 (Education), SDG 8 (Decent Work and Economic Growth), SDG 9 (Industry, Innovation and Infrastructure) and SDG 11 (Sustainable Cities and Communities). All the companies except Microsoft have a degree of negative alignment with SDG 12 (Responsible Consumption and Production), Google and Facebook both negatively align with SDG 16 (Peace, Justice and Strong Institutions), and additionally Facebook negatively aligns with SDG 3 (Good Health and Wellbeing).

Our analysis shows that Google has the highest SDG alignment, followed closely by Microsoft and Apple. Amazon is ranked 4th while Facebook is a distant last with a negative net score and more SDG detractors than any of its peers.

SDG Alignment for Big Tech

Source: Alphinity

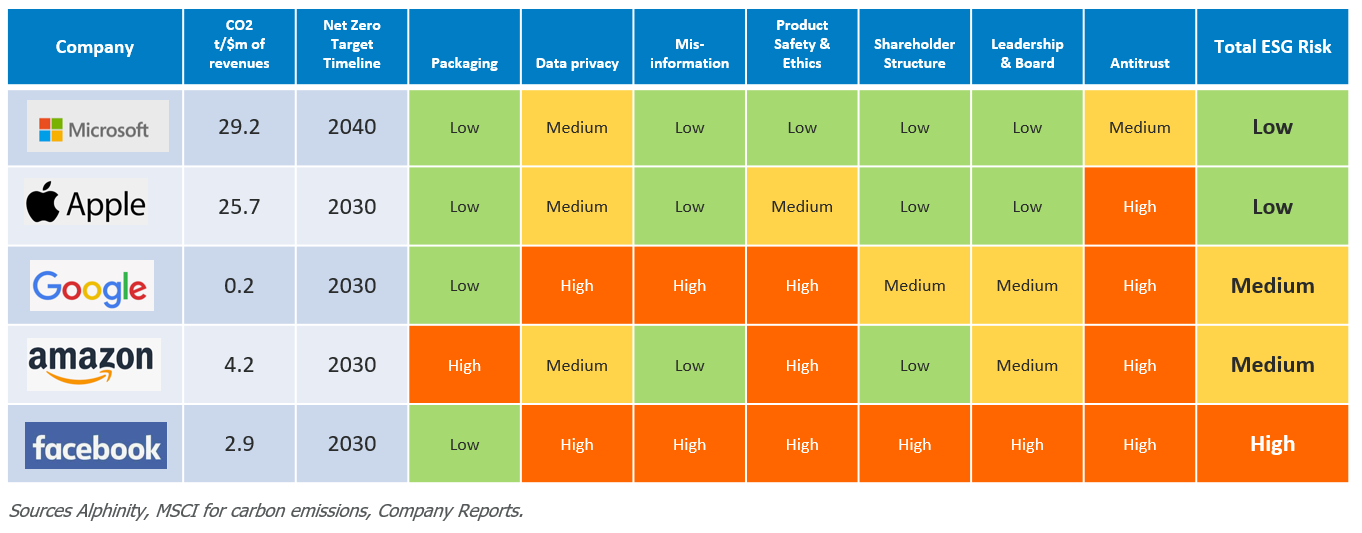

Big Tech and ESG: With great power come great responsibility

Alphinity Investment Management uses a proprietary ESG framework, external data providers, and the insights of our Sustainable Compliance Committee, which includes two independent ESG specialists, to assess companies across industries and geographies. This analysis is then summarized in an ESG Risk Report for individual stocks and classifies companies into high risk, medium risk and low risk categories.

Environmental Risks: Tech companies as a group, usually have lower environmental risks versus peers in sectors like Materials, Energy and Industrials given their asset light business models. However, when considering Big Tech companies this is not always the case. Microsoft and Amazon both have reasonably high Scope 1 and 2 emissions footprints. And with Google, every click of a button comes with a small hidden carbon cost which accumulates into a significant Scope 3 carbon footprint. Amazon, in particular, also has higher exposure to packaging waste than peers given the nature of its business model.

Social Risks: Big Tech companies employ large numbers of people, both directly and indirectly, and also have significant exposure to global supply chains including within developing countries. This means they are exposed to a number of potentially material social risks, including human rights and modern slavery, worker safety, product safety and quality, and labour rights. For example, Amazon is particularly exposed to labour rights issues in their factories and distribution. Facebook and Google have specific risks associated with data privacy, product safety and ethics, and misinformation. Facebook has also had difficulties in the past associated with managing the mental health and working conditions of content moderators, who screen for content that doesn’t meet their policies.

Governance Risks: In our view, Facebook lags peers on leadership and overall corporate governance. Following Jeff Bezos’ decision to step away from the CEO role at Amazon, Facebook is now the only Big Tech company where the founder is still both the CEO & Chairman, and who also controls a majority of voting rights. Similarly, Google’s triple shareholding structure is a significant ESG risk for Google. The GOOGL Class A shares have voting rights, Class C have no voting rights and Class B provides preferential voting rights to the founders so they maintain control. Antitrust is another issue for all the Big Tech companies, but more so for Facebook, Google and Amazon than for Apple and Microsoft.

ESG Risk Summary: These points are summarised in the table below and show that Microsoft and Apple have relatively lower ESG risk, Amazon and Google are medium risk, and Facebook is high risk.

Comparative ESG Risk Assessment

Putting it all Together: High Sustainability and Strong ESG

We aim to invest in companies that have both high sustainability and strong ESG management practices. The matrix below combines the conclusions of the ESG and SDG analysis.

Currently, Microsoft and Apple are in the sweet spot boasting both high sustainability and strong ESG, while Google falls into the high sustainability and medium ESG category. Amazon is relatively weaker on both sustainability and ESG, while Facebook is the clear loser with weak ESG and low sustainability. Neither Facebook nor Amazon are held by the Alphinity Global Sustainable Equity Fund – Active ETF at this time.

Sustainability / ESG Matrix for Big Tech

Source: Alphinity

Summary and Conclusion

The sustainability and ESG credentials of Big Tech are significantly differentiated. Quantitative SDG alignment analysis and comparative ESG risk assessments show that some of the Big Tech stocks are facilitating the move towards a sustainable future and are doing so in a way that is consistent with strong ESG practices. These are the stocks in which the Alphinity Global Sustainable Equity Fund – Active ETF invests. Do good. Do it well.

Author: Mary Manning, Global Portfolio Manager