As the global AI race accelerates, so too does the scrutiny on its environmental, social, and governance (ESG) implications. A recent thematic research trip across Seoul, Taipei, Beijing, Shanghai, and Shenzhen offered a rare window into how Asia’s tech giants and infrastructure providers are navigating the complex intersection of AI innovation and sustainability.

AI’s expanding footprint: Capex, chips, and cooling

The AI value chain is booming. In 2024 alone, hyperscalers like Microsoft, Amazon, Google and Meta spent more than $200 billion in capex with the vast majority of this being on AI infrastructure. Forecasts for 2025 have capex investments for these four key players reaching $320 billion. It’s not only US hyperscalers; other companies like XAi, Oracle, Coreweave, Alibaba, and Tencent are also investing significantly. Sovereign AI clouds are growing as well.

This surge is driving growth not only in semiconductors, data centres, and cooling technologies, but also in numerous other supporting industries such as power and real estate. Companies like SK Hynix and Samsung Electronics are doubling down on high-bandwidth memory (HBM), a critical enabler of AI workloads. However, HBM consumes three to five times more electricity than traditional memory, raising concerns about energy intensity and water consumption.

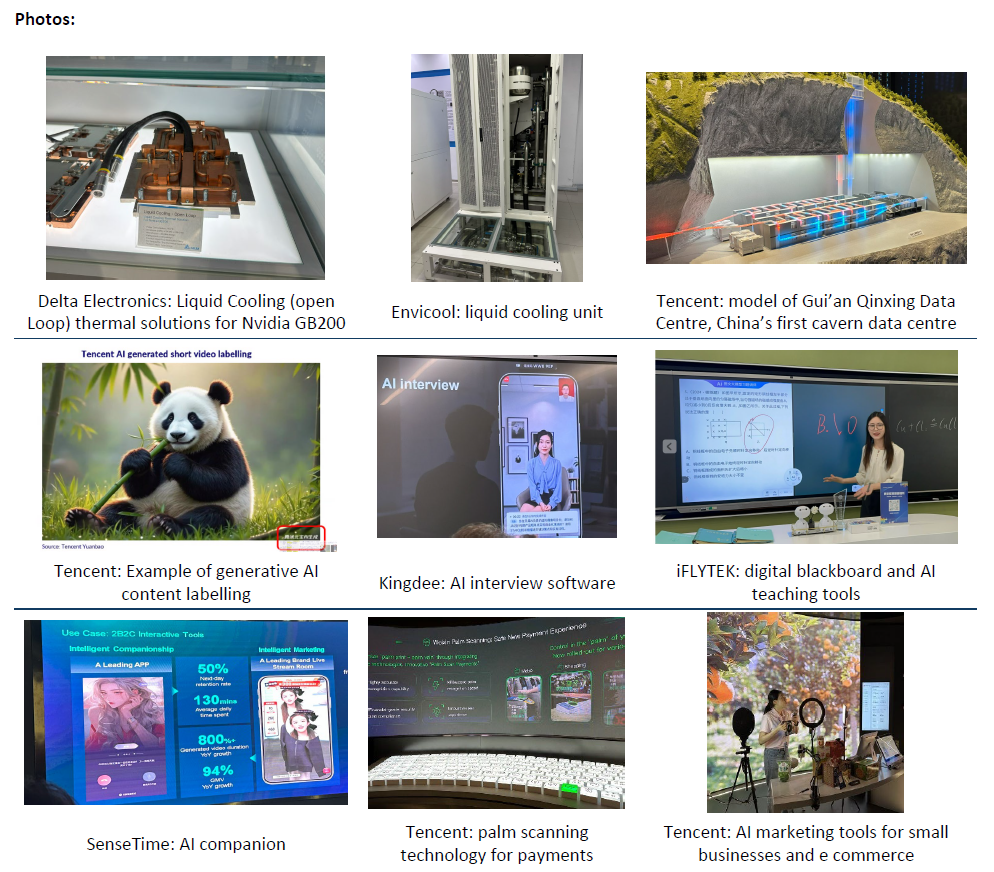

Cooling is a major ESG pressure point. It accounts for 20–40% of data center energy use. Firms like Delta Electronics, Envicool, and Asia Vital are innovating with liquid and hybrid cooling systems. Envicool noted that liquid cooling penetration across their mostly Chinese customer base is still only ~10% but is growing fast. Delta’s modular containerized data centers are also gaining traction, offering flexibility and improved energy efficiency.

Geopolitics and supply chain resilience

Tariffs and chip bans remain a moving target. Companies like Voltronic and Delta Electronics began diversifying manufacturing as early as 2018, with new capacity in Vietnam, India, and even the UAE. While some, like Samsung, await clarity on Korea-US tariffs, others are proactively stockpiling GPUs or developing local alternatives. Baidu’s Kunlun chip cluster, for example, is reportedly capable of training DeepSeek-like models.

Despite geopolitical headwinds, AI capital expenditure remains resilient. Delta noted that hyperscalers still account for 50% of their data center business, and modular solutions are helping customers manage privacy and security concerns.

Winners, losers, and the east-west divide

The AI race is not just about chips—it’s about ecosystems. While the West leads in hardware, the East is catching up fast in applications and user adoption. iFLYTEK’s AI-powered education tools are already deployed across Chinese schools, offering real-time translation, grading, and personalized learning. The contrast in AI integration between the East and West was striking.

In the search vs. chatbot debate, companies like Naver and Baidu are finding ways to coexist. Naver’s AI-powered ad solutions reversed a -10% decline in 2023 to +20% growth in 2024. Meanwhile, Baidu’s AI-enhanced search is improving user engagement and retention.

Tencent’s strategy of integrating a mix of proprietary and open-source models, like DeepSeek, exemplifies a flexible approach to AI development, allowing for more versatile and complex task handling. This contrasts with Naver’s exclusive reliance on their own models and Samsung’s dependence on Google Gemini. By leveraging various tools, companies like Tencent, Zhihu, Kuaishou, and iFLYTEK are better positioned to innovate and adapt in the rapidly evolving AI landscape.

Responsible AI: governance, ethics, and regulation

The ethics of AI were front and center. From AI interview bots to facial recognition tools, the spectrum of use cases was vast, and sometimes controversial. Companies like Tencent and Baidu stood out for their robust governance frameworks, including internal AI ethics committees, structured approval processes, ISO42001 AI Management System certifications, and clear oversight mechanisms.

China’s regulatory environment is also evolving. In 2024, the government introduced three national standards on generative AI security and governance, including mandatory labelling of synthetic content. While some companies rely on government-led frameworks, others like Naver, Tencent, Baidu and Zhihu are embedding ethics into product design and deployment.

Data privacy and energy efficiency were the most frequently cited ESG priorities. Baidu reported a PUE (Power Usage Effectiveness) of <1.15, while SenseTime aims to reach a PUE 1.1 by 2050. These metrics are becoming key differentiators in a crowded market. They are also highly variable depending on data centre locations, renewable energy uptake, ambient temperature, and the design of the servers.

AI sentiment and ESG maturity

Globally, sentiment around AI remains mixed. However, in China, there is a notable sense of optimism, less concern, and a greater rate of adoption. This positive outlook can be attributed to the government’s centralized approach to the AI technology transition, comprehensive job retraining programs, and ongoing promotion of AI as a strategic priority. Despite this enthusiasm, data privacy and security continue to be top priorities.

ESG maturity is uneven. Tencent and Baidu emerged as leaders, with integrated ESG strategies and strong investor engagement. Others still view ESG as a compliance exercise. Human rights and modern slavery were rarely discussed, and in one case, questions on human rights were met with resistance.

Conclusion: A complex, evolving landscape

The AI value chain is expanding rapidly, but so are its ESG challenges. From energy-hungry chips to ethical dilemmas in AI deployment, there are many trade-offs to consider. Companies that can balance innovation with responsibility—like Tencent, Baidu, and Delta Electronics—are likely to emerge as long-term winners.

As investors, the opportunity lies in identifying those who are not just riding the AI wave but shaping it sustainably.