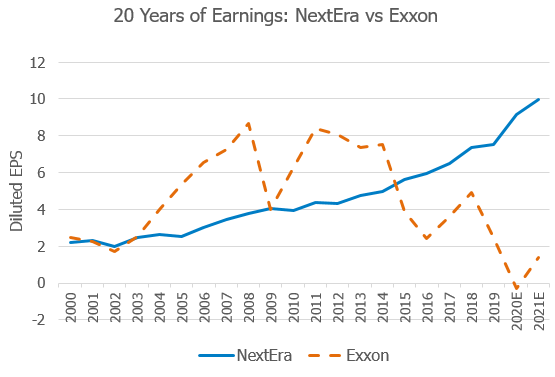

Source: Bloomberg

NextEra Energy, the world’s largest generator of wind and solar energy, has overtaken Exxon to become the most valuable energy company in America. In just 7 years, Exxon has gone from being the most valuable company in the world to being only one of the three largest energy companies in America. And in August it was kicked out of the Dow Jones index.

NextEra’s rising fortune has been almost as profound as Exxon’s decline. The company started 2013 with a market cap of less than $30 billion. This has grown to $150bn today with its’ share price compounding at 20% p.a., almost double the rate of the tech-heavy S&P 500 Index and three times the rate of the Utilities sector. In comparison, the Energy sector has actually lost significant value over the same period, falling from 12% of the S&P 500 to just 2% today.

This is a milestone in the shift from fossil fuels to renewables. NextEra’s vision is to be “the largest, most profitable clean energy provider in the world”, a journey it started in 1997 long before clean energy was in vogue. Over the past decade NextEra has invested nearly $90 billion in clean energy infrastructure. Since 2005 its CO2 emissions rate has reduced by over 50%, and it boasts that “no company in any industry has done more to reduce carbon emissions and to confront climate change”.

NextEra continues to deliver on its promise of investing in the future of energy, as well as growing earnings and shareholder value at an impressive pace. NextEra’s EPS has compounded at 10% per annum over the last decade and shows no sign of slowing down.

Important information

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.