Sector Spotlight: Retail

Each quarter, Alphinity Investment Management’s portfolio managers share their expert views on the trends and themes emerging within their relevant sectors. This quarter, Bruce Smith shares his thoughts on recent market developments for supermarkets within the retail sector.

How do you think the retail sector has fared over the September quarter?

There are two types of retail: discretionary and staple. As the name suggests, discretionary retail spending is at the whim of the consumer: in good times they might spend freely but when times are tough, spending drops. Discretionary retail has been difficult recently due to a degree of economic uncertainty. Staples, which the supermarkets fall under, tend to be a lot less volatile and their earnings should be quite

defensive. Even when times are tough consumers still need to buy food: cheaper food maybe but you still need to eat. In fact, it can work in supermarkets’ favour if those tough times cause people to shift from eating in restaurants to cooking at home. As a result, when the stock market has its occasional dummy-spit, investors often tend to hide in the supermarket stocks as they generally don’t go down as much as the rest of the market. In the end however they also have to be able to deliver the earnings in order to perform.

What are your thoughts on the major retailers in Australia?

Woolworths and Wesfarmers are the key players within the consumer sector: both will have sales in excess of $60 billion this year and have market capitalisations between $40 and $50 billion.

Woolworths is a pure retailer: supermarkets accounts for the bulk of its earnings with the modestly profitable discount department store Big W, loss-making start-up hardware chain Masters Home Improvement and interests in hotels rounding it out. Over the past couple of years it has fractionally underperformed the market.

Wesfarmers is much more diverse: supermarkets are a smaller proportion of total earnings but it has much larger discount department stores and its own hardware chain, Bunnings, which is possibly the best-performing retail business in the country. Wesfarmers also has other interests like coal mining, industrial supplies, fertilisers, chemicals and (until recently) insurance. Wesfarmers is almost like a little equity fund all by itself! Over the past couple of years it has fractionally outperformed the market.

Supermarkets are often perceived to have a duopolistic structure in Australia but that’s not entirely correct. There are also a number of other players including IGA, Aldi and Costco. IGA mostly consists of independent operators who band together and buy groceries from listed company Metcash. These independents have been hamstrung by perceptions (and probably the reality) of uncompetitive pricing relative to the big two, and have been gradually ceding market share for some years.

Aldi has been the biggest change in the landscape over the last decade. It has been quietly rolling out stores on the eastern seaboard and has accumulated around 10% market share. It is about to enter South Australia and Western Australia as well, which will make life more difficult for the incumbents there. Aldi has a different operating model: almost entirely private label goods, much of which are sourced globally utilising its existing network, a much more limited range of items and very sharp pricing compared to the branded goods in Coles or Woolworths. Aldi also utilises a ‘treasure hunt’ approach whereby they might offer TVs, gardening tools or ski gear on a very limited-time-only basis in order to bring people into the stores, and increase sales.

Another interesting development is the entry of Costco, the US warehouse membersonly shopping operator. It has a very different model, selling general merchandise as well as food stuffs mainly in much larger quantities than traditional supermarkets. Now with six stores in Australia and plans for at least twenty, Costco will have an increasing impact on the retail sector over time.

So it’s hardly a duopoly, but the big two remain dominant and intent on opening as many new stores annually as they can build. However this is likely result in the major players’ growth rate being crimped slightly rather than a fall in sales over any period: the market is very big.

What do you think drivers for supermarkets within the retail sector will be going forward?

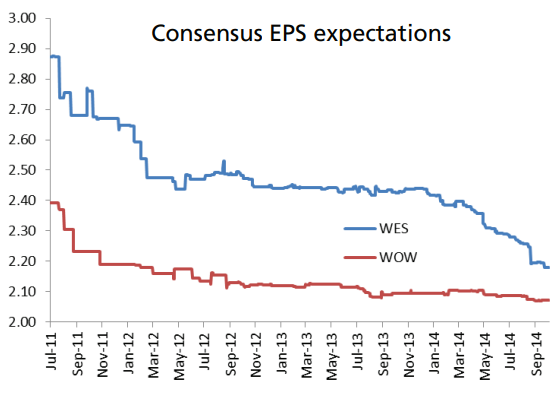

Earnings expectations tend to drive share prices. In reality, the earnings outlook for both Woolworths and Wesfarmers will be driven by things other than their supermarket operations: Woolworths by (hopefully) reducing losses in its nascent hardware business; and while Coles will be an important factor in Wesfarmers’ future earnings picture, there are many other moving parts in its portfolio of businesses which will impact earnings. Both are high-multiple stocks with relatively

low earnings growth. Both have been subject to meaningful earnings downgrades over the past few years, which normally

keeps a lid on share price performance. We are looking for the downgrade cycle to end and an upgrade cycle to start as a signal that the time might be right to buy one or both – there’s no sign of it happening just yet though.

Source: Bloomberg

For more information please contact our Investor Services team on 13 51 53 or visit alphinity.com.au