In this series, Alphinity Investment Management’s investment team share their expert views on the trends and themes emerging within their relevant sectors. Below, Stuart Welch shares his thoughts on the current trends and outlook for the Healthcare sector.

How would you describe the Australian healthcare sector?

Healthcare is a relatively diverse sector with many different segments of the domestic healthcare value chain, each exposed to quite different economic forces. These segments include primary care providers, diagnostic imaging providers, pathology labs, distributors, private hospitals and aged care operators. The diversity of companies and share price outcomes makes the healthcare sector an interesting place to invest.

In addition, the sector includes a handful of companies that are global leaders within their respective segments. These include CSL operating in the blood plasma industry, Cochlear providing surgically implanted hearing devices and Resmed providing sleep apnoea devices.

How has the healthcare sector performed?

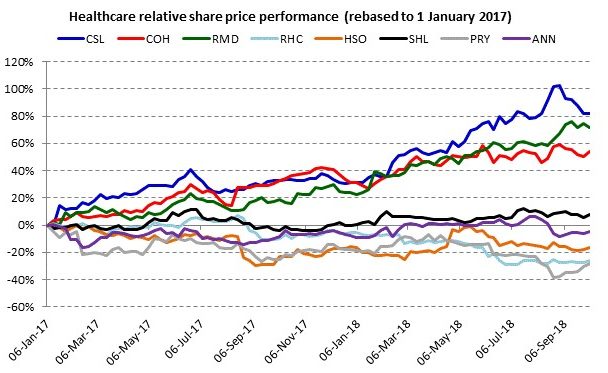

The Australian healthcare sector has been the best performing sector of the Australian share market over the last couple of years, although this statistic masks considerable variability within the sector. The global leaders (CSL, Cochlear and Resmed) have driven the lion’s share of the sector’s outperformance over the last two years. Many of the other companies in the sector have underperformed over this time period.

Source: Bloomberg, Alphinity

What has driven the divergence of outcomes in the healthcare sector?

Although they operate in entirely different segments of the healthcare industry, the common theme linking the healthcare sector outperformers (CSL, Cochlear and Resmed) is innovation. These companies have successfully invested in R&D, brought new products to market and found new ways to grow and expand their respective markets.

CSL has developed and launched of a number of new products and gained label extensions for some existing products. Many of these new products are significantly more effective than previous treatments, meaning that CSL is growing the market while also taking market share from its competitors. Cochlear introduced the world’s first made-for-iPhone sound processor last year which is both small and light, while also allowing recipients to stream sound directly from a compatible iPhone, iPad and iPod touch to their sound processor. This was particularly popular with patients and, together with various marketing initiatives, helped Cochlear also to both grow the market and take market share.

Throughout 2017 Resmed launched its new N20 & F20 masks with improved mask fit and comfort. It also invested in technology that helped distributors improve patient compliance and streamlined its mask resupply processes. Both of these initiatives drove higher volumes for Resmed while also improving economic outcome for their supply chain.

What is the growth outlook for the healthcare sector?

The healthcare sector generally enjoys strong demand growth for its products and services driven by a growing and aging population, the increased prevalence of chronic conditions and the availability of innovative new treatments that improve health outcomes. Demand growth for healthcare services is not tied to the economic cycle which, all else being equal, makes these companies attractive throughout economic cycles, and particularly attractive during

cyclical downturns.

However, despite strong underlying demand growth, the growth outlook for healthcare companies also needs to be considered in the context of government efforts to contain costs by rationing healthcare and reducing funding. Changes such as these have potential to disproportionately impact certain segments of the healthcare value chain.

Healthcare companies that generate the majority of their revenue directly from government sources such as Medicare are most exposed to political and budgetary cycles. For example, primary care, pathology and diagnostic imaging are almost entirely government funded and have suffered funding cuts in recent years. In 2013 the Labor government froze the indexation of Medicare rebates as part of its budget savings plan. Indexation for GP consultations

only recommenced this year, while the diagnostic imaging industry will have to wait until 2020 to get compensation for inflation. These same risks also exist abroad with recent US & German regulatory changes expected to adversely impact prices and volumes in Sonic’s offshore pathology businesses.

Another key growth consideration for healthcare companies is affordability. Despite free access to the public hospital system many Australians elect to purchase private health insurance (PHI). The key value proposition of PHI is being able to skip the queue (avoiding the rationing of healthcare in the form of public hospital waiting lists) and having your choice of physician. In addition people are encouraged to purchase PHI by a combination of government imposed subsidies and penalties. Strong demand for healthcare services has meant PHI premiums have grown much faster than CPI resulting in affordability concerns, with many people electing to either drop or downgrade their coverage.

As a result PHI participation rates have fallen and coverage has been downgraded which has had a knock on impact to private hospital volumes. This has been a headwind for the private hospital operators Ramsay Healthcare and Healthscope in recent times. In addition, in response to affordability concerns amongst voters, Labor intends to cap PHI price increases at 2% should it win the next election. In response insurers will likely attempt to negotiate lower price increases for private hospitals services which further complicates the outlook for private hospitals.

What other factors should healthcare investors consider?

The attractive secular demand drivers of the sector are generally well recognised by the market, so valuations can often be demanding. This requires confidence in the ability for earnings to at least meet, if not positively surprise, relative to expectations. If companies with elevated valuations fail to meet expectations earnings forecasts are downgraded at the same time as valuation multiples decrease.

Despite ongoing efforts to contain healthcare costs, there is persistent pressure for both governments and insurers to provide funding for new drugs and treatments that improve health outcomes. Healthcare companies that continue to innovate and demonstrate improved health outcomes will likely enjoy both strong demand for their products/services together with broad based funding support.

So, healthcare companies that invest in R&D and successfully leverage that R&D to both deliver innovative products/therapies and grow the addressable market are best placed to outperform. A good example of successful innovation is CSL’s new haemophilia B therapy Idelvion which has improved health outcomes and is rapidly becoming the standard of care as a result. Products like this take many years to develop at significant cost, so confidence in management and its capital allocation discipline is important.

When considering a healthcare company’s growth prospects investors should also consider the company’s portfolio of products and the stage those products have reached in their respective life cycles. A new product progresses through a sequence of stages from introduction to growth, maturity, and decline. The points at which a particular company’s products are in their respective cycles, particularly in the context of competitor product launches, will have implications for the company’s growth outlook.

Author: Stuart Welch, Portfolio Manager

Important information

Unless otherwise specified, any information contained in this publication is current as at the date of this publication and is provided by Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante Partners), the responsible entity and issuer of interests in the Alphinity Australian Share Fund (ARSN 092 999 301), Alphinity Australian Equity Fund (ARSN 107 016 517), Alphinity Concentrated Australian Share Fund (ARSN 089 715 659), Alphinity Sustainable Share Fund (ARSN 093 245 124) and Alphinity Global Equity Fund – Active ETF (ARSN 609 473 127) (Funds). Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity) is the investment manager of the Fund. It is intended to be general information only and not financial product advice and has been prepared without taking into account any person’s objectives, financial situation or needs. Each person should, therefore, consider its appropriateness having regard to these matters and the information in the product disclosure statement (PDS) and any additional information brochure (AIB) for the Fund before deciding whether to acquire or continue to hold an interest in the Fund. The PDS can be obtained from your financial adviser, our Investor Services team on 13 51 53, or on our website www.fidante.com.au. Please also refer to the Financial Services Guide on the Fidante Partners website.