Resmed: Tackling a large opportunity while capitalising on a competitor’s misstep

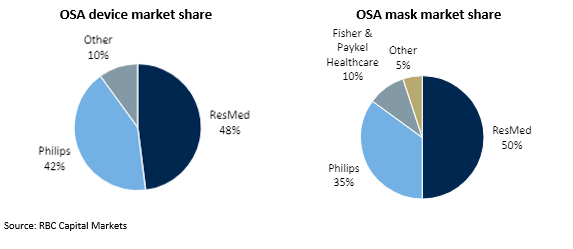

Resmed (RMD) is a sleep medicine and non-invasive ventilation company with technologies advancing the diagnosis, treatment, and management of sleep-disordered breathing. Their primary focus is treating obstructive sleep apnea (OSA) through continuous positive airway pressure (CPAP). We estimate RMD’s current market share in OSA to be ~55%. They generate 60% of their revenue in the US and 40% from rest of world. Roughly 60% of revenue is from selling CPAP and other devices. The remaining 40% of revenue comes from associated consumables such as masks.

CPAP therapy

Source: Resmed.com

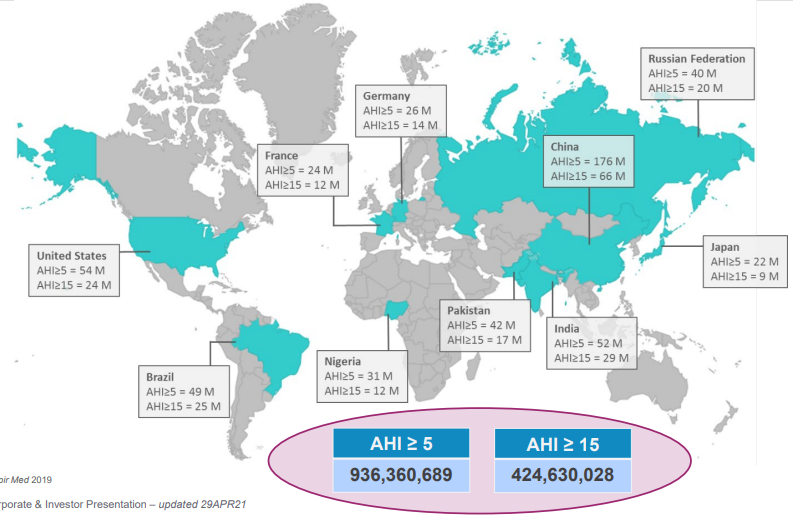

What is the market opportunity?

Globally, studies have estimated there are 936 million people with sleep apnea, of which 425 million suffer from severe sleep apnea. An “apnea” is a pause in breath during sleep and can last seconds to minutes and can occur multiple times an hour. The OSA market is largely undiagnosed and untreated. The US is the most developed OSA market, but remains only 20% penetrated, while the European market is only ~5% penetrated.

Source: Resmed Investors presentation – July 2021

Resmed’s key competitor stumbles

Resmed’s key competitor is Philips (operating as Respironics). Collectively, Resmed and Philips supply 90% of global OSA devices and 85% of global OSA masks.

Philips issued a global recall of up to 4 million devices

During June 2021, Philips recalled 3 million to 4 million devices, given concerns that sound abatement foam, which is used to reduce sound and vibration in these affected devices, may break down and potentially enter the device’s air pathway. If this occurs, black debris from the foam or certain chemicals released into the device’s air pathway may be inhaled or swallowed by the person using the device. The exposure to debris or chemicals could cause serious adverse events. The scale of the recall is large when compared to Philip’s estimated annual production capacity of roughly two million devices.

Exactly how many of these units will be replaced versus repaired is somewhat uncertain, although current Philips’ commentary indicates that two thirds of the units will be replaced. Given this backdrop, it is unlikely that Philips will be able to serve new patients for roughly a year. Philips historically generated c. US$800m revenue from device sales which RMD can now target. This gives RMD an unprecedented opportunity in our view to gain market share, particularly given the lack of any other scale competitors.

Resmed is well positioned to capitalise on Philip’s misstep

The Philips recall couldn’t have come at a better time for RMD. RMD has invested in new production lines and has been building device inventories ahead of releasing a new OSA device (Airsense 11) later this year. This positions RMD well to respond to capture material market share. RMD’s key limitation to scaling production is access to computer chips, which are currently in short supply globally. Industry feedback is that computer chips will remain supply constrained into CY20. However, feedback from RMD’s component suppliers indicates that, despite tight overall market conditions, microprocessor manufacturers are preferentially supplying medical technology companies such as RMD.

AirSense 11 AutoSet

Resmed and Philips sell their products through durable medical equipment suppliers (DMES) in the US. DMES typically have preference for one of the major brands, in order to concentrate volumes and secure more favourable pricing. Those DMES aligned with Philips are now facing serious business risks given Philips are unable to supply devices. OSA products contribute up to 40% of DMES revenue, so their concerns are palpable.

RMD has the opportunity to support them through this period in return for greater share of their business going forward. This likely extends to both devices and masks. Masks are much higher margin products, and more importantly, provide a more enduring benefit as patients typically replace their masks up to four times per annum. This likely means that market share gains are likely to be relatively sticky.

There are also pricing benefits. Industry feedback is that RMD has withdrawn any volume-based discounts given this more favourable sales environment, and the recall has cleared the path for the Airsense 11 to be launched at a higher price point.

A perfect environment for Resmed’s new product launch

The recall also gives RMD an opportunity to showcase their new Airsense 11 device, particularly with those DMES that historically have sided with Philips. RMD intends to accelerate the Airsense 11 launch, with details expected imminently. It is our understanding that the Airsense 11 will have the ability to engage with patients and link patient feedback with device utilisation data. This in turn will enable more immediate identification and resolution of issues, which should drive greater patient treatment compliance and lower DMES costs. Patient compliance is particularly important, as DMEs only get reimbursed by Medicare and health insurers when patients are compliant for a certain period.

Importantly, the Philips recall also avoids the sales air pocket that often occurs around new product launches. Ordinarily patients delay purchases as they wait for the new device. This time around it will be quite the opposite, RMD should be able to sell everything they can make for the next year.

What are the key risks that we are monitoring?

There are a few key risks to our investment thesis that we are monitoring:

- The resurgence of the COVID delta variant could stall the otherwise improving underlying OSA market conditions. More recently mobility trends have improved in the US, together with the patient propensity to engage with healthcare systems, however this could stall should the delta variant continue to escalate.

- What percentage of Philips recalled products are repaired vs replaced. Philips is currently engaging with the FDA in the US and other regulator regarding possible fixes. It is possible they devise a solution that allows more devices to be repaired rather than replaced, which would free them up sooner to pursue new patients.

- Mask resupply volumes could be impacted if large amounts of patients using recalled devices stop using their device immediately. This risk appears manageable for a few reasons: Firstly, feedback from doctors thus far has been that they would recommend serious patients continue usage of recalled devices. These patients are typically the largest users of masks. Secondly, given the importance of mask resupply to their business, DMES will be ensuring the largest mask resupply customers, which typically are the most serious patients, receive new machines first.

- Many sleep labs use recalled Philips equipment. This has the potential to materially slow new patient flow. Given the importance of opening this channel and appropriately servicing sleep physicians we would expect this will be the primary focus of both RMD ad Philips.

Outlook, valuation & conclusion

Prior to the Philips recall, we were already growing increasingly confident about the underlying recovery in the OSA market. Industry feedback was that sleep labs were back operating at capacity with no shortage of patients. That recovery is expected to accelerate as COVID vaccination rates further increase in RMD’s key markets. As outlined above, in addition to this improving underlying momentum, the Philips recall has given RMD an unprecedented opportunity they are uniquely positioned for.

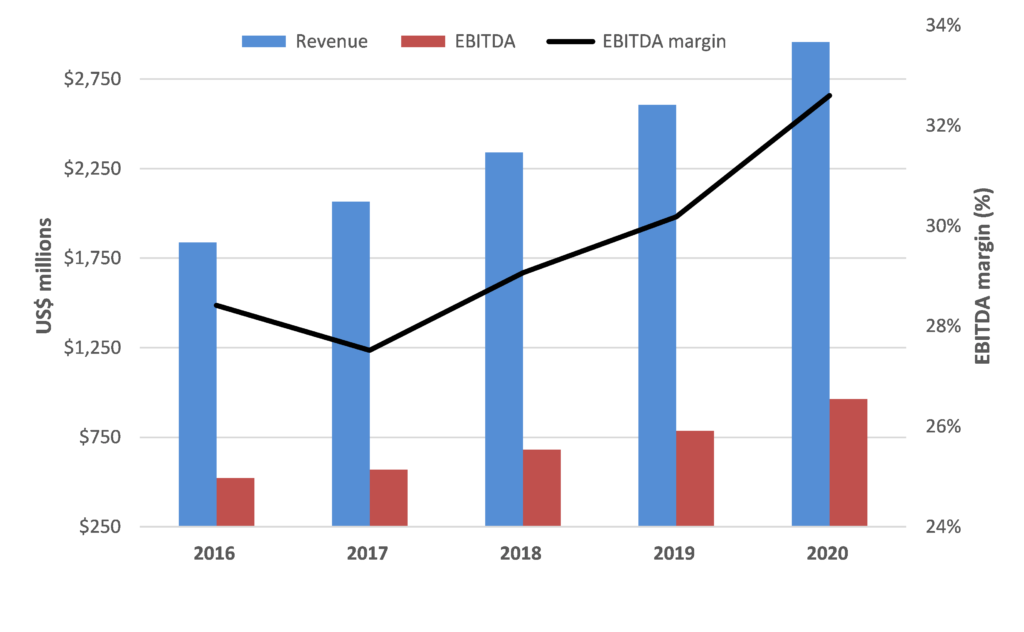

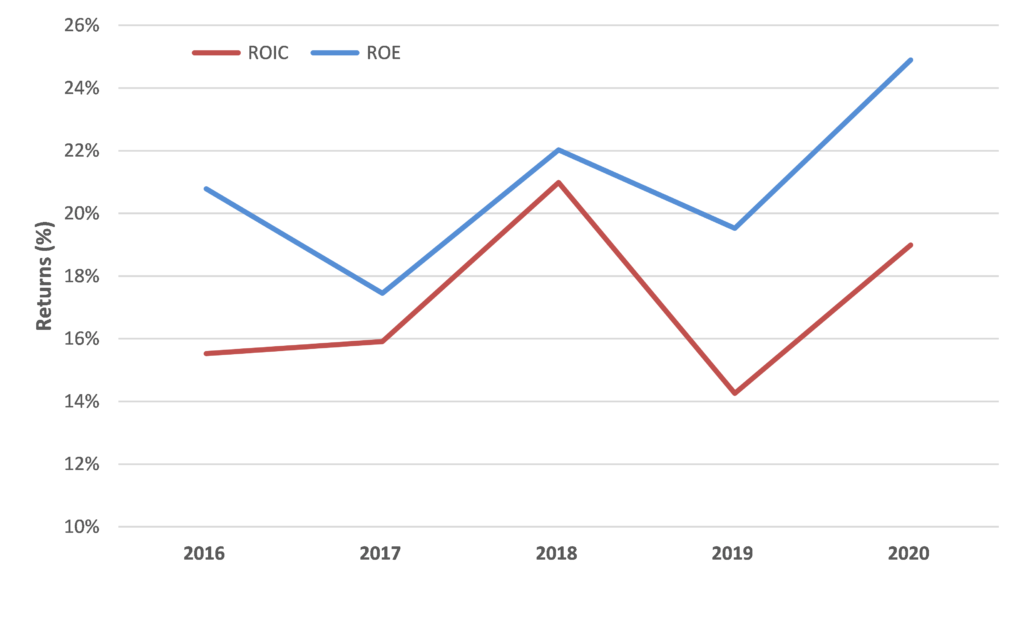

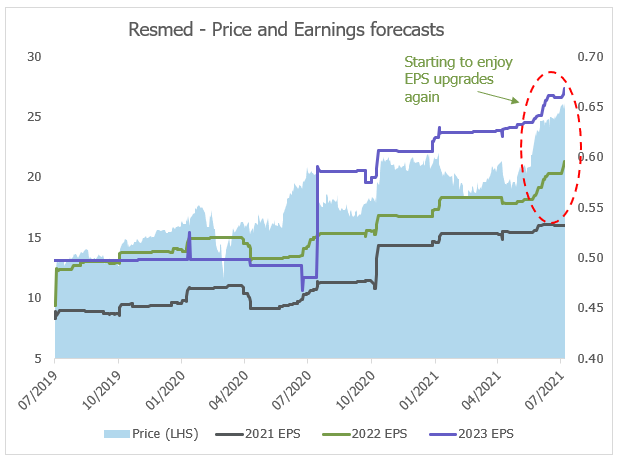

While Resmed is optically not cheap trading on 43x FY22 consensus forecasts, we are confident in RMD’s outlook for the reasons above and think the market is underestimating the potential earnings upside for RMD from both accelerating system growth and market share gains. This should support further improvement in already strong financial performance and metrics.

In addition, RMD is a very cash generative business with a rapidly de-gearing balance sheet which provides flexibility for either capital management or accretive bolt-on growth initiatives.

Source: Alphinity

In summary, Resmed is a superb business with a high-quality management team. Prior to the recall, RMD was already looking increasingly attractive as it recovered from COVID related impacts. That recovery will now take a giant leap forward as RMD takes material market share from its key competitor and secures its ascendency in the OSA market. While RMD trades at high multiples, we believe the market is underestimating the opportunity ahead, supporting that valuation.

Source: Bloomberg

Resmed – ESG and Sustainability Considerations

| Material ESG Factors | UN SDG Alignment (products & services) | |

| Product safety and quality | SDG 3 – Good health and well-being | |

| Privacy and data | ||

| Waste |

A good night’s sleep is critical to our health and Resmed are beating the notion of discomfort with high-quality masks paired with advanced software. With the prevalence of OSA increasing, touching close to 1 billion people with a large number still undiagnosed, Resmed plays a key role in providing desirable products that improve people’s health. Resmed’s cloud-connectible devices designed for all sleeping positions are changing the landscape behind OSA—patients can now monitor usage and sleep quality through an app, which helps them stay on top of their condition and also makes organising mask resupply much easier.

More technology means more data. Providing customers with greater control and insight to manage their own health from home means Resmed is exposing themselves more significantly to data and privacy risks; especially because health data is seen as particularly sensitive. Their disclosures indicate that they have the appropriate policies and controls in place, however, this is a risk that’s very dynamic and will require ongoing monitoring.

Considering environmental footprint without compromising performance or integrity. The close proximity of humid air to OSA masks is a recipe for bacteria growth, so regular replacement is essential for patient health. That being said, a mask replaced every three months generates a fair amount of waste—especially plastic. Leveraging their expertise, Resmed are continually making improvements to the entire end-to-end lifecycle and design of new masks to reduce their environmental impact. In comparison to predecessors, new masks have better recyclability, consume less raw materials and packaging, and generate less waste matter across the manufacturing process.

Author: Stuart Welch, Portfolio Manager