Reporting Season – ESG insights

This 2Q22 reporting season was all about the ‘E’. Climate change, biodiversity and waste management were key themes across the ASX. In the social space, the main topic was labour. COVID continues to have impacts in terms of staff shortages and the tight labour market. Committed investment and partnership towards sustainability, including sustainable fuels, new technology, and research, is growing.

There is an overarching sense that sustainability is becoming more than just an add-on for companies. There is a growing focus on demonstrating alignment of corporate strategy with sustainability outcomes and integrating sustainability into corporate governance.

Environment

- Ongoing focus on climate change and decarbonization. Seven companies committed to net zero during the period including Cochlear (COH), Cleanaway (CWY), Super Retail Group (SUL), and NIB (NHF).

- CSL (CSL) has committed to 2030 carbon reduction targets including a 40% reduction of its absolute scope 1 and 2 emissions and a commitment to ensure material suppliers have scope 1 and 2 reduction targets.

- The Commonwealth Bank (CBA) disclosed its financed emissions for the first time. It has also set new targets for oil and gas which brings the bank in line with peers.

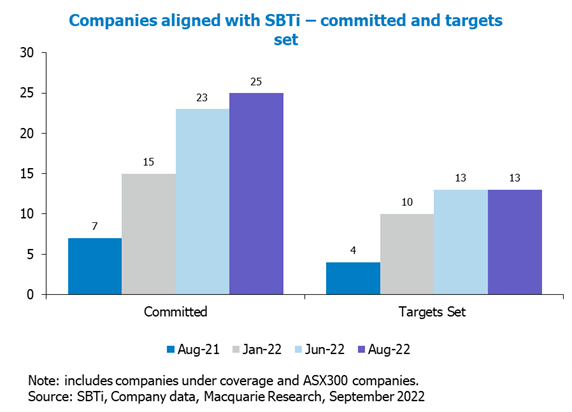

- Use of the Science Based Targets Initiative (SBTIs) continues to increase year on year. There has also been a growing trend of companies stating that their emissions reduction targets are science based without being verified by SBTI. We see this as a significant greenwashing risk.

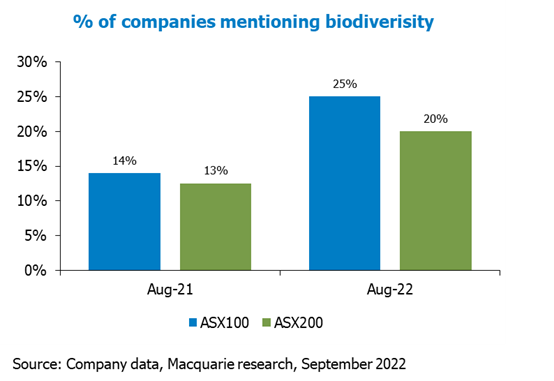

- Biodiversity was a stronger focus this year in comparison to 2021. With the Taskforceon Nature-related Financial Disclosures Framework (TNFD) expected to the finalised in the next couple of years, it’s not surprising that the commentary around nature and biodiversity is growing. At this stage, the mentions are mostly related to water use, nature-based offsets, and post-mining rehabilitation. We expect that the commentary will evolve to also highlight key dependences with biodiversity, for example, in the agriculture sector.

- Woolworths (WOW) has announced a phased removal of reusable plastic bags in Supermarkets.

- Worley (WOR) maintained a strong message on transitioning the business to more sustainable revenues including gas and gas infrastructure, new energy like hydrogen, and recycled plastics.

Social

- The past year has been challenging for labour. Companies like Qantas (QAN) and Woolworths (WOW) highlighted impacts from staff shortages largely due to COVID and the winter colds. More generally, several companies, including most miners, reinforced the tight labour market and issues recruiting staff for key roles.

- A flow-on impact of higher staff turnover and absenteeism has been a negative trend in safety. We expect this will correct itself, however our view is that 2022 should not be the new baseline and improvement should be benchmarked to 2021 levels.

- BHP (BHP) gave an update on progress at Samarco. 145 settlement cases have now been completed across the region with a further 190 in progress. A total of R$2.4bn (~$A700m) has been spent on resettlement. BHP are also facing further legal action in the UK with a total of US$8.8 billion being sought by the complainants.

Governance

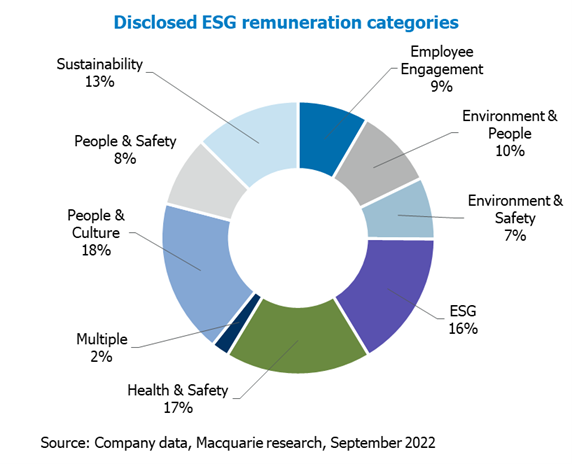

- 17 companies introduced ESG focused metrics into their management scorecards. Across the ASX300, 191 companies have tied their variable remuneration to ESG metrics. Metrics generally include culture, employee engagement, health and safety, environment, sustainability, and climate change.

- Several companies announced partnerships and ongoing investment in sustainable trials and new technology. This is mostly focused on climate change and new energy solutions. Bluescope (BSL), for example, announced a new vehicle, named BluescopeX, to make direct investments in small-scale start-ups and businesses in the decarbonisation and efficient buildings space.

Looking ahead for the upcoming AGM season

Key topics for our discussions with management in the upcoming 2022 Australian AGM season:

| Topic | Key questions for Boards |

| Labour | • Do you perceive an ongoing issue related to cost of labour and absenteeism? What changes need to take place to manage this risk?

• Any concerns with health and safety as a flow on risk from higher turnover? |

| Biodiversity | • Notable increase in disclosure related to biodiversity – how is the Board thinking about biodiversity risk and opportunity?

• How does nature affect the business from a company impact and dependency perspective? • Does management have the skills to deliver nature related disclosures? Is this new or was it something that was already within the organisation? |

| Workplace Culture* | • What key metrics do you consider to better understand whether workplace culture is improving or deteriorating?

• How are you building psychological safety and capability to manage workplace culture incidents through the organisation? |

| Greenwashing Risk | • How concerned are you about the focus on greenwashing? What discussions have been had around this at Board level and is management sufficiently across this issue?

• Has there been a review of sustainability-related statements internally? |

| ESG links with Remuneration | • Most material ESG issues for performance?

• Why/when to be linked with STI/LTI? • Are there clear hurdles? |

*Questions and priorities identified through our internal assessment of workplace culture. A report on this assessment will be published by the end of the 2022 calendar year.

Conclusion

Each year sustainability becomes more engrained in company annual reporting and this year has been no different. We see it as positive that companies are recognising the materiality of ESG issues like labour management, social licence, and climate change, and are choosing to report more transparently on progress against these issues to investors.

We also see it as positive that more ESG reporting is released alongside Annual Reports and Financial Statements. This allows ESG considerations to be more integrated with investment analysis and enables our reporting season engagements with senior management to also include ESG aspects.

Looking ahead, we expect that climate change management will remain a focus for next year. Given the global focus on greenwashing, we think that the expectation related to climate change will shift from net zero goals and high-level commitments to the identification of clear strategies with actions, timelines, and aligned capital allocation frameworks. We also expect that biodiversity and greenwashing risk will continue to grow as core ESG focus areas for companies and investors.

Author: Jessica Cairns, Head of ESG and Sustainability