Over the past several months, our global investment team has embarked on a series of research trips across multiple continents, meeting more than 250 companies in five countries to gain first-hand insights and identify emerging trends. All six team members recently completed another round of visits to the United States ahead of the 1Q25 reporting season. In today’s highly volatile environment, this on-the-ground perspective has proven indispensable for staying ahead of rapidly unfolding developments.

Our conversations with management teams spanning Singapore’s financial centres and San Francisco’s tech corridors to Mumbai’s manufacturing hubs and Beijing’s policy circles have revealed a striking shift in corporate sentiment. The optimism that characterized the start of the year has been replaced by widespread operational uncertainty, especially since March, as executives navigate unpredictable policy changes and ongoing supply chain disruptions. This environment has prompted many companies to withdraw forward-looking statements, narrow their guidance ranges, or append new disclaimers to their 1Q25 earnings releases considering persistent macroeconomic volatility.

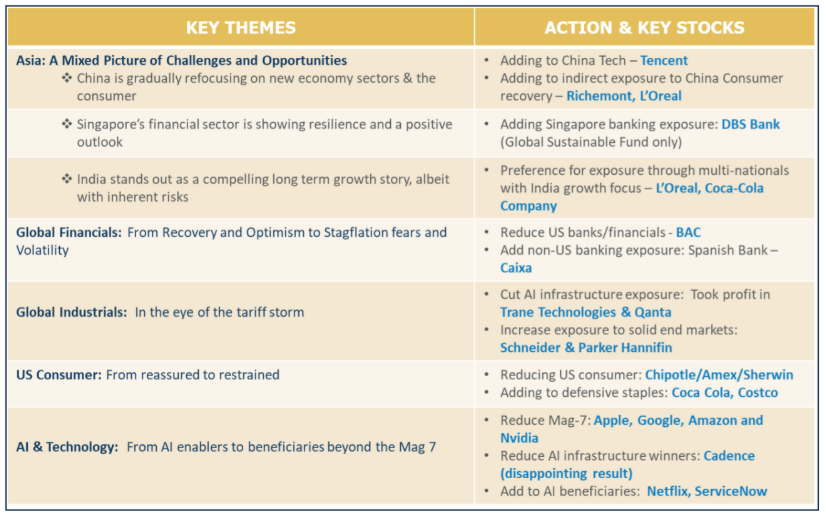

In this note, we outline some of the key themes emerging from our recent travels and discuss how our on-the-ground insights are helping us refine our portfolio-balancing a more defensive stance with selective growth opportunities that have been unjustly discounted.

Asia: A Mixed Picture of Challenges and Opportunities

- China is gradually refocusing on new economy sectors like AI, robotics, batteries, EVs, and consumer support, but consumers remain cautious, adopting a “wait and see” approach to spending despite elevated levels of savings. Value for money and quality now outweigh brand prestige, signalling a decline in traditional brand loyalty. Some signs of stabilisation are emerging, with improvements in mall traffic, top-tier city housing prices, and reduced property inventory, while retail sales and appliance purchases have exceeded initial executive expectations so far in 2025. However, luxury spending is mixed: aspirational luxury is still declining, ultra-luxury is stable, and fashion and leather goods are outperforming jewellery and watches, in line with forecasts for a modest, rebound-dependent year. We recently added Richemont to our portfolio, recognizing its strong performance in hard luxury through iconic brands like Cartier and Van Cleef & Arpels. These brands benefit from significant pricing power, which helps offset potential tariff impacts, and position Richemont to capture further upside if Chinese consumer demand stabilizes or rebounds.

- Singapore’s financial sector is showing resilience and a positive outlook, with major banks benefiting from strong wealth management inflows-a clear sign of a flight to quality amid global uncertainty. The prevailing sentiment among corporates is one of cautious optimism, summed up as “overall good for now, but watch out,” reflecting both confidence in current conditions and awareness of potential external risks. DBS Bank stands out as a high-quality, blue-chip leader in Singapore’s banking sector. It has posted record results, driven by robust growth in wealth management, early adoption of technology and digital innovation, and a strong regional footprint. DBS is well positioned to capture further growth opportunities in higher-growth markets like Indonesia and India and could also benefit from any recovery in China.

- India is emerging as a compelling long term growth story, albeit with inherent risks. While direct investment opportunities in pure-play Indian stocks are currently limited for our investment process, the country’s growth potential adds an attractive dimension to high-quality multinationals such as Walmart, L’Oreal, Schneider, Coca Cola, Amazon, and Unilever. India is also a significant beneficiary of global supply chain realignment, as companies diversify manufacturing away from China in response to escalating tariffs and geopolitical uncertainties. Apple, for instance, assembled $22 billion worth of iPhones in India in the year ending March 2025-a 60% increase year-over-year-now representing 20% of global iPhone output, with plans to further expand production for the U.S. market by 2026. We recently added L’Oréal, the global beauty leader, to our portfolio as its valuation has returned to five-year lows, with compelling medium term growth prospects. While India currently represents just 2% of L’Oréal’s sales, it’s likely to meaningfully increase over the next several years.

Global Financials: From Recovery and Optimism to Stagflation fears and Volatility

Post-election optimism for deregulation and tax cuts initially fuelled a global banking rally at the end of 2024, buoyed by robust deal pipelines and corporate engagement. However, stagflation fears and plunging consumer confidence reversed sentiment by mid-February 2025, freezing corporate activity. Recent 1Q25 results and CEO commentary show limited numerical impact to date, with tariff-driven front-loaded spending creating sporadic activity and heightened volatility boosting trading desks like Morgan Stanley’s. On the real estate side, CBRE’s result reflected a continued, yet sensitive commercial real estate recovery cycle. The business was buoyed by the strength of its resilient business lines and continued benefit from scarcity within the office sector for capital markets and leasing.

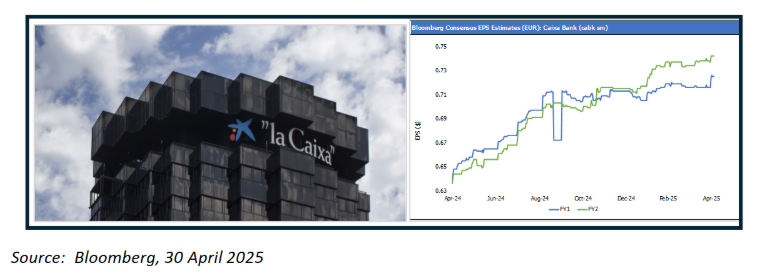

Across the Atlantic, Germany’s €1 trillion defence and infrastructure package represent a structural break from decades of austerity. A potential growth tailwind for Eurozone banks, including Spanish lenders like CaixaBank. Spain’s economy is already outpacing EU peers with 2.5%+ GDP growth likely, and we expect that CaixaBank will be a key beneficiary given its market-leading positions in mortgages, payroll services, and wealth management—sectors poised to compound gains from digital transformation and demographic tailwinds. That said, the spectre of U.S. tariffs on EU goods looms large, potentially offsetting 20-30% of Germany’s stimulus benefits and introducing cross-sector vulnerabilities.

CaixaBank – Leading retail bank exposed to relative strength of the Spanish economy & seeing strong earnings upgrades

US Industrials – in the eye of the tariff storm

The prevailing sentiment among US industrial players in February 2025 closely echoed what we observed during our September 2024 visit. The sector remains on a path toward gradual, measured recovery, rather than a rapid resurgence. Management teams were however cautious, reflecting uncertainties about inflation, tariffs, political instability, and the Chinese economic landscape. While there were some signs of emerging positive momentum, a “low and slow” industrial rebound is more likely. Notably, regions outside the US – particularly Europe and China – may see stronger recoveries, given their steeper prior declines. End markets continue to matter, with aerospace, electric grid and waste operators all remaining relatively positive, while in contrast the environment remains tough for agriculture, transportation and residential housing.

Two key themes stood out: tariffs and a short-cycle manufacturing recovery. Companies are preparing for tariff-related cost increases, with some already passing on surcharges and viewing tariffs as an opportunity to raise prices, which likely drives inflationary pressures. A fragile short-cycle recovery was noted despite scepticism regarding the underlying causes, with inventory buildup ahead of tariffs largely dismissed by management teams.

Amid these conditions, we remain focused on defensive industrial names such as Waste Connections, the third-largest US waste operator, which recently exceeded 1Q25 estimates and reiterated its FY25 guidance, reporting no material impact from recent macro volatility. Whilst our current exposure to US industrials remains aligned with resilient, high-quality industrials underpinned by resilient end markets, the recent market weakness is starting to throw up exciting opportunities at more reasonable valuations.

US Consumer – From reassured to restrained

During our US visit in January 2025, consumer management teams described the business environment as “generally positive” with expectations of faster policy execution under a new Trump administration. Supply chains have already notably shifted away from Chinese reliance since the previous Trump administration and any potential impact of tariffs was expected to be partially absorbed by Chinese manufacturers, maintaining competitive pricing for US retailers.

The mood had shifted somewhat by March 2025, where our conversations with management were more cautious. Companies were generally reluctant to provide any detail on potential tariff impacts given the changing external goalposts and messaging from the government. There were no clear broad-based trends across the consumer aside from a continuation of the low- and high-income divergence, with the unusually cold start to the year also muddying the data. Whilst consumer confidence has since plummeted to 2022 lows, spending has been more resilient, but often more value-driven with consumers seeking the best bang for their buck and being selective about where to splurge or cut back.

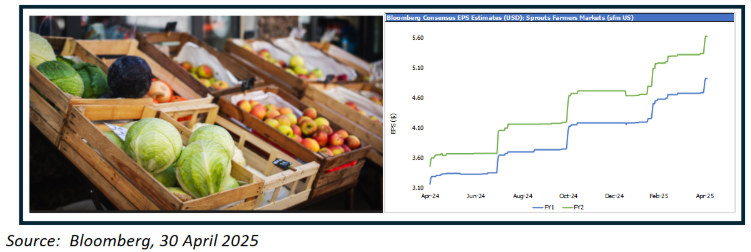

In response we have reduced some of our consumer facing holdings, such as Chipotle and Sherwin Williams, but added to Costco given its relatively defensive growth profile underpinned by a loyal membership base. We also added a new position in our Sustainable Fund to Sprouts Farmers’ Market, a specialty grocer with a scarce growth profile within the Consumer Staples sector. We believe Sprouts should benefit both from near term consumer preferences for food at home (vs food away from home) and structural tailwinds of attributes-based healthy foods.

Sprouts Farmers Market – Specialty organic grocer with multiple drivers supporting strong earnings growth

AI & Technology: From AI enablers to beneficiaries beyond the Mag 7

There was a striking disconnect during Technology meetings between the upbeat tone from technology management teams and the turbulence sweeping through equity markets. Enthusiasm around AI remains robust as functionality pushes deeper into business models, unlocking both revenue opportunities and operational efficiencies. “Agentic AI” is the next step in AI evolution where autonomous systems are created that can make decisions and executing complex, multi-step tasks with minimal human oversight.

On top of AI technological advancement, there were three key themes emerged from company discussions:

- The impact of tariffs and associated policy responses: Uncertainty around tariffs and trade policy is causing companies to delay investment decisions, risking reduced capital spending until clearer guidance emerge

- The position of China within the global AI race: The recent breakthrough from China AI company DeepSeek, coupled with continued semiconductor advances from Huawei have prompted the US administration to deploy new policy restrictions to stay ahead in the AI race. These responses wash through companies like Nvidia but also more broadly across the semiconductor supply chain.

- The waning leadership of the Mag 7: The dominance of the “Mag 7” tech giants what appeared at times to be unassailable positions area now showing signs of weakening, due to both policy changes and technological shifts that are increasing competition, especially in areas like search.

Reflecting these shifts, we have steadily reduced our exposure to the Mag-7 and taken some profits in other AI capex exposed plays, such as Cadence Design Systems, and Nvidia. The capital has been reallocating towards AI software beneficiaries such as ServiceNow, while also establishing a position in Chinese champion Tencent, where growth is rebounding on the back of a revitalised gaming pipeline, surging advertising on WeChat Video Accounts, and expanding opportunities in fintech and cloud. TSMC and Netflix also remain favoured holding given the relative resilience of the business models.

In conclusion, our extensive global research travels have proven essential in navigating today’s rapidly shifting landscape, allowing us to gain direct, actionable insights from management teams grappling with unprecedented uncertainty. As policy volatility and trade tensions reshape corporate strategies and outlooks, the value of certainty has never been higher for leaders making critical decisions. By grounding our portfolio positioning in these first-hand observations, we are better equipped to follow new earnings leadership and remain agile and well-informed as new challenges and opportunities emerge.

Author: Elfreda Jonker – Alphinity Client Portfolio Manager