On the Road: China

Who: Stephane Andre, Portfolio Manager

Where: Shanghai, Beijing and Zhengzhou in Henan Province

When: May 2016

What were you looking for?

I travelled to China in May, a trip I conduct at least once a year to check the pulse of the economy, to determine how it will impact demand for commodities over the next 6 to 12 months.

Over the past few years the combination of slower demand and increasing supply has led to relentless downward pressure on commodity prices. However, early this year commodity prices recovered strongly on two drivers that surprised the investment community: a weakening USD, and a mini stimulus.

The economic slow-down post the corruption crack down and pursuit of reforms had apparently been so severe that the government was forced to revert to stimulus to accelerate the economy in order to reach its targeted 6.5%-7% GDP growth target. I wanted to get a feel for how strong and lasting this change in policy would be and how it would affect underlying demand for commodities this year.

What did you discover?

1. The stimulus is focused on Property and Infrastructure:

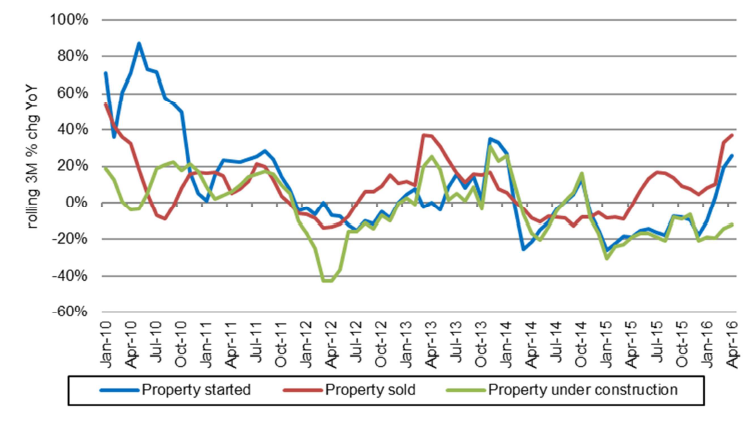

- Property sales and starts have been boosted by interest rate cuts, lower deposit requirements, lower lending requirements and tighter controls on capital outflow. The surge in Tier 1-2 cities has rippled through Tier 3-4 cities.

- Local governments are providing property purchase subsidies to farmers which are available until the end of 2016. This will support the higher volume segment of the market this year despite elevated level of property inventories.

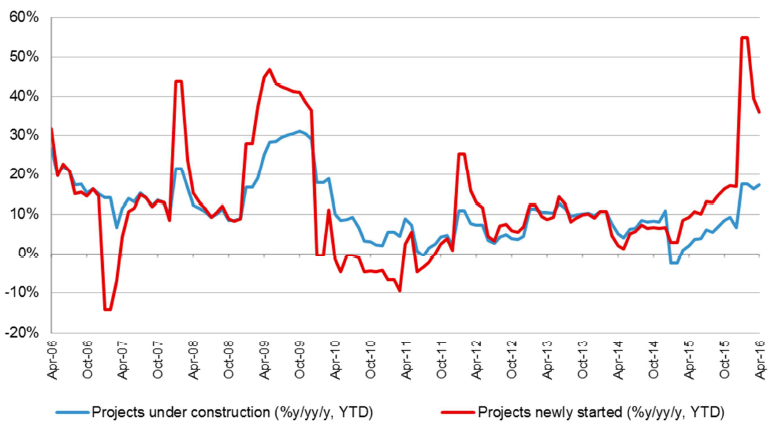

- Numerous infrastructure projects (high speed rail, subways, and highways) had been approved in 2015 but government funding has only been released late that year / early 2016. Given it takes a few months from project design to construction start, I expect steel demand to pick up during the year.

Chart 1: China Property Construction, Sales and new starts

Source: UBS Research as at 30 April 2016

Chart 2: FAI- Projects under construction and newly started

Source: UBS Research as at 30 April 2016

2. Stimulus will mainly benefit steel and steel raw materials, namely iron ore and metallurgical coal. For iron ore, the demand lift combined with announced supply cuts is likely to support a $45-55/t price range, well above market expectations for this year. The longer term outlook remains challenged as new supply keeps coming and as demand is likely to soften. Metallurgical coal benefits similarly from the demand lift but also from a new supply restriction policy implemented by the Chinese government since May 1 enforcing a 15% national production cut. The extent it remains enforced is to be monitored.

3. The Chinese government is likely to ensure no large over/under heating of the economy up until the Oct 2017 Party Congress by keeping a foot on the accelerator (mini stimulus) and brake (reform and monetary tightening) until then. The demand is therefore likely to remain relatively stable. However, the medium to longer term horizon is quite challenging with more pain to come as unavoidable reform becomes the priority:

- Chinese Debt to GDP level has risen from 100% to 260%, and is tipped to grow to about 300% by 2020.

- Industries such as steel, cement, coal, aluminium face significant overcapacity forcing operation at low utilization and generating growing losses. Capacity will have to be cut which will involve large loan write downs and large job losses.

- The IMF have estimated that non-performing loans as per OECD standards would be closer to 15% to 20%vs the official number of 1.0%. Assuming 100% write down, it would represent losses of $1.1 to $1.7 trillion (10% to 20% of GDP). A full plan is needed ahead of the deadline of IFRS and Basel III in 2018.

What does this mean for the Alphinity portfolio?

Global demand for commodities will be better than expected in 2016 primarily for steel related commodities. Headwinds are expected to increase as much needed reforms start to pick up at a slower pace. This will result in a slowing of stimulus injections and property subsidies. Demand has been front loaded. We remain cautious on the longer term outlook for demand

We have a preference over the short to medium term for stocks with exposure to iron ore and metallurgical coal. Due to the pull forward of demand there is a good chance of surprise earnings upside for some commodity producers.

Mining and metals exposure moved from a neutral sector position to slightly overweight. We have maintained overweights in Syrah, Rio Tinto and Fortescue and have added Newcrest Mining and S32 as we see upside to production and efficiencies.