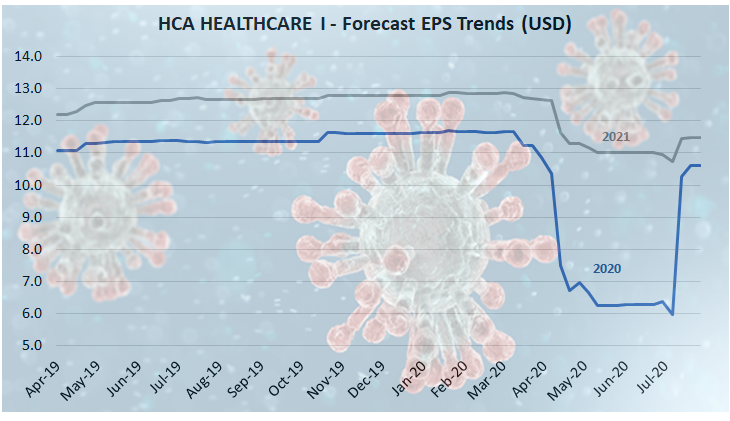

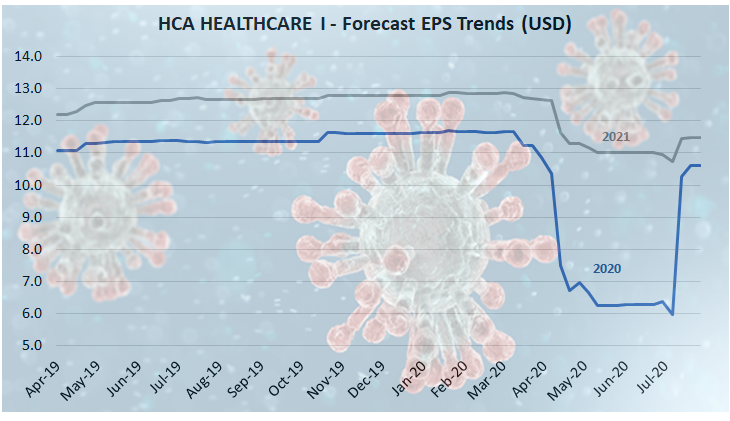

Source: Alphinity Global, as at 31 July 2020

Quality growth hospital operator. HCA is the largest hospital operator in the US, focusing on top-performing hospitals in selected growth regions (urban and suburban, not rural). It has been very active in growing and managing its portfolio of nearly 50k beds across primarily the South and East of USA. HCA has a long history of consistent mid-single digit sales growth (organic, build-outs, acquisitions) and very healthy returns on invested capital (12-18%).

Floored by COVID…or maybe not? When COVID hit in March, hospital operators were naturally at the centre of events and risks. Analysts were quick to slash EPS for 2020 by around -50% and for 2021 by -14% (see chart). However, recently analysts have been forced to start reversing these cuts, as they increasingly appear too aggressive. HCA’s recent second quarter report beat expectations by 7% on revenues and 71% on earnings. The market seems to be under-estimating three factors: Firstly, HCA launched aggressive cost and capex-saving programs early on, indicating that its cost base is more flexible than previously thought. Secondly, there was a discrepancy between war-like media headlines about hospital admissions & capacity, and the more benign, actual patient admissions on the ground. Thirdly, the US government immediately launched funding programs to support the hospital sector, including the CARES Act, which partly underwrote HCA’s cash flow, balance sheet and earnings in case the pandemic impact had deteriorated.

Looking for stock opportunities in volatile times. Every bear market is different, but they always create opportunities to invest at attractive prices. HCA is one of the new stocks we added to the portfolio during the high-volatility period earlier this year, as the stock collapsed. The initial opportunity was in the earnings ‘gap’ created between media headlines and hospital reality, and here we have already seen a good recovery in 2020 earnings forecasts. We see further upside to expectations, not least for 2021 and forward. HCA also serves as a ‘vaccine stock’ in the portfolio, as an earlier than expected Covid vaccine (and full hospital normalisation) would be very beneficial to the company. Beyond Covid volatility, HCA is a quality earnings compounder with a structural tailwind from increasing health care needs, and managements’ ability to allocate capital into growth areas.

Important information

This material has been prepared by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.