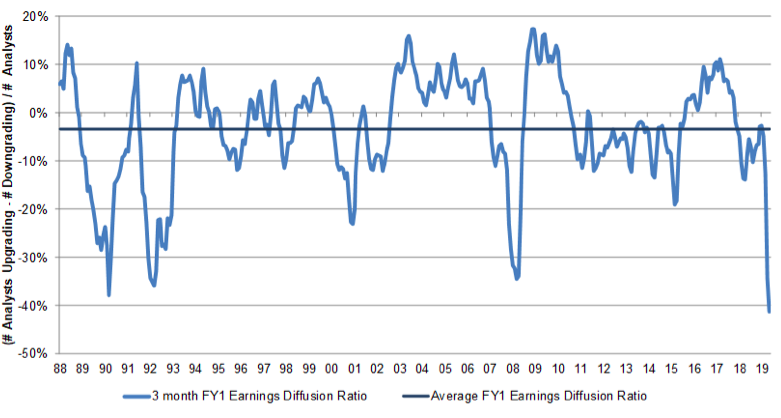

Global earnings – take a deep brea(d)th!

Alphinity Global Earnings Diffusion Ratio

The highest share of global stocks on record are now seeing downgrades. Our investment process leads us to analyse global earnings data very carefully for both individual companies and the overall market. In the second week of April, our own global diffusion index for 2020 earnings, which measures earnings revisions breadth, plummeted to levels below those seen in GFC levels (see chart). This indicates earnings are now collapsing right across the market.

Capitulation of expectations sows the seed for a future earnings recovery. The diffusion indicator isn’t a precise market-timing tool, but it’s an important pre-requisite for a trough of the cycle and markets. We do not yet know the exact timing of the earnings diffusion trough, but the upcoming reporting season should give us more clues at a company level. Also, our work on previous bear markets shows that when this breadth of downgrades starts improving again, the actual global earnings bottom normally arrives just 3-6 months later. This period is also often coupled with a gradual change of the relative global earnings leadership, which we always seek to invest in.

Every bear market is different, but they always present opportunities. After eighteen months of stable earnings leadership, and relatively limited portfolio changes, we have recently become more active in the portfolio. We have divested some stocks with rapidly deteriorating and uncertain earnings outlooks: Airbus, Safran, Lloyds and Walt Disney. At the same time, we have opportunistically added new companies – with strong earnings fundamentals and at low valuations – to the portfolio: Seagate Technology, AON, FMC Corp, CME and Activision Blizzard. These stocks all meet our quality thresholds and come from both the cyclical and growth sides of the market.

Looking forward, not backward. After a deliberate sudden-halt, the success of upcoming attempts to re-start economies again is highly uncertain. Therefore, the timing of the earnings trough and the speed of the recovery are still unclear. We are taking balanced steps forward through the turbulence when opportunities arise. Our investment approach is agnostic and agile, and we will follow the earnings leadership through the bottoming of the global cycle.

Author: Jeff Thomson, Portfolio Manager