The following piece was originally published in Livewire on 19 February 2021.

Typically, a company that releases its earnings is striving for high single-digit net profit growth. A company reporting 9% net profit growth for the half is one that you want to own. So most investors jumped to buy Australia’s market darling, CSL as it released its results this morning, announcing a whopping 45% profit growth over the half. A bloody brilliant performance, some would say.

But is that big number convincing enough? According to Stuart Welch, while this number is encouraging investors to dive into their pockets and splurge on Australia’s third-largest company, the unchanged guidance issued by the company raises a few questions.

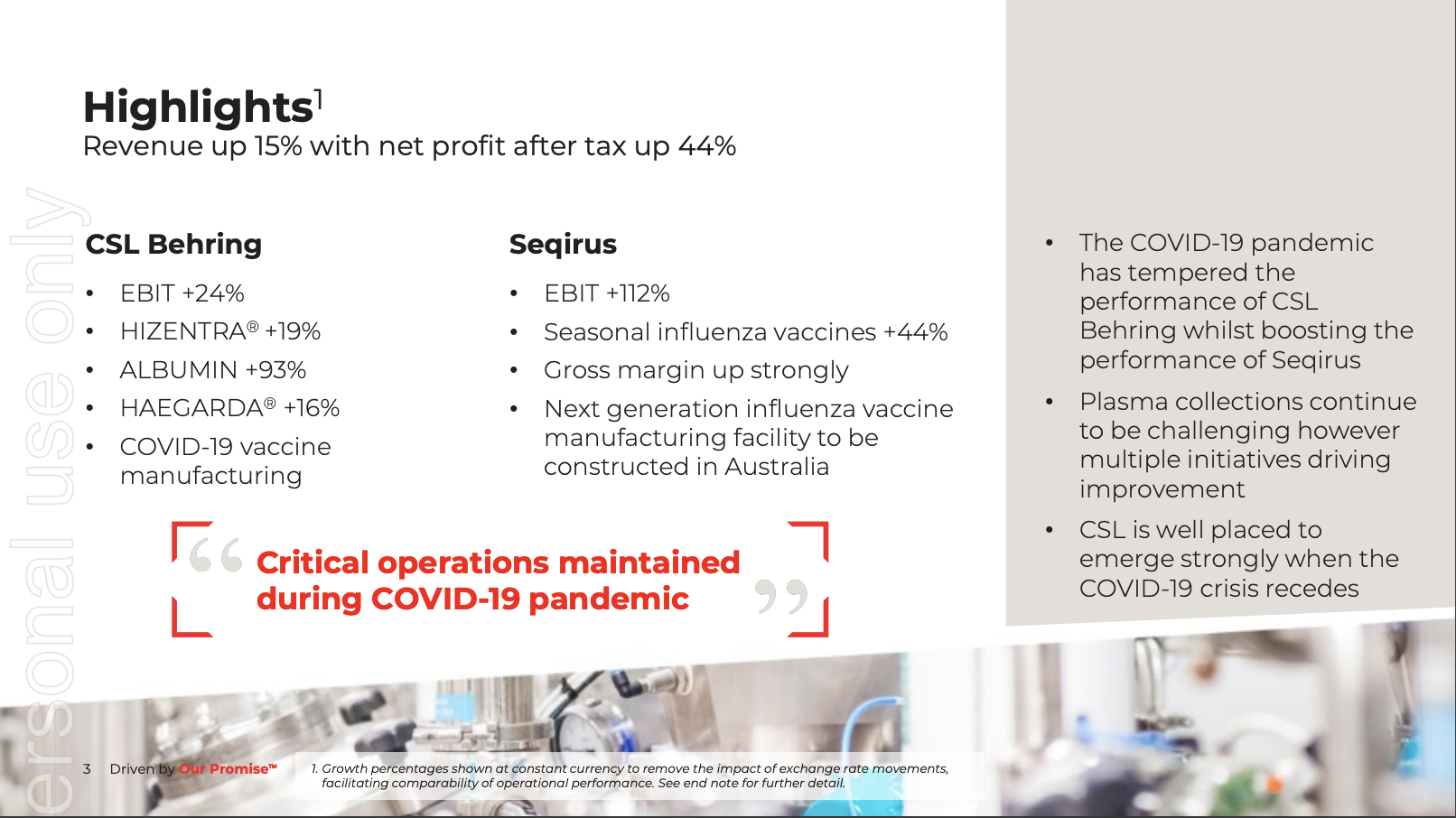

CSL key result metrics:

- 44% growth in NPAT (net profit after tax)

- 16.9% growth in revenue

- An increased dividend of $1.04 USD, up 9%

Source: CSL Investor Presentation

What are the key points of CSL’s recent result?

The key point of the result this morning, was that it was a fairly substantial beat on expectations. Particularly on the Sequirus side which was where the real strength came through. Revenue, relative to market expectations was about a 15% beat. There was great operating leverage through that part of the business – certainly more than the market expected. We also saw a 60% beat on expectation on the EBIT line, again through the Sequirus business. The Sequirus business is primarily the flu vaccination business and there has been insatiable demand for that product, particularly because people have been trying to avoid a ‘twindemic’.

On the Bhering side, there’s very well known issues with plasma collections, and that’s causing issues with IG volumes. Likewise, the product lines have been affected due to less hospital activity. On that side of the business, what was most significant was the extraordinarily strong cost control. They managed to keep costs down pretty materially, which assisted them in beating market expectations.

Given CSL’S strong report, why is the share price only up 2.5% today? Have investors missed something?

There are still a couple of things that the market is still concerned about.

Collections continue to be an issue, on the Bhering side. Plasma collections are still down in the month of December 2020, 20% relative to the prior corresponding period. So although there’s been an improvement when considering the COVID related impacts, it’s still down. It has been trending in the right direction and the company provided some positive remarks about the recovery they’re seeing, but the reality is, it hasn’t returned to pre-covid levels.

The key concern for people is that, despite the strength of the first half result, CSL has kept the full year guidance. That means that having delivered 80% of the guidance in the first half, implies a pretty week second half. This asks the question is the guidance conservative or will lower collections cause some weakness until such time as volumes recover. It could be a bit of both, as is usually the case.

Were there any surprises?

The two key surprises were the strength of the cost control on the Bhering side and both revenue and margin beat on the Sequirus side. These are the two standout points of the result.

Additionally, it was a very strong result but there were also a few ‘one-offs’ that the company had to absorb during the period. For example, they had a manufacturing issue in one of their high margin products that went backwards during the period. Likewise, they also had some royalty streams that went backwards – high margin also – and they also took a $50m write down. These impacts were only partially offset by some COVID related revenue. So, the strength of the result, as strong as it was, also incorporated a bunch of negative one-off impacts. So the underlying result was probably a little better than the headline numbers would imply. The business has really managed things well during the period, so that just speaks to their management team.

Given we’ve seen two major tailwinds for CSL in the last few days, is that likely to drive the share price higher?

There’s some reasonably positive indications for CSL that it will continue to perform. The collections issue is a major issue, but there is some light at the end of the tunnel in terms of a vaccine rollout which should make people more comfortable in attending collection centres. This no doubt, is likely to improve at some point.

There’s an argument to be made that the numbers we’ve seen from Sequirus indicate strong growth for this part of the business. Although COVID has somewhat impacted this, the growth is likely to stick, post COVID.