Can Mining be Ethical?

Ethics are generally understood to be the moral principles that influence a person’s behaviour, however with so many people in the world the scope for differences in ethical beliefs and standards is enormous. There is sometimes a debate in the community as to whether practices like mining are intrinsically unethical and should therefore be avoided, and we are exploring this thought in this brief paper. While we are certain that some mining is probably unethical, is that the case for all, or can it be done in a way that is not?

The UN has identified 17 Goals, the Sustainable Development Goals (SDGs) which, if achieved, would genuinely make the world a better place. While not intentionally an ethical framework, an important part of ethical thinking is the notion that all people are intrinsically equal, that the value of a human life in one part of the world should not be different to that of another. There is a great deal of inequality of living standards between countries, and even within countries, and raising the standards of the disadvantaged would go a long way to achieving many of the SDGs. Alphinity has concluded that some of the commodities mining produces are essential to raise living standards and produce a more Sustainable world. We use the SDGs to determine whether particular commodities are really needed to achieve one or more of the Goals. In our view, mining can be ethical if it produces raw materials that are really needed as long as the mines are operated in a socially responsible way. We will invest in companies only if they meet both criteria.

Some mining produces materials that we believe are not necessary to achieve the SDGs, and some mine in a way that is unnecessarily destructive to the environment and/or damaging to local communities or exploits its workers or service providers. We will avoid companies that operate in this way.

As a responsible investor, Alphinity actively engages with all the companies we own, including mining companies, and encourages them to operate in the most ethical manner possible. We hold them accountable for their impact on the environment, their workers and their local communities. We understand that, as an allocator of capital, Alphinity has a significant role in encouraging positive changes to the way companies and industries behave. We have a responsibility to use whatever power and influence we have for good.

What we believe about Ethical Mining

Alphinity will only invest in mining companies that produce essential raw materials and support positive SDG outcomes (i.e. ‘do good’) and also have strong ESG performance (i.e. ‘do it well’). Strong ESG performance means supporting mining companies which take responsibility for the environment and for the stakeholders at their mine sites – the local population and their workers.

Environmental impact is a critical part of our assessment. We assess the manner in which the company manages hazardous substances, tailings, water usage, greenhouse gas emissions and recycling amongst others.

From a Social perspective, we seek to understand how mining company workers are treated and paid. A good safety record is often the sign of a well-run company with good operating practices and well-trained workforce.

A sustainable mining company will also have good Governance, reflected in processes to protect against bribery and corruption; also with reasonable management incentives and equitable sharing of the wealth it generates with the local population.

Raw materials that are essential to achieve Sustainable Development Goals

Alphinity supports the extraction of:

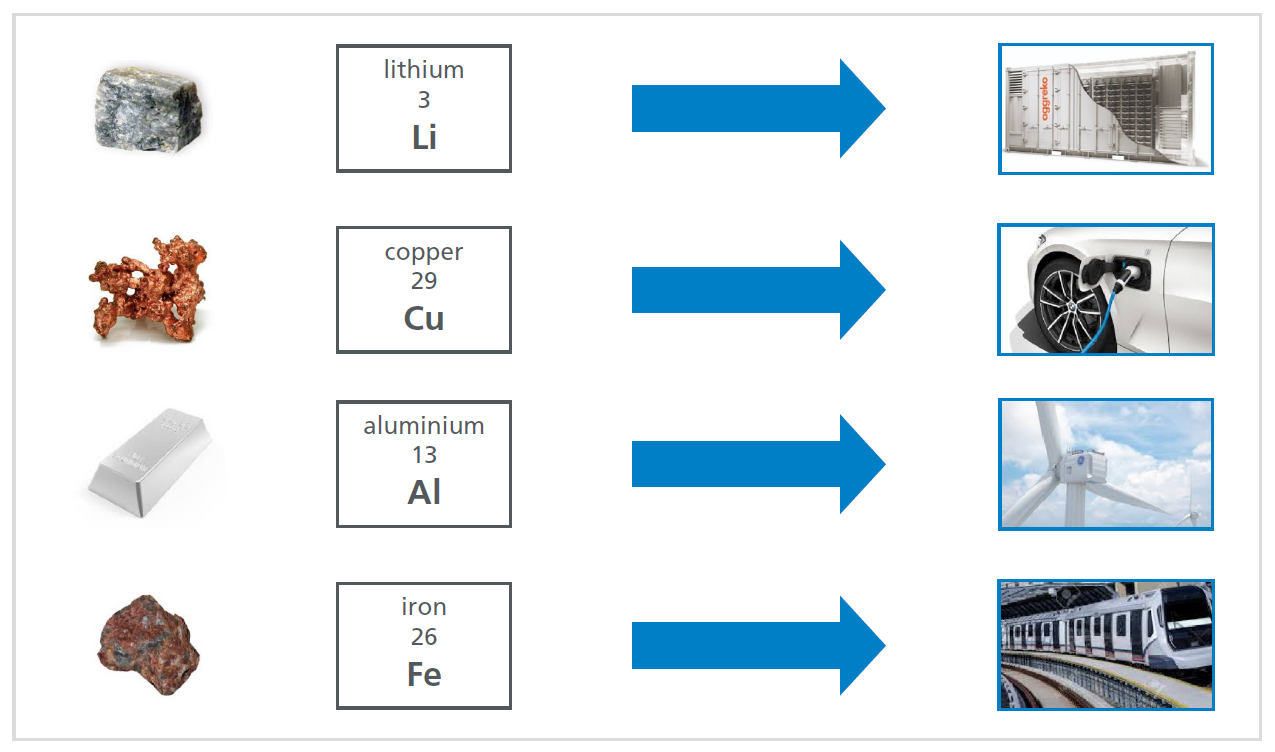

- Copper, Nickel, Aluminium and Lithium which are essential raw materials to support Sustainable Infrastructure and Cities (SDG 9 and 11) but also Climate Change (SDG 13). Lithium is a key input in producing battery storage; Copper and Nickel are required for Electric Vehicles and power transmission, Aluminium for wind generators and lightweight products.

- Iron Ore and Metallurgical Coal which are required for Sustainable Infrastructure (SDG 9) and Sustainable Cities (SDG 11). There are presently two main ways to make steel: using Iron Ore and Metallurgical Coal in Blast Furnaces; and recycling scrap steel in Electric Arc Furnaces which can be powered with renewable energy. We are aware of technologies being developed which would avoid the need to use Metallurgical Coal in Blast Furnaces, but they are currently uncommercial; however, we would no longer support Metallurgical Coal if this became viable. There will also come a time at which there will be sufficient scrap steel available to produce all the steel needed to achieve Sustainable Development without Iron Ore: from that point we will not support Iron Ore mining. For the present however the world still does need steel made from Iron Ore, so we will support its production while engaging with the companies in which we’ve invested to encourage greater efforts to reduce carbon emissions in the steelmaking process.

We do not support the extraction of:

- Gold, as its end uses do not support any of the Sustainable Development Goals, and its extraction can cause significant damage to the environment through its mining and the disposal of its tailings. Gold’s primary usage consists of jewellery making and storing wealth, neither of which add significantly to achieving Sustainable Development. Less than 10% of Gold production is destined for industrial use, and this can easily be satisfied by Gold which is produced as a by-product of more socially necessary metals such as Copper. We will not support companies whose primary purpose is mining Gold.

- Thermal Coal, as cleaner and affordable alternatives already exist. Thermal Coal is burned in power stations to produce Electricity. With a mix of renewables and storage in a well-designed electricity grid, society’s electricity needs can be satisfied without burning Coal.

The information in this publication is current as at the date of publication and is provided by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895.

It is intended to be general information only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. Past performance is not a reliable indicator of future performance.