Our Investment

Process

Identifying and Investing in Earnings Leadership

A truly unique partnership between detailed analyst-driven fundamental research and targeted quantitative research inputs.

Alphinity’s investment process has been in use for more than 20 years. We use a unique combination of fundamental and quantitative signals to identify companies with Earnings Leadership potential. Our approach requires deep fundamental analysis to understand the specific drivers and likely endurance of a company’s earnings, which results in valuations and forecasts of expected medium term earnings growth for each company covered. Fundamental research is combined with objective quantitative factors and a detailed ESG integration process.

Fundamental Research

Fundamental research is heavily focused on gathering and analysing first-hand information with the aim of determining whether a company’s earnings growth is being under or over-estimated by the market. To assess this, one needs to understand the company’s share price drivers and as well as what the rest of the market expects those earnings to be. We then compare this against our own insight and outlook on the company. Industry contacts and probing company management are both essential to generate this research. We conduct hundreds of company meetings each year, both in Australia and across the globe. Each analyst spends much time out of the office meeting with companies to determine factors which will impact them.

The investment team, with support from internal ESG specialists, identifies and assesses material ESG issues for any stock actively being considered for investment, as well as on an ongoing basis for all stocks in the Fund. The outcome of this assessment is an overall ESG risk level. Significant matters are also incorporated into the qualitative assessment of the company, and/or into direct valuation parameters where appropriate, in order to maximise returns and minimise ESG risk.

Quantitative Research

Quantitative factors provide another perspective when identifying companies for which the market is under- or over-estimating earnings potential. We use various quantitative factors which have each been comprehensively tested and have proven effectiveness in pointing to undiscovered earnings growth. Our quant factors cover all areas of a company’s financial reporting, including profit & loss, cashflow and balance sheet statements. They can be broadly grouped into Momentum and Quality factors. Using such widely ranging factors brings valuable diversification to our research.

Composite Research Model (Domestic)

& Alphinity Quantitative Model (Global)

While the ultimate investment decisions are made by the portfolio managers, the vast amount of data generated by the two complimentary sides of research are brought together for Australian shares in the Composite Research Model (CRM) and for global shares in the Alphinity Quantitative Model (AQM).

The CRM and the AQM allow us to:

- objectively compare companies across and within sectors

- facilitate and direct the research discussion within the team

- receive strong buy and sell signals, and

- construct and monitor portfolios.

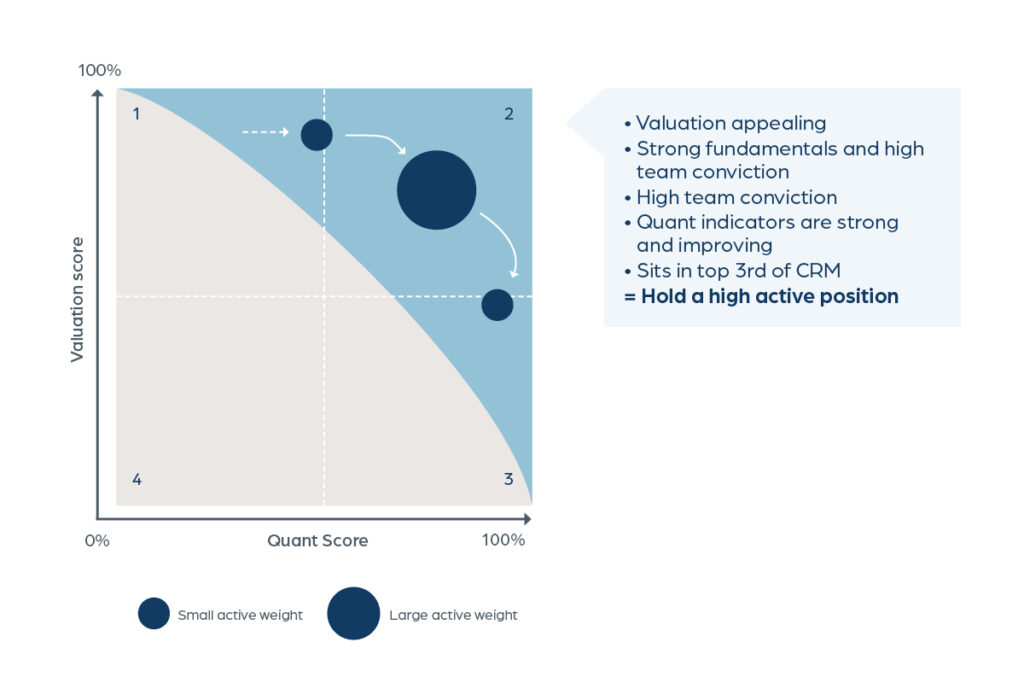

Portfolio Construction

Portfolio construction is conducted by the portfolio managers taking into account both fundamental and quantitative research inputs. It is centred therefore on stocks with high CRM scores preferably achieved through scoring highly on both fundamental valuation appeal as well as the quantitative factors. Finding stocks that have strong appeal across both spectrums of research significantly increases the probability of finding earnings surprise stocks and therefore generating outperformance for our clients, however they are not considered in isolation. This ensures sensible portfolio diversification and pragmatic positioning to the current macro environment.

The chart highlights the ‘ideal stock path’, in other words the types of stocks we want to make up the portfolio. We want to be fully invested where the probability of being right is the greatest. We constantly track individual stocks and the portfolio as a whole to ensure we are meeting that objective. We find over time that this provides the best outperformance for the lowest risk possible.